Table of Contents

The energy infrastructure and water treatment group Coxwhich debuted last Friday on the stock market, has an ambitious strategy to strengthen its energy self-sufficiency through investments in energy storage and renewable technology.

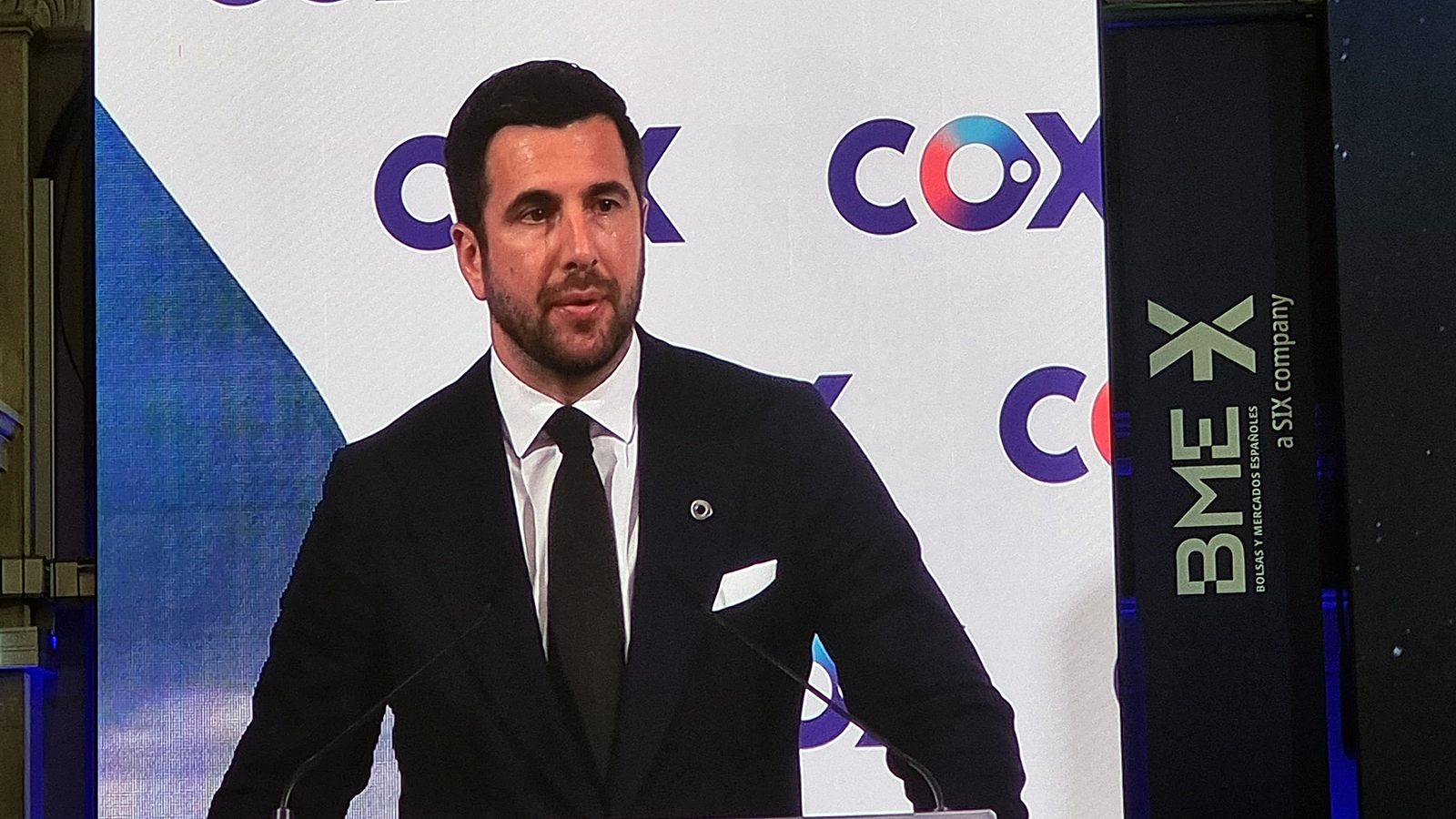

As the president of the company explained to a group of journalists, the strategy will be carried out in two phases – and therefore two different strategic plans -, each one with a different approach to ensure a stable and efficient supply.

