Table of Contents

- 0.1 Two years of oscillations – What have we learned?

- 0.2 The cashback that made the difference

- 0.3 Comparing the MacBook Pro to CRO investing

- 0.4 An invitation to reflect on your investments

- 0.5 Conclusion of the experiment in the third year

- 0.6 Related

- 1 What are some effective strategies for beginners to navigate the complexity of cryptocurrency investing while still making informed decisions?

MacBook Pro or Cryptocurrencies? The Third Year of My Experiment with CRO 5

It was 2021 and, in front of me, there were two options: spend 3,000 euros on a MacBook Pro or invest that same sum in cryptocurrency. You know those decisions that make you think about what could happen in the future? Well, that was one of them. The idea was simple: what would happen if, instead of buying a technological product that I really needed, I invested my savings in a digital and risky asset like a cryptocurrency? Thus began my experiment with Crypto.com and its cryptocurrency, the CRO.

In that period, the price of CRO it was 0.36 euros, and with my 3,000 euros I managed to purchase 8.152 CRO. It seemed like the beginning of an interesting adventure, especially with the boom that the cryptocurrency world was experiencing. But this is not a story made only of enthusiasm or promises of easy money: it is a concrete and personal reflection on an alternative to technological consumerism.

Now, in the third year of this experiment, the time has come to take stock again and understand if that investment was more profitable than a MacBook Pro, exploring every facet of this experience.

Two years of oscillations – What have we learned?

