Table of Contents

The world of cryptocurrency investments has taken another important step. Options trading on the iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF in the world, with assets of $42 billion, began on Tuesday 19 November 2024. The news, confirmed by Nasdaq, represents a turning point for investors who wish to access new tools to speculate, protect themselves from risk or diversify their portfolios in a more sophisticated way.

Options debut on the world’s largest Bitcoin ETF

The launch of these options marked a crucial moment for the cryptocurrency market, which is now increasingly integrated into traditional financial circuits. Until now, investors who wanted to use options to gain exposure to Bitcoin had few alternatives.

One of the most popular was to bet on MicroStrategy shares, the company famous for its huge Bitcoin reserves, often exploited to speculate on the cryptocurrency’s performance. In October alone, options on MicroStrategy were among the most traded on the market, but the arrival of options on IBIT finally offers a direct and probably more liquid instrument. The first day of options trading on IBIT closed with a volume of 1.9 billion dollars, with over 288 thousand “calls” and 64 thousand “puts” traded.

Fonte: Bloomberg

Bitcoin itself has experienced weeks of great turmoil, with the price hitting $94,000 tonight before stabilizing at $93,200. The 38% surge since November 5, the day of the presidential elections in the United States, is no coincidence: President-elect Donald Trump is seen as a supporter of the cryptocurrency industry, a factor that has driven interest in the asset.

Strengths of the IBIT ETF

But what makes the IBIT ETF so important isn’t just its size. With assets more than double that of competitors like the Grayscale Bitcoin Trust and the Fidelity Wise Origin Bitcoin Fund, IBIT has become the point of reference for those seeking structured exposure to Bitcoin through regulated markets. Now, with the introduction of options, it becomes even more interesting for traders and institutional investors.

The approval of options trading on IBIT is the result of a meticulous regulatory process, which involved players such as the Options Clearing Corp., which is responsible for clearing and settling the trades. This step not only expands the possibilities for investors, but also consolidates the credibility of cryptocurrencies in the global financial landscape.

With the debut of options on IBIT, Bitcoin is confirmed not only as a disruptive asset, but also as an opportunity for advanced and diversified strategies. In fact, it is no coincidence that Bitcoin has reached the threshold of 1800 billion market capitalization, becoming the fifth largest “currency” in the world, surpassing the British Pound.

