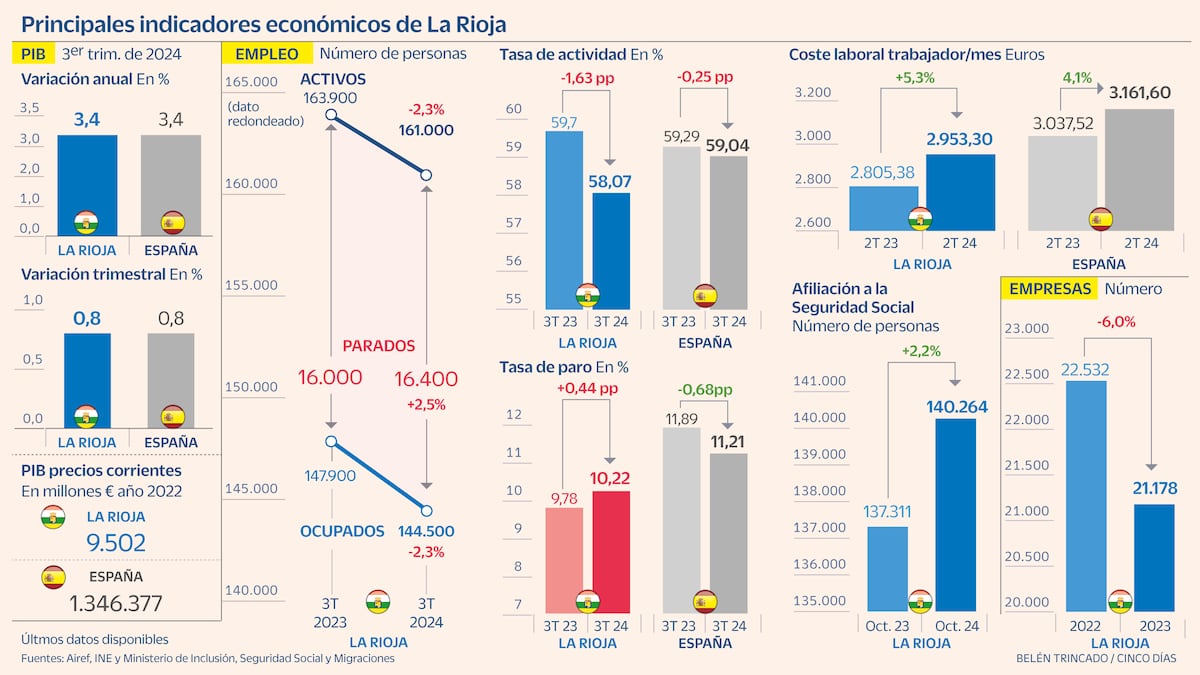

The economy of La Rioja maintains its historical pillars and identity in the agri-food and wine sectors. The production of wine with designation of origin and the canning industry represent an engine of development and a differential value. However, these activities face new challenges in the face of global economic uncertainty, variations in consumption and the decline of the industry. Tradition and innovation converge in new possibilities for the Rioja economy, whose GDP grew by 3.4% in the third quarter of 2024 compared to the same period of the previous year and in line with the average for Spain as a whole, according to estimates by the Independent Authority for Fiscal Responsibility (Airef).

The rise of the region also coincides with the national average in quarter-on-quarter terms, with an increase of 0.8% compared to the second quarter of 2024. The autonomy exceeds, as usual, the Spanish whole in GDP per capita with a difference of 5 %, although the trend points to a reduction in the distance due to the slowdown in economic growth.

The main sign of optimism is in foreign trade, despite the slowdown in sectors such as wine. La Rioja exports grew by 10.4% in 2023 compared to the previous year, up to 2.3 billion euros, and maintain a favorable evolution, according to the La Rioja Statistics Institute. Foreign activity reflects the importance of the manufacturing industry, which exported 98% of the total in 2023, and in which food (23.6%) and beverages (13.4%) stood out. The Riojan coverage rate reached 130.9% that year, above the national rate (90.4%).

Exports soared in 2023 by 10.4% compared to the previous year, up to 2.3 billion euros

This external push contrasts with the “prolonged decline of the industry”, reports CaixaBank Research. This is attested to by the adverse evolution of the Industrial Production Index (IPI): La Rioja recorded the second largest drop in the country in 2023, with an average interannual variation of 6.5%, below the national average (decrease of 1.4 %), according to the National Institute of Statistics (INE). The collapse is evident in comparison to 2019, before the pandemic, when the Rioja IPI registered an average interannual variation of 2.1%.

Among the shadows, the lower dynamism of the Riojan labor market compared to the country as a whole also stands out. In the third quarter of 2024, the unemployment rate stood at 10.22%, above that registered in the same period of 2023 (9.78%) and with an inverse evolution to the national rate, which decreased (the 11.21% compared to 11.89% the previous year).

There is also light, La Rioja set a record number of workers in October, with 140,264 affiliated with Social Security (2.2% more than in 2023). Never before had the barrier of 140,000 contributors been surpassed.

Challenges for wine

The Rioja wine sector faces a delicate situation. In the midst of global economic stagnation, the qualified DOCa Rioja designation of origin estimates that 238 million liters were sold in 2023, which represents a drop of 5.18% compared to 2022. “Now we are looking for less alcoholic products, beer consumption is growing and we associate La Rioja with red wine, when we drink more white wine,” says Ernesto Gómez, president of the College of Economists of La Rioja.

Although it is a situation that different denominations of origin experience, it has particular relevance in a region focused on this industry, indicates María Cruz Navarro, professor of Applied Economics at the University of La Rioja. “Almost half of the regional agricultural production has to do with the wine sector, there are municipalities with monoculture and it has an impact on other activities such as wine tourism,” he adds. Added to this is the shortest harvest of the century: 275 million kilos of grapes in 2024.

In October, 140,264 affiliates were registered, an increase of 2.2% compared to the same month in 2023

For the professor, the crisis requires a calm analysis and assessing “whether it is something structural, to make drastic decisions, or temporary.” These sharp actions have to do with the uprooting of vineyards to compensate for supply and demand, a demand among winegrowers. What is clear, according to Navarro, is that it is urgent to take measures to consolidate a fundamental Riojan industry.

Among the challenges are some opportunities focused on innovation, such as precision agriculture. “Technology can give added value to the agri-food sector with more special wines and preserves, but also to others such as footwear production, in which we stand out,” Gómez clarifies. The key for the expert is obvious: “La Rioja must look for new avenues without forgetting what it is traditionally good at.”

Pending tasks

Territorial diversification. 150,020 people reside in Logroño, almost 47% of the total regional population (319,892 Riojans), according to the National Institute of Statistics. This enhances economic concentration in the capital, as pointed out by Ernesto Gómez, president of the College of Economists of La Rioja. “We are experiencing the depopulation of the region’s capitals,” says the expert, who highlights the need to balance economic production and the arrival of services throughout the territory.

Sustainability. The region must work on the integration of sustainable development, “an unavoidable challenge,” says María Cruz Navarro, professor of Applied Economics at the University of La Rioja. “This imposes structural changes that affect directly affected sectors,” adds the teacher. For Navarro, this challenge also provides opportunities linked to “new ways of producing and managing natural resources,” among others.