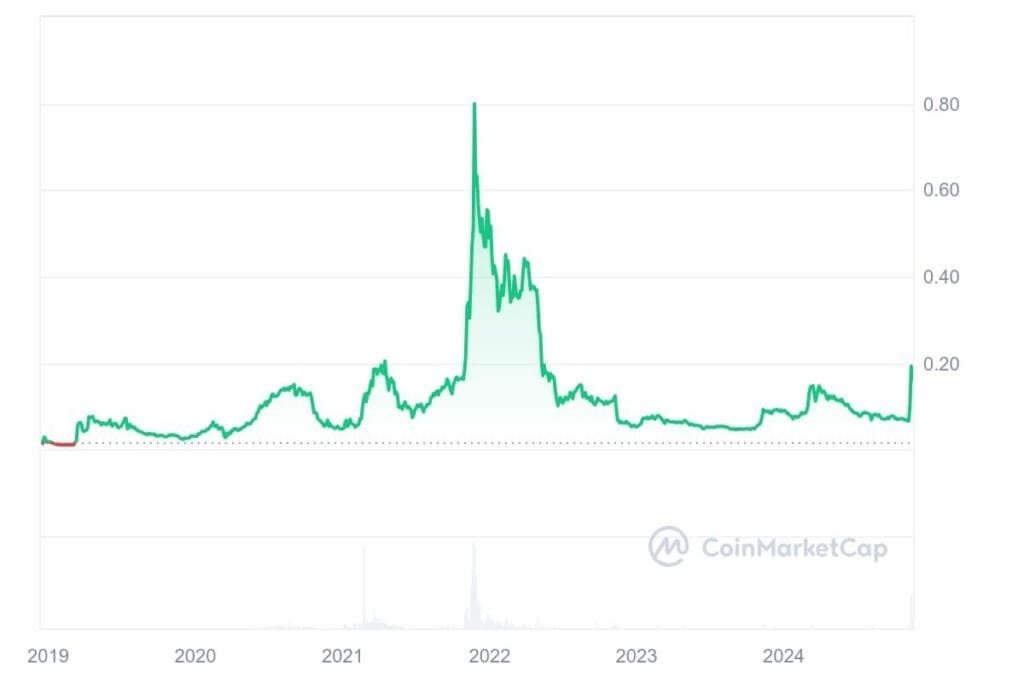

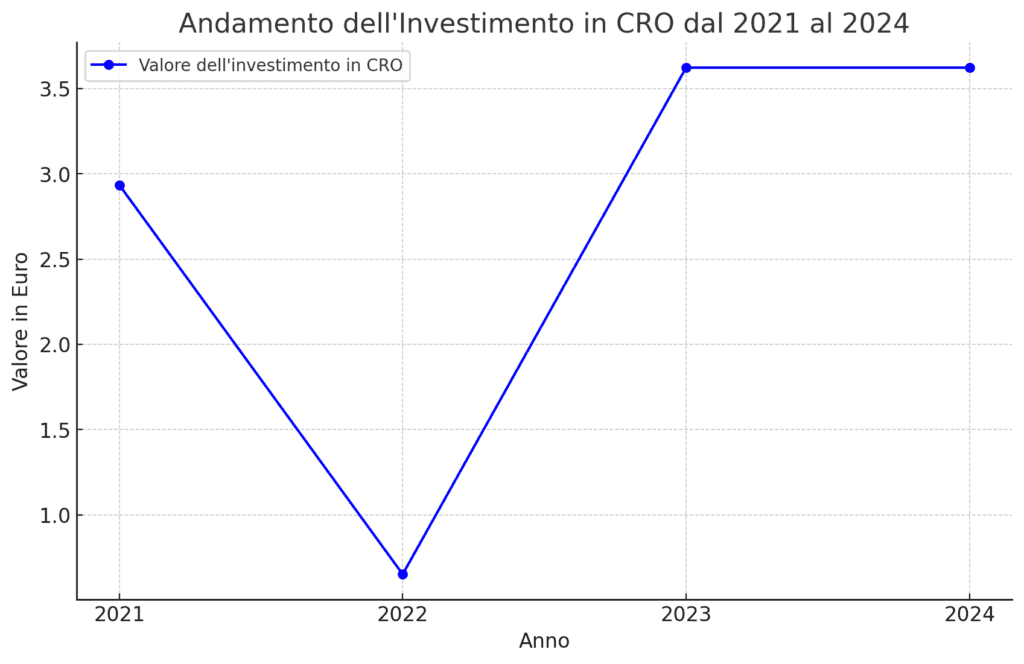

The underlying question remains the same: Is it worth investing in cryptocurrencies or is it better to buy something tangible like a computer? Last year, after the second annual budget, the situation did not seem particularly exciting. In 2022, the value of CRO had dropped and my portfolio hadn’t quite performed as I’d hoped. Compared to the 0.36 euros per CRO of the initial investment, last year the value had dropped to 0.08 euros. It wasn’t easy to see the value of my investment decline, but there was an unexpected twist.

This year, in 2024, the value of CRO it rose slightly, stabilizing around 0.16 euros. It’s definitely not close to the initial purchase price, but the rise was still good news. The experience showed me how volatile the cryptocurrency market is, but also how a long-term approach can offer opportunities for recovery. It was a lesson in resilience and patience, a constant game of waiting and oscillating, which taught me not to make hasty decisions in such a changing environment.

MacBook Pro or Cryptocurrencies? The Third Year of My Experiment with CRO 6

MacBook Pro or Cryptocurrencies? The Third Year of My Experiment with CRO 6

Cryptocurrencies are influenced by a variety of external factors that include government regulations, investor perceptions, and even the mainstream adoption of new technologies. Every market movement was a lesson for me, an open window onto an alternative economic world, which goes beyond the paradigms of traditional investments. Anyone who has ever invested in cryptocurrencies knows that there are ups and downs, and the important thing is to learn to live with this instability.

The cashback that made the difference

One of the most interesting aspects of this experiment was the program cashback Of Crypto.com. Over the course of these three years, thanks to purchases made using the Crypto.comI have accumulated additional 14.486,52 CROcoming to a total of 22.638,52 CRO. This was a major factor in mitigating the loss of value of the initial investment.

The program of cashback it was kind of like an unexpected bonus. With every daily purchase, 2% was returned in the form of CRO. This allowed me to accumulate many more tokens compared to the only 8,152 purchased in 2021. While on the one hand the value of CRO decreased compared to the initial purchase price, on the other hand the total quantity owned more than doubled, partially offsetting the losses.

This continuous accumulation strategy, based on the daily use of paper, proved to be crucial. Every small purchase – from coffee to the weekly shop – has helped increase my balance CROand this mitigated the losses caused by the decline in the value of the token. It is interesting to note how cashback, such a simple concept, can transform into a real investment tool. Of course, the value of the cashback is always linked to the performance of the asset, but in my case it represented an important safety net.

