Why China needs massive fiscal stimulus

Ha Hyeon-ok, editorial writer

Can we save the weakened ‘world market’? The market’s attention is focused on the scale of ‘money release’ that will be decided by the Standing Committee of China’s National People’s Congress (National People’s Congress), which concludes on the 8th. They are paying close attention to whether the Chinese government will come up with a strong move to stimulate the slumping economy.

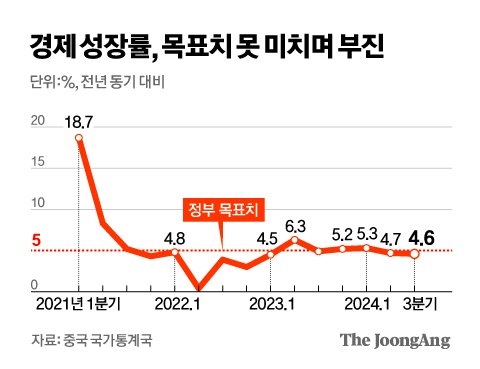

China’s economic growth, which showed signs of recovery last year, fell short of market expectations in the second quarter (4.7%) and third quarter (4.6%) of this year. The growth rate in the first to third quarters was only 4.8%, making it difficult to achieve the government’s growth target of around 5% this year. Deflation (falling prices) pressure is also increasing. The Chinese government has mobilized various stimulus measures in recent months, including lowering interest rates, easing real estate loans, injecting funds to stabilize the stock market, and disbursing early next year’s budget, but they have not been as effective as expected.

Due to the slowdown in the real estate market and sluggish consumption

A red flag for achieving a growth rate of ‘around 5%’

Amidst the risk of prolonged deflation

There are concerns about ‘Japanization’ of low growth and low prices.

To achieve economic stimulation and structural reform

A strong economic stimulus package must be presented

The place to rely now is to revitalize the economy through fiscal injection. The market is still going through an optimistic cycle. The expected size of fiscal stimulus varies. It ranges from 1 to 2 trillion yuan up to 10 trillion yuan. 10 trillion yuan is more than 8% of China’s gross domestic product (GDP). Reuters reported, “We plan to announce additional borrowing of 10 trillion yuan and use it to stimulate the economy over the next five years.” The Wall Street Journal (WSJ) said, “There are various expectations, but many are expecting a stimulus package worth 10 trillion yuan,” and added, “If it is less than expected, the market will be disappointed.”

There are also strong voices in China calling for large-scale stimulus. Hong Kong’s South China Morning Post (SCMP) reported the argument of Chinese government scholars that a stimulus package of at least 4 trillion yuan and up to 12 trillion yuan is needed. According to SCMP, Zhang Bin, deputy director of the World Economic and Political Research Institute under the Chinese Academy of Social Sciences, said, “If next year’s growth target is set at 5%, the government fiscal deficit rate will have to be at the 7% level, and if that happens, the creation of government debt worth 12 trillion yuan is inevitable.” did it

China exits ‘balance sheet recession’

The reason the world is desperate for a megaton stimulus package is that the situation in China is not so favorable and the impact is devastating. China, enjoying high growth, was a powerful engine of the world economy. China’s demand has been a strong support in the markets for everything from oil and raw materials to consumer goods and luxury goods, and has sometimes been the main cause of price surges. But things have changed. China’s economic slowdown has become a risk factor that can lead to poor corporate performance and a slowdown in the global economy.

![[하현옥의 세계경제전망] To prevent ‘deflation exports’, fiscal injection is necessary to revive consumption. [하현옥의 세계경제전망] To prevent ‘deflation exports’, fiscal injection is necessary to revive consumption.](https://pds.joongang.co.kr/news/component/htmlphoto_mmdata/202411/07/315dc740-cf07-4f77-ae33-06078a0dfefb.jpg)

Reporter Kim Joo-won

The impact of China’s economic slump is being felt everywhere. The Financial Times (FT) reported on the 31st of last month that Western consumer goods companies such as cosmetics and luxury goods are experiencing difficulties due to China’s economic downturn. Cosmetics company Estee Lauder withdrew its profit forecast for this year and cut its dividend. This is because it is unclear whether sales in China will recover. Anheuser-Busch InBev, the world’s largest beer company, saw sales in China decline 14.2% in the third quarter, and Carlsberg sales fell 6% during the same period.

The ‘China shock’ in the luxury goods industry is even bigger. The Chinese market accounts for about 30% of the global luxury goods industry. Louis Vuitton Moët Hennessy (LVMH), which owns Louis Vuitton and Dior, saw sales in the Asian market (excluding Japan) decrease by 16% in the third quarter. A double-digit decline continued following the second quarter (-14%). Kering Group, which owns Gucci and other brands, saw its sales in China plummet by 35% in the third quarter of this year compared to a year ago.

Reporter Kim Joo-won

China’s domestic demand recession is prolonged. This is the effect of sluggish consumption and a slowdown in the real estate market. In particular, the recession in the real estate market, which accounts for about 20% of China’s GDP, is a variable that will shake not only the Chinese economy but also the global economy. After the default crisis of real estate company Hengda in 2021, the Chinese real estate market froze due to the Chinese government’s strong regulations. According to the Center for International Finance, as of last September, Chinese real estate market prices and transaction volumes had been negative for 18 and 17 consecutive months, respectively. As a result, a vicious cycle of ‘recession in real estate transactions → increase in vacancy → insolvency of real estate companies → worsening economic sentiment → sluggish consumption → economic slowdown → market contraction’ continues.