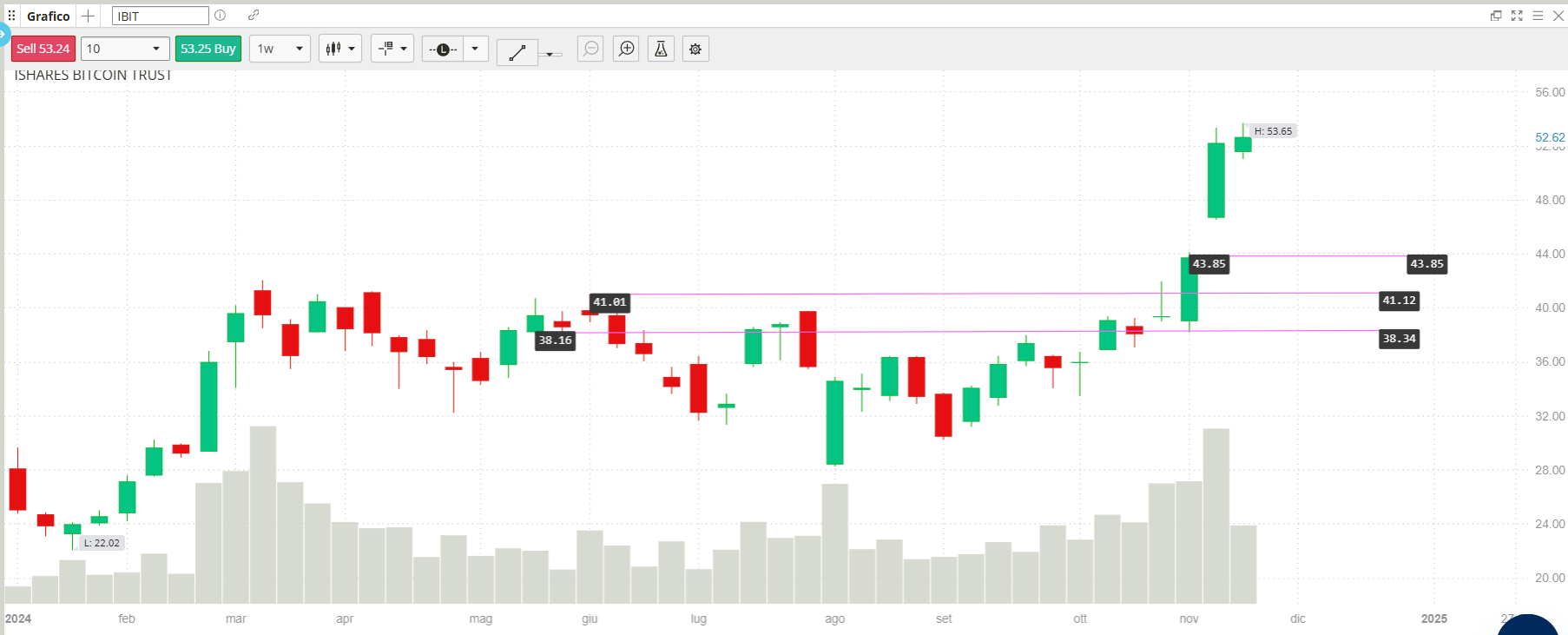

Key levels and graphical analysis on IBIT

Today’s analysis will be based on the price of the IBIT ETF which obviously has the same trend as Bitcoin. Seeing the volumes linked to options, we are confident that the price of the king of cryptocurrencies can reach the $100,000 threshold in a short time and then undergo a physiological retracement.

Source: Trive.com/it

We will therefore await a possible correction, operating directly on the IBIT ETF by adopting a long-term accumulation strategy on very specific key levels. We will do this via the broker Trive which makes trading available on IBIT without costs on the transaction and with only 1 cent spread between bid and ask (bid and ask).

There are 3 levels in question, very close to each other but very different from a technical point of view. The first level, $43.85, represents the origin of last week’s bullish gap and could at least be retested. The second and third levels, however, represent an entire very important technical zone, the former highs of the enormous accumulation zone created between March and October 2024.

From the hypothetical threshold of $100,000 for Bitcoin (around $56.5 on IBIT), we are talking about retracements equal to -20% for the first level and -28% for the other zone. Figures that are easily feasible and appropriate for Bitcoin, especially thanks to the volatility that ETF options could bring.

We are therefore waiting for these possible retracements on IBIT and Bitcoin.

Disclaimer: File MadMar

1. As a website editor for world-today-news.com, I would like to interview two guests to discuss the significance of the launch of options trading on the iShares Bitcoin Trust (IBIT). Our first guest is a cryptocurrency analyst who will provide insights into the potential impact of this event on the cryptocurrency market, while the second guest is a financial expert who can offer a traditional finance perspective on this development. Could you please provide us with your insights into the potential implications of this event for the world of cryptocurrency investing?

2. The launch of options on IBIT marks a major milestone for the cryptocurrency market as it integrates further into traditional financial circuits. From a cryptocurrency analyst perspective, can you explain why this is such a significant event? What new opportunities does it open up for investors and the broader market?

3. From a financial expert perspective, how does the launch of options on IBIT challenge traditional investment tools and strategies? Additionally, how does it change the way institutional investors approach the cryptocurrency market, and what potential risks or challenges might they face in doing so?

4. How do you see the role of the Options Clearing Corp. in this process? Can you explain their role in clearing and settling these trades, and how it helps to establish credibility for cryptocurrencies within the global financial landscape?

5. The IBIT ETF’s $42 billion in assets makes it a massive player in the cryptocurrency market. From an investment perspective, what strategies can investors use to capitalize on the launch of options on IBIT? Do you see any specific sectors or assets that could benefit from this development?

6. Broker Trive is offering trading on IBIT without transaction costs, with a tight spread of 1 cent between bid and ask. As a financial expert, can you explain how this compares to traditional investment brokers and their fees? Does this model provide unique advantages or limitations for investors?

7. Analysts predict that Bitcoin could reach $100,000 in the near future. From a technical analysis perspective, how does the price movement of IBIT compare to that of Bitcoin? Are there any key levels or resistance points that traders should watch out