Photo = AFP space exploration company Elon Musk Space On this day, Space SpaceX returned the Super Heavy that was descending to the launch site with the robotic arm Mechazilla about 7 minutes later.

A Wall Street investor who saw this vision said, “Global investors are coming to the value and potential of the innovation launched by Space. It is estimated that major players in the global investment market are eager to use innovative companies to use the liquidity collected after the COVID-19 pandemic.

○ Collection of innovative technologies

What SpaceX demonstrated was a collection of innovative technologies, including a highly detailed control system, engine restart, launch pad engineering, and shock absorption. Because it has innovative technology that surpasses the level of the National Aeronautics and Space Administration (NASA), it is expected that it will be difficult for a company to surpass SpaceX for several decades when it grows popularity of the private space industry.

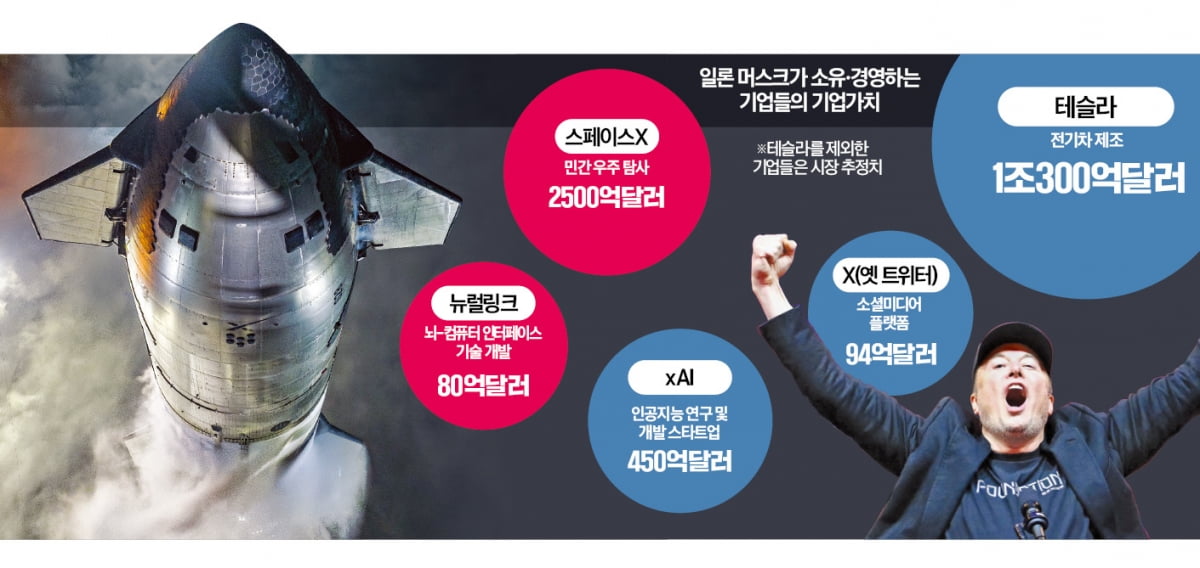

The Financial Times (FT) reported on the 16th (local time) that Space is a scale that far exceeds the value of Samsung Electronics, which fell to ‘40,000 Electronics’ in the past 4 years and 5 months and which lost 300 trillion won in market capitalization. SpaceX’s market value, previously set, was $210 billion.

Global institutional investors are also outnumbering Musk’s other companies. Musk’s artificial intelligence (AI) startup, xAI, recently raised $5 billion in funding and has been valued at $45 billion. This is almost double the valuation of a few months ago. The funding was reportedly completed quickly, just a month after Musk and investors began talks.

Investors are paying attention to xAI’s construction of Colossus, the world’s largest supercomputer and supercluster, which has 100,000 graphics processing units (GPUs) in Memphis, Tennessee. Wall Street expects Colossus to create a system that can compete with Open AI through AI training.

○ An innovative company that became a black hole of global investment

Analysis suggests that the cash flow into Musk’s company is similar to the recent global investment industry. As the US venture capital (VC) industry has been wary of investing in Silicon Valley startups, the size of the investment reserve is estimated at $311 billion. During the COVID-19 pandemic, we invested in startups with cash flow, but it was not easy to get the investment back. On the other hand, Musk’s companies are said to build hope in investors by showing visible technological innovation. The explanation is that there is a widespread feeling of hopelessness among investors, no matter how much investment is made, if they do not get dividends now, they will forever miss the opportunity.

In addition, Musk has helped US President Donald Trump to win the presidential election, thus gaining more influence in the next administration. With President-elect Trump appointing Musk as head of the Ministry of Government Efficiency, it is expected that if Musk leads the relaxation of various regulations, favorable conditions will appear for his corporate activities.

Reuters pointed out, “Korean technology giant Samsung Electronics has had the worst stock price performance among global semiconductor companies such as TSMC and NVIDIA this year,” and added, “This is believed to have because it has lagged behind its competitors in taking advantage of the growing demand for AI chips.”

New York = Reporter Park Shin-young [email protected]

![[19Samhain]Japan national football team vs China national football team | TV broadcast / online distribution | [19Samhain]Japan national football team vs China national football team | TV broadcast / online distribution |](https://www.soccer-king.jp/wp-content/uploads/2024/11/41c88eb914606d60ee577510c2e10064-2.jpg)