Getty Images Bank Creating one new drug requires an investment of approximately 3 trillion won over a period of more than 10 years. This is because the process of discovering new drug candidates must be verified through animal testing and clinical trials to prove drug efficacy and safety. The launch of a new drug does not necessarily lead to commercial success. Of the drugs that are brought to market, only two or three out of ten are successful enough to cover the development costs.

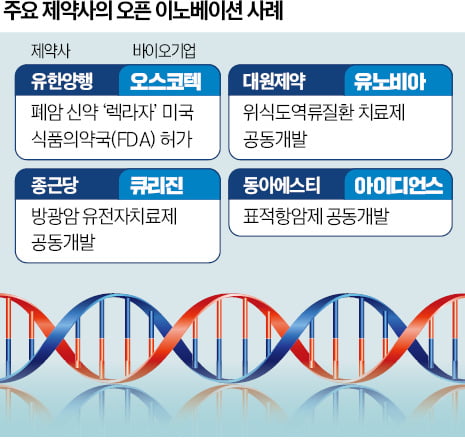

According to the pharmaceutical and bio industry on the 13th, domestic pharmaceutical companies are recently making active efforts to reduce the burden of failure on new drug development costs amounting to trillions of won through open innovation. Bio companies or small and medium-sized pharmaceutical companies can secure research and development (R&D) costs instead of providing initial research data, and pharmaceutical companies can focus on clinical development, which requires enormous funds.

○Open innovation craze brought about by the success of Recraza

The success of Yuhan Corporation’s lung cancer new drug ‘Recraza’ ignited a wave of open innovation in the domestic pharmaceutical and bio industry. Recraza, introduced from Genosco, a subsidiary of domestic bio company Oscotec, in 2015, received approval from the U.S. Food and Drug Administration (FDA) in August this year. It has become possible to use it as a first-line treatment for lung cancer through combination therapy with the antibody treatment from Johnson & Johnson (J&J), which has transferred global technology. With this approval, Yuhan Corporation is expected to record its highest ever sales this year, and if the therapy is commercialized in the future, it can expect royalties worth hundreds of billions of won every year. Yuhan Corporation has continued to collaborate with domestic pharmaceutical and bio companies by making strategic investments of more than 500 billion won in a total of 50 locations over the past 10 years. Allergy treatment (YH35324, introduced from GI Innovation) and anticancer drug (YH32367, introduced from ABL Bio), which are considered successors to Lecraza, are all imported from domestic bio companies.

Yunovia, Ildong Pharmaceutical’s R&D subsidiary, signed an agreement with Daewon Pharmaceutical in May to jointly develop a treatment for gastroesophageal reflux disease. The two companies are developing a third-generation gastrointestinal drug (P-CAB, potassium-competitive gastric acid secretion inhibitor), which is steadily increasing its share in the peptic ulcer medication market. Daewon Pharmaceutical is conducting clinical development for Yunovia’s candidate materials and has the right to commercialize them in Korea.

Chong Kun Dang develops gene therapy through open innovation. In April, a technology transfer agreement was signed with domestic bio company Curizine to develop a bladder cancer treatment that simultaneously targets genes related to cancer cell proliferation and metastasis (mTOR·STAT3). Chong Kun Dang is focusing on the development of gene therapy treatments, including operating a gene therapy research center (Gen2C) at Seoul St. Mary’s Hospital in 2022.

Donga ST seeks synergy through collaboration with traditional pharmaceutical companies. In May, the company invested about 25 billion won in Ildong Pharmaceutical Group subsidiary Idience and is jointly developing targeted anticancer drugs. Last year, we signed a contract with HK Innoen and GC Green Cross and are jointly developing anti-cancer drugs targeting non-small cell lung cancer and new drugs for immune diseases.

○Securing promising new drug candidates through preemptive investment

There are also attempts to preempt cooperative relationships with bio companies with promising technologies through early-stage investment. Daewon Pharmaceutical, which has become a pharmaceutical company with sales of 500 billion won thanks to the remarkable results of its cold medicine ‘Coldaewon’, is promoting an open innovation program with Seoul Biohub. In August, two companies, including Acuribio and Enparticle, were selected and agreed to cooperate from the early stages of development.

If there is a company with outstanding technology, we may directly participate in its management as a strategic investor (SI). Donggu Biopharma invested 10 billion won in Qurient in May, becoming the largest shareholder and actively participating in management. They have continued to invest in domestic bio companies such as Vuno, D&D Pharmatech, and Genome & Company since 2021.

○Increasing number of cases of overseas cooperation

Recently, it is also noticeable that cooperation between domestic pharmaceutical companies and global pharmaceutical and bio companies has increased. JW Pharmaceutical announced on the 30th of last month that it would cooperate with Tempus AI, a global leader in the field of artificial intelligence (AI)-based precision medicine. JW Pharmaceutical’s new drug candidates will be verified using multimodal data such as clinical records and pathology images held by Tempus AI and patient-derived organoid models.

The speed of new drug development can also be accelerated through the introduction of technology. In May of this year, HK InnoN signed a technology transfer and partnership agreement with China’s Cywind Bioscience for obesity treatment in the phase 3 clinical trial. The plan is to quickly develop an obesity medicine by introducing substances whose safety and tolerability have been confirmed through previous clinical trials. Kwak Dal-won, CEO of HK Innoen, said, “We are making full-fledged inroads into the obesity treatment market, which is growing rapidly around the world.” He added, “We will develop a product that will produce results of more than 100 billion won in the domestic obesity treatment market.”

Reporter Lee Young-ae [email protected]