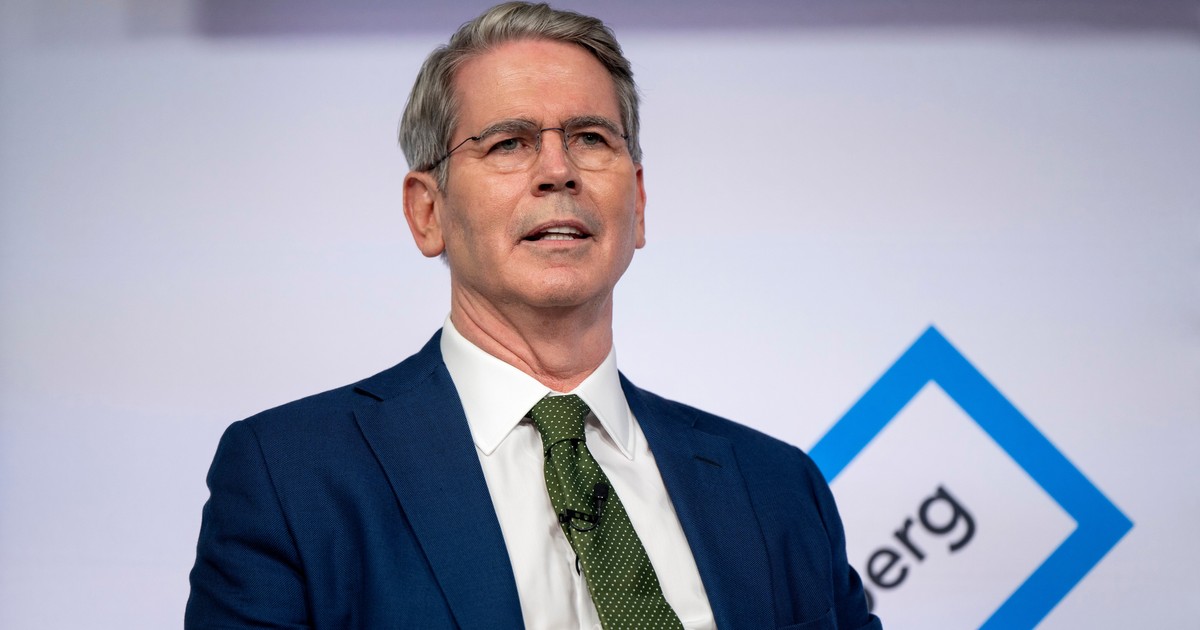

Billionaire Scott Bessent is to become US Treasury Secretary in the Donald Trump administration. The 62-year-old advised Trump on economic issues during his election campaign. At the same time, he is the founder of the hedge fund Key Square Capital Management. He was previously a major investor in the hedge fund for investment legend George Soros, who is a major Democratic donor.

In an article for The Wall Street Journal, Bessent supported Trump’s policy of deregulation and tax cuts. However, if investors have their way, Trump should also address the high national debt. According to Bessent, it is the result of “four years of reckless spending” under Joe Biden.

During his election campaign, Trump promised to impose 60 percent tariffs on goods from China and 10 percent tariffs on goods from other countries. So far, Bessent has been skeptical about the issue.

In recent interviews with the Financial Times and CNBC, Bessent indicated support for a gradual increase in tariffs to prevent the risk of rising inflation.

2024-11-23 17:58:00

#billionaire #Donald #Trump #Scott #Bessent #nominated #Treasury #Secretary

Given your cautious approach to tariffs and emphasis on navigating complex economic situations, how would you balance the needs of specific industries seeking protection with the broader goal of maintaining a stable and competitive global market?

## Open-Ended Questions for an Interview Based on the Article:

**General Approach:**

* **Focus on understanding Bessent’s perspective:** His views on trade, economy, & experience are central to his potential role.

* **Encourage critical thinking:** Go beyond surface-level responses, prompting analysis and justification.

* **Promote discussion, not just answers:** Questions should spark dialog and exploration of different angles.

**Thematic Sections:**

**I. Bessent’s Background & Temperament:**

1. **Stepping Stone:** How does your background in finance equip you for the complexities of the Treasury Secretary role, particularly given the ongoing economic climate?

2. **Cautious Approach:** The article mentions your skepticism about immediate, drastic tariffs. Can you elaborate on your philosophy towards navigating trade policies? What’s your approach to balancing protectionist measures with global trade?

3. **Leadership Style:**

How would you describe your leadership style? How will you approach building consensus and navigating potential disagreements within the administration & with Congress?

**II. Trade Policy & Economic Outlook:**

4. **Tariff Strategy:** Given your support for gradual tariff increases, what indicators would signal the appropriate time and level for such increases? How do you balance the goal of protecting domestic industries while mitigating the risk of inflation?

5. **Global Tensions:** How will you address the ongoing trade tensions with China? What is your vision for a long-term trade relationship with China?

6. **Economic Growth:**

What are your key priorities for stimulating economic growth in the US?

How do you plan to address issues like income inequality and job creation?

**III. The Role of the Treasury Secretary:**

7. **Independence:** As Treasury Secretary, how do you see your role in relation to the President and Congress? How will you ensure the independence and integrity of the Treasury Department?

8. **Public Trust:** Trust in financial institutions is crucial. How will you work to build and maintain public trust in the Treasury Department under your leadership?

9. **Legacy:**

Looking ahead, whatTCM `legacy do you hope to leave as Treasury Secretary?

What positive impact do you envision for the American economy during your potential tenure?