In the first phase, and part of the current strategic plan, Cox will focus its investments on energy sources it knows well, such as solar energy with storage systems and onshore wind projects. These sources, which the company controls, will provide the electricity necessary for your operations in the water sectoran area in which Cox has positioned itself as one of the main players in the market.

Additionally, Cox has decided to focus these investments in countries with strong economies and stable currencies, seeking to minimize risks and ensure cash flow insurance for your projects. “We have opted for technologies that we know well and that are designed to power our water projects,” said the president, emphasizing that economic stability is a key factor at this stage.

For the second phase, and as part of the future strategic plan, on which the company is already working, Cox projects explore new energy storage technologies that optimize the use of renewables and further enhance their capacity to respond to growing energy demands. “We are working on new storage technologies and on being increasingly more efficient with the ones we already have,” said the president, making clear the company’s long-term vision in energy efficiency and sustainability.

Entry into Malta

A month ago, Cox took a major step toward long-term energy storage by acquiring a participation in Maltaan emerging firm with the aim of accelerating the development of innovative long-duration storage solutions. Malta, founded in 2018, has focused on providing a stable energy supply through flexible storage systems that also offer essential grid services.

With Cox as its new partner, Malta counts among its investors renowned figures such as Bill Gates, Marc Zuckerberg, Jeff Bezos, Jack Ma and Richard Bransonthrough the Breakthrough Energy Ventures initiative, which promotes green technologies and promotes renewable energies.

IPO

With the debut of Cox, there are now three Spanish companies that have made their jump to the Spanish stock market in 2024. The first of them was Puig, which debuted on May 3 in what was the largest OPV of Europe in the year, and this same week it was the turn of Inmocemento, the real estate and cement subsidiary of FCC. Europastry has been left along the way, which tried twice to launch, although without success.

Last Tuesday, Cox decided to cut the size of his initial public offering to around 175 million euros, compared to the more than 200 million euros initially planned.

In a supplement to the prospectus, the company thus modified the size of its IPO, offering between 15.37 million and 17.10 million common shares, compared to the initial 17.57 million and 19.55 million new shares. The group also decided to reduce the size of the over-allotment option, the so-called ‘green shoe’, in its offer, from the 15% initially planned to a maximum of 10% of the offer.

The proceeds will be used to finance part of the own funds needs for medium-term projects. This includes the expansion of the SEDA and AEB desalination plants, those water concessions identified as opportunities that are awarded for achieve a water portfolio of two million cubic meters/day of aggregate capacitythe concessions of transmission of São Paulo and Bahia, those transmission concessions identified as opportunities to reach 575 kilometers of transmission concessions, as well as certain projects in the area of energy generation.

What are the potential risks and challenges Cox anticipates as it expands its energy self-sufficiency through new technologies and partnerships?

Thank you for your interest in having Cox’s president and another executive on our website to discuss their energy infrastructure and water treatment group’s recent developments. To ensure a well-rounded interview, we have prepared several thematic sections and questions for the discussion.

1. Expansion Plans: Cox has big plans for expanding its energy self-sufficiency through investments in energy storage and renewable technology. Can you tell us more about these plans and how they align with the company’s current infrastructure and capabilities?

2. Strategic Approach: Cox’s strategy includes a two-phase approach for ensuring a stable and efficient supply of energy. Can you elaborate on these two phases and the reasoning behind them? What is the timeframe for completing each phase?

3. New Energy Storage Technologies: Cox is exploring new storage technologies beyond the current ones. Can you share some of the technologies you are considering and why you believe they will be beneficial for the company’s long-term goals?

4. Acquisition and Partnerships: Recently, Cox acquired a stake in Malta, an emerging firm focused on long-duration storage solutions. Can you tell us more about this partnership and how it will benefit the company’s energy storage portfolio? Who else is involved in this venture and what are their roles?

5. Initial Public Offering (IPO): Cox’s IPO was recently scaled back to around 175 million euros. What led to this decision? How do you plan to use the funds from the IPO to support your company’s growth and expansion goals?

6. Overall Impact: what do you see as the overall impact of Cox’s unique approach to energy infrastructure and water treatment on the industry? How do you envision this sector changing in the coming years, and what role will Cox play in that transformation?

7. Sustainability and Environmental Impact: As sustainability becomes a key factor for many businesses, how do you ensure that your investments in energy storage and renewable technology align with environmental goals? How do you measure the environmental impact of your projects and ensure they are in line with global standards?

Thank you for your time. We look forward to your insightful responses.