Table of Contents

- 1 ‘Loan cold wave’ continues for Dunchon Jugong loans at the beginning of the year

- 2 Next year’s ‘loan penalty’ is also key

- 3 * **Question 1 for Guest 1:** How could the ”loan cliff” exacerbate existing social and economic inequalities, and what measures can be taken to mitigate these potential disparities?

The financial authorities have decided to manage the increase in household loans in the banking sector on a monthly and quarterly basis starting next year. Initially, there was an expectation that the ‘loan cliff’ would be resolved early next year when a new household loan management plan is established. However, as the financial authorities decided to take action on monthly management, the trend of tightening loans is expected to continue.

Last September, a promotional notice regarding home mortgage loans was posted in front of a bank in downtown Seoul. Yonhap News

Preventing concentration of loans… Authorities take on detailed management

According to financial authorities and the banking industry on the 26th, major commercial banks submitted a draft of next year’s household loan management plan to the Financial Supervisory Service last week. Financial authorities plan to review banks’ household loan management goals and adjust management plan goals by the end of the year. The goal next year is to manage household loan growth within the nominal gross domestic product (GDP) growth rate. The financial authorities also required each bank to submit policy loan supply targets, such as stepping stone and support loans.

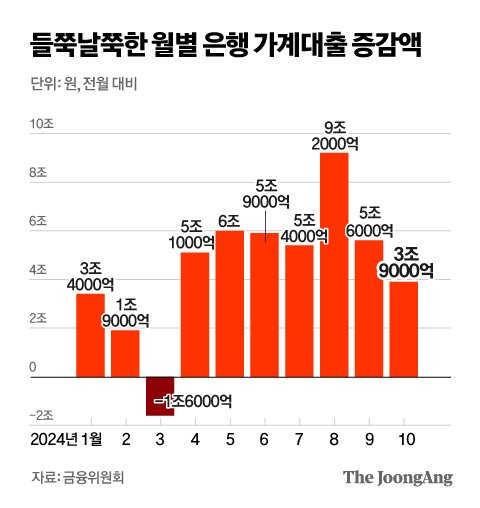

Financial authorities plan to ask banks to set separate targets for each month and quarter during the consultation process for next year’s household loan management plan. As household loans piled up in the middle of this year, additional lending capacity plummeted at the end of the year, so this is to prevent something like this from happening again next year. In fact, bank household loans increased by 3.7 trillion won in the first quarter, but the increase expanded in the second quarter (17 trillion won) and the third quarter (20.2 trillion won). Afterwards, as the financial authorities strengthened household loan management, the increase decreased again to 3.9 trillion won in October.

Geunyoung Jeong Designer

‘Loan cold wave’ continues for Dunchon Jugong loans at the beginning of the year

The financial authorities’ goal next year is to spread the increase in household loans over the course of a year. In addition, as loans for the balance of Olympic Park Foreon (Dunchon Jugong) are expected to flood in early next year, the lending capacity of banks is not expected to increase significantly even in January. This is because it becomes difficult to significantly expand household loans at certain times like this year.

An official from the financial authorities explained, “We will receive the household loan target on a monthly basis, but in reality, we will encourage you to meet the target on a quarterly basis,” adding, “The purpose is to prevent a repeat of closing loan windows at the end of the year.” did it

According to next year’s management plan, household loans are expected to not exceed 2% compared to the end of this year. The government forecast next year’s nominal GDP growth rate to be 4.5%, but considering that policy loans account for about 30 trillion won, the growth rate of banks’ own loans is limited to around 2%. Lee Bok-hyun, head of the Financial Supervisory Service, also requested at a recent executive meeting, “We must closely establish a plan to manage household loans across the financial sector so that the household debt-to-GDP ratio can gradually stabilize downward next year.”

Next year’s ‘loan penalty’ is also key

The key question is whether the banking sector will be able to meet this year’s household loan target. Financial authorities have decided to impose a penalty on banks whose household loan balances have increased beyond this year’s target when setting plans for next year. Imposing a penalty that reduces the average total debt service ratio (DSR) has the effect of reducing loan supply.

Banks told the financial authorities that they could “achieve the goal by December,” but it is known that many major financial holding companies have exceeded the goal as of now. For this reason, some say that the lending cold wave could hit even harder next year than this year.

Meanwhile, second-tier financial institutions such as savings banks, credit unions, and Saemaeul Geumgo are also required to submit household loan management plans for next year. The financial authorities plan to first complete discussions on the banking sector’s management plan and then request second-tier financial institutions to establish a management plan as well. The financial authorities plan to establish a management plan at the central association level and manage local safes for mutual financial institutions that operate in a cooperative manner.

Reporter Jeong Jin-ho [email protected]

## World-Today-News Interview: Navigating the “Loan Cliff” and Tightening Credit

**Introduction:**

Welcome to World-Today-News! Today we’re discussing the recent announcement by financial authorities regarding tighter management of household loans. To unpack the implications of these changes and explore their potential impact on individual borrowers, the economy, and the banking sector, we’re joined by two distinguished guests.

**Guest 1:**

[Insert Name & Expertise, e.g., Dr. Sarah Lee, Economist specializing in consumer finance]

**Guest 2:**

[Insert Name & Expertise, e.g., Mr. Mark Kim, Former Banker and Financial Consultant]

**Section 1: Setting the Stage: Understanding the “Loan Cliff”**

Let’s start by understanding the backdrop of these changes.

* **Question 1 for Guest 1:** The article mentions a “loan cliff” that was initially expected to be resolved next year. Can you explain what this “loan cliff” refers to and why it posed a potential risk?

* **Question 2 for Guest 2:** Financial authorities are now adopting a more granular approach to managing household loans, focusing on monthly and quarterly targets. What prompted this shift in strategy?

**Section 2: The Impact on Borrowers: A Balancing Act**

This new regulatory environment will undoubtedly affect borrowers.

* **Question 3 for Guest 1:** What are the most significant implications of these loan management measures for individuals seeking mortgages or other types of household loans?

* **Question 4 for Guest 2:** While curbing excessive lending is crucial, what are some potential downsides for borrowers who might need to access credit for legitimate purposes like homeownership or education?

**Section 3: Navigating the “Loan Cold Wave”: Economic Perspectives**

The article alludes to a potential “loan cold wave.” Let’s explore the broader economic context.

* **Question 5 for Guest 1:** How might these tighter credit conditions impact economic growth, particularly in sectors like housing and consumer spending?

* **Question 6 for Guest 2:** Could these measures contribute to a rise in non-performing loans, and what strategies can banks employ to mitigate this risk?

**Section 4: The Future of Lending: A Collaborative Approach?**

Looking ahead, what can we expect from this evolving landscape?

* **Question 7 for Guest 1:** What role can government policies play in promoting responsible lending practices while ensuring access to credit for those who need it?

* **Question 8 for Guest 2:** The article mentions penalties for banks exceeding loan targets. Is this an effective approach, or are there alternative mechanisms for promoting responsible lending behavior?

**Closing Remarks:**

Thank you, [Guest 1] and [Guest 2], for your insightful perspectives on this complex issue. It’s clear that navigating the “loan cliff” requires a thoughtful and balanced approach, considering the needs of borrowers, the stability of the financial system, and the broader economic landscape.

We encourage viewers to stay informed and engage in discussions as this important topic continues to unfold.