Table of Contents

ChatGPT The number of companies seeking to raise funds through price return swap (PRS) is increasing. This is the result of companies that were neglected by the financial market securing liquidity by selling their stocks as a ‘last resort’. The interests of financial companies such as securities companies seeking to collect relatively high PRS fees also coincided. In this process, there are an increasing number of cases where indirect procurement is attempted through a ‘PRS only’ structure rather than a genuine sale. Concerns are rising that this may be a ‘parking transaction’.

○Companies putting out urgent fires with PRS

According to the financial investment industry on the 18th, inquiries about PRS-type financing are pouring in to the corporate finance departments of securities companies every day. PRS is a derivative product that provides a profit if the stock price is lower or higher than the reference price at the expiration of the contract. When the stock price rises above the standard price, the buyer (financial company) gives the seller (company) a share of the increase. Conversely, if the stock price falls compared to the base price, the seller must compensate the buyer for the loss.

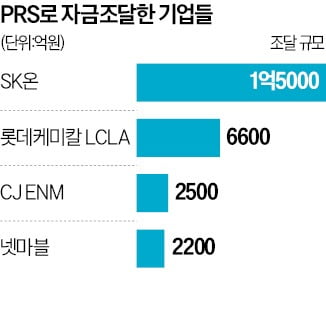

This year, major companies appear to be actively seeking funding through PRS. SK On raised an additional 500 billion won this month after expanding 1 trillion won through paid-in capital increase allocated to a third party last month. The parent company, SK Innovation, provides support by signing a PRS contract. Last month, Lotte Chemical raised about 660 billion won through PRS through a paid-in capital increase allocated to a third party by LCLA, an ethylene glycol (EG) production corporation in the United States. CJ ENM and Netmarble also raised 250 billion won and 220 billion won, respectively, through PRS.

The reason companies are taking out the PRS card is because they are having difficulty raising funds in the fund market, including corporate bonds. The financial structures of Lotte Chemical, SK On, and CJ ENM have recently deteriorated significantly. Another advantage is that it is possible to realize profits when stock prices rise while securing funds through PRS. Financial companies can also enjoy higher returns than bond investments.

○ “Stock-backed loan is close”

The problem is that many companies are attempting to indirectly raise funds through a ‘PRS only’ structure. PRS first appeared during the processing of Doosan Bobcat shares by Doosan Energy in 2018. It attracted attention because it was a PRS rather than the previous Total Return Swap (TRS). TRS often retains the right to repurchase sold shares. Even after the company sold its shares, it retained voting and dividend rights. On the other hand, in PRS, all legal rights, including voting rights and dividend rights, are transferred along with the sale of shares. Unlike TRS, PRS, which is classified as a genuine sale, can avoid regulation by financial authorities.

However, suspicions have recently emerged in the financial market that some companies are raising money by temporarily entrusting shares to financial companies based on an implicit agreement during the PRS contract process. Although it looks like stocks were bought and sold with PRS, it actually means that it is a parking transaction similar to TRS. Many say it is closer to stock-secured lending than stock trading.

It is difficult for PRS, which uses shares of unlisted companies or overseas corporations, to find a third party buyer after the contract expires. An official from a securities company said, “To avoid accounting audits, etc., we do not specify specific call options (right to buy),” and added, “Agreements tend to be made in such a way that the relevant company or affiliate receives the shares back when the PRS contract expires.” He said. He continued, “Even if it is not a share repurchase, the PRS maturity is extended continuously until the IPO and merger and acquisition (M&A) transactions begin in earnest, so in effect, the financial company is providing a stock-secured loan.”

Financial authorities are also watching closely.

An official from the financial authorities said, “PRS conducted normally is generally classified as a genuine sale,” but added, “We will look into it as it is similar to TRS.”

Reporter Jang Hyeon-joo/Ha Ji-eun [email protected]

What are the key benefits of using price return swaps (PRS) for companies facing challenges in traditional funding avenues like corporate bonds and IPOs?

Great, let’s begin the interview. First, we have Chae Sung-hoon, a financial analyst at Shinhan Investment, and Kim Jeong-tae, a CEO of Wise Asset Management.

Interviewer: As we can see from the article, the number of companies seeking funding through price return swap (PRS) is increasing. What could be the reasons behind this trend?

Chae Sung-hoon: Companies are turning to PRS due to their inability to raise funds through other sources such as corporate bonds and initial public offerings (IPOs), which are currently restricted due to market conditions. Also, PRS allows companies to secure financing while maintaining control over their business operations. It is less restrictive than debt financing, which typically comes with covenants and interest payments.

Kim Jeong-tae: I agree with Mr. Chae. Additionally, PRS provides an opportunity for companies to generate profits if their stock prices rise during the contract period. This can be particularly appealing for companies whose stock prices have dropped recently but are expected to rebound in the future.

Interviewer: The article mentions that some companies are attempting to raise funds indirectly through a ‘PRS only’ structure. Can you explain what this means and what potential issues this raises?

Chae Sung-hoon: Sure, a ‘PRS only’ structure refers to situations where companies use PRS as a last resort to raise funds, even when they have other financing options available. This can be problematic because it can be viewed as a way for companies to circumvent regulations and avoid accounting scrutiny. Moreover, if the PRS contract is not genuine, it might be considered a parking transaction, which could harm investor confidence in the market.

Kim Jeong-tae: I completely concur with Mr. Chae’s assessment. When PRS is used in this manner, it can potentially lead to moral hazard issues and misrepresentation of financial statements. It is crucial for financial authorities to monitor these transactions closely to ensure transparency and protect investors’ interests.

Interviewer: Looking ahead, what can be done to address these concerns and promote responsible use of PRS as a financing tool?

Chae Sung-hoon