Furthermore, the cashback has made my approach to investing much more dynamic and engaging. It was no longer a matter of waiting and hoping that the value of CRO went up, but of an active process that allowed me to constantly accumulate new resources. This aspect was perhaps the most rewarding of the whole experiment, and led me to reflect on how even small habits can contribute to the growth of one’s capital.

Comparing the MacBook Pro to CRO investing

Let’s now see how the investment is positioned compared to the initial alternative: the purchase of a MacBook Pro. In 2021, the model I was interested in cost 3,000 euros, and today a similar model it has a fairly stable market price, around 2,000 euros, depending on the configuration. If I had purchased that computer, today I would have a technological product that is still functional, although no longer of the latest generation. So my €3,000 invested in the computer, considering obsolescence, could have a maximum of €1,000 in current value.

On the other hand, today the value of my portfolio of CRO is approximately 3,622 euros, calculating 22,638.52 CRO at the current value of 0.16 euros. In strictly economic terms, the investment in CRO managed to exceed the value of MacBook Probut at what price? The variability and uncertainty were enormous, and there were times when the value was drastically lower.

MacBook Pro or Cryptocurrencies? The Third Year of My Experiment with CRO 7

MacBook Pro or Cryptocurrencies? The Third Year of My Experiment with CRO 7

If we also consider the use value of the MacBookthe situation becomes further complicated. A computer like that could have offered me tangible, everyday benefits, such as work efficiency and advanced tools for creating and working. On the contrary, investing in CRO it didn’t give me anything immediately useful, but rather the hope of a greater financial return. It is a gamble between what is concrete and what is abstract, between what has immediate use value and what could have long-term financial value.

However, the fact that the value of my portfolio of CRO has exceeded the value of the MacBook shows that, at least in purely monetary terms, this choice had its merits. But it’s also a reminder of how important it is to balance risk and reward. Investing in technology immediately gives you something you can use that improves your productivity, while investing in cryptocurrencies is like sailing through often choppy waters, hoping to arrive at a richer port.

An invitation to reflect on your investments

Investing in cryptocurrencies like the CRO it can be exciting, but it’s also risky. This personal experiment highlighted both the potential benefits and risks inherent in this choice. The program of cashback it was certainly a positive element that allowed us to accumulate more tokens, but we must consider that not all investments have reward programs of this type.

For those interested in exploring this world, Crypto.com offers several tools to get started. Use a codice referral it can be a good starting point to obtain initial advantages. Of course, it is important to only invest what you are willing to lose and carefully evaluate your risk profile.

Another crucial element is patience. During these three years, there were times when I thought about selling everything, abandoning the idea and withdrawing what was left of my investment. But I resisted, and today I see the fruits of that choice. Sure, I didn’t earn astronomical amounts, but I learned a lot about myself and the world of cryptocurrencies. And I believe this is worth more than any profit.

Conclusion of the experiment in the third year

After three years, I can say that this experiment has been interesting and educational. The investment in CRO showed its extreme volatility, but thanks to the cashback I was able to get a higher overall value than that of MacBook Pro.

And now? I continue to keep mine CRO and to use the card Crypto.com to accumulate even more tokens. The objective is to continue to observe the evolution of this investment, aware that it is a risky but, at times, also potentially profitable game. I think, in the end, this experiment taught me an important lesson: it’s not just about how much money you can make, but also how much you can learn along the way. And this is a form of enrichment that goes beyond simple economic value.

I will continue to follow this experiment, hoping that, over time, the value of CRO can still grow. But I’m also aware that it may never happen. What interests me is the experience, the challenge, and the possibility of being part of a larger shift in the way we think about money and investing. And ultimately, that’s exactly what makes it all so fascinating.

1. How does the risk and reward dynamic work when investing in cryptocurrencies like CRO? Are there strategies to mitigate risk while still potentially enjoying returns?

2. What advice would you give to someone who is interested in investing in cryptocurrencies but feels overwhelmed by the complexity of the market?

3. Do you think investing in cryptocurrencies requires a particular mindset or attitude towards risk?

4. How does the long-term sustainability of an investment in CRO compare to other types of investments?

5. Can you talk about the practical applications of having a crypto wallet and using a cryptocurrency rewards program?

6. Do you think investing in CRO was a personal financial decision or a broader socio-economic statement? And can one’s financial decisions reflect societal values and beliefs?