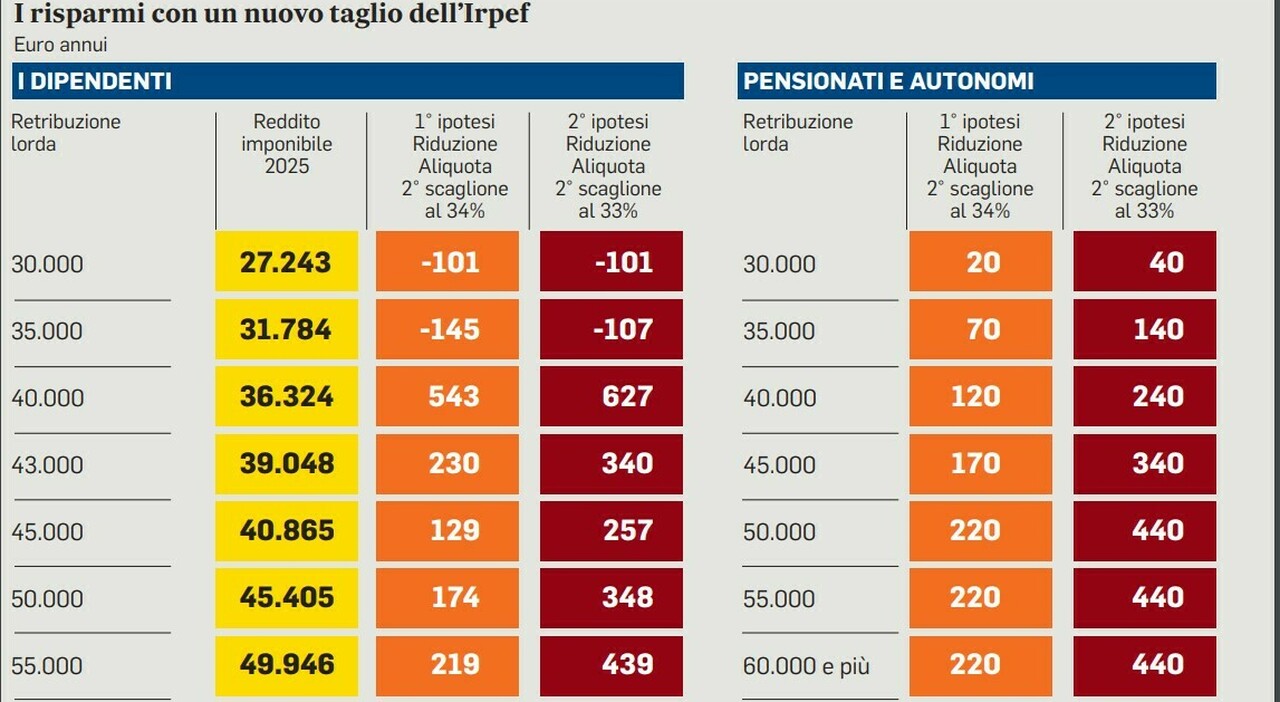

The beginning of the second half of the budget movement will be given today with the presentation of the changes to the government text. But beyond the planned changes that come from the majority and the opposition parties, the real game will be played on one point: a new tax cut for workers, pensioners and self-employed people. And it will, if successful, target the middle class. The government’s intentions were expressed several times by the Deputy Minister of the Economy Maurizio Leo, the holder of the tax delegation. The intention is to reduce the second tier of Irpef, the 35 percent rate that affects income between 28 and 50 thousand euros. From 51 and above we move to the last bracket, 43 percent. The intention is to be able to reduce the tax by two percentage points, bringing it to 33 percent, using the income from the biennial writing with creditors of VAT numbers. The “agreement” with the tax authorities had to be signed by self-employed people before 31 October. 522 thousand did so, with money for the State of 1.3 billion euros.

2024-11-10 22:55:00

#Irpef #cut #middle #class #benefits #euros #profit #symbols #tables