Real estate accounts for about 60% of household assets in China. As uncertainty in the real estate market grew, households entered austerity mode. We have fallen into a so-called ‘balance sheet recession’ where debt is paid off, savings are reduced, and consumption is reduced. It’s not that you don’t have money, but it’s natural for your spending power to decrease. The weak monetary policy of lowering interest rates and easing lending is not effective due to households’ ‘hold-on stance’. According to the Center for International Finance, the forecast for next year’s consumption growth rate was also lowered from 5.6% in January to 4.5% last month. Rather, it means that the amount of money spent is decreasing.

“China’s low consumption is a problem for the global economy”

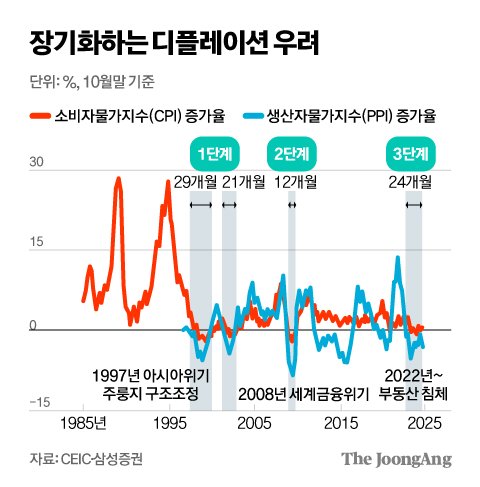

Sluggish consumption due to a slowdown in the real estate market is causing deflation. Core inflation, excluding food and energy prices, has remained below 1.0% for 20 consecutive months. The rise in consumer prices and producer prices is also slowing, and the risk of deflation continues for 24 consecutive months. What is slowly raising its head is the concern about the ‘Japanization’ of the Chinese economy. Japaneseization refers to the process in which a country’s economy is in a situation where it cannot escape from low growth and low prices without shock therapy, or is falling into such a phase.

The problem is that the ‘Japanization of the Chinese economy’ triggered by the real estate market recession may be a red flag for the global economy. In its ‘Asia-Pacific Regional Economic Outlook Report’ on the 1st, the International Monetary Fund (IMF) pointed out that China’s prolonged adjustment in the real estate sector could be detrimental to the Asian and global economies. The most worrying situation is that China, facing deflationary pressure due to the economic slowdown, is trying to solve the problem by exporting goods. The analysis is that with China’s so-called ‘deflation exports’, the industrial competitiveness of countries with a similar export structure to China may be harmed by the offensive of cheap Chinese products, and trade conflicts may intensify.

Designer Younghee Kim

China’s ‘deflation exports’ result from China’s growth model and economic structure. WSJ cited a report from Rhodium Group, an American market research and consulting firm that analyzed household consumption in China last August, saying, “The low consumption share in the Chinese economy is a headwind to China’s economic growth and is causing problems around the world.” “There is,” he pointed out. According to the report, China accounts for only 13% of global consumption, but its share of investment is 28%. Amid this imbalance, China has actively promoted exports, and China’s annual goods trade surplus has increased to $900 billion, or 0.8% of global GDP.

In the process of resolving China’s overinvestment and resulting overproduction through exports, countries suffering from low prices may fall into the inability to invest. We are no exception. Domestic companies are also suffering from China’s ‘predatory sales’ of low-priced products led by online commerce platforms Ali and Temu. WSJ said, “If China tries to revive its economy through deflationary exports by relying on global demand, it will pose a risk to the global economy.”

“Growth of household consumption, determinant of China’s growth rate”

So, can China, which is trying to revive its economy, find peaceful means other than ‘deflation exports’? The IMF emphasized, “Trade conflict could worsen if China uses methods to boost manufacturing and exports,” and added, “Promoting restructuring of the real estate sector and promoting private consumption is helpful to the Asian and global economies.” Rhodium Group said, “As the investment-led growth model that drove China’s economic growth has reached its peak, the growth of household consumption will be the most important factor in determining China’s long-term economic growth.”

Designer Younghee Kim

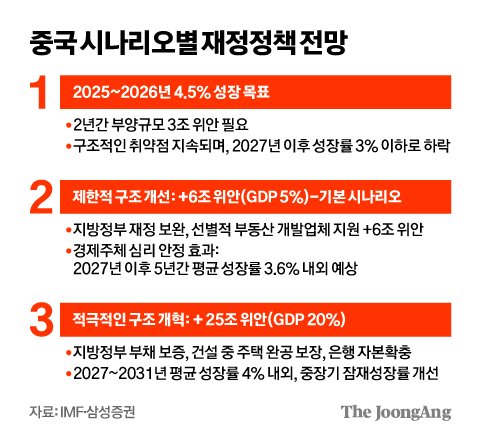

Rhodium Group predicted that unless significant fiscal reforms are implemented, China’s long-term household consumption growth rate is likely to slow to 3-4% per year over the next 5-10 years. In this case, it is predicted that the contribution of household consumption to the annual economic growth rate will be only 1.5 percentage points, and the overall long-term economic growth rate may be limited to about 3%.

Now the market’s attention is focused on how much, where, and how the Chinese government will release the country’s treasury. The market is expecting a bazooka, but there are also predictions that the Chinese government will not present specific figures. The strength and direction of the stimulus package may vary depending on the results of the US presidential election.

It may be difficult to feel the effects of the stimulus package

Some point out that the Chinese government’s ‘helicopter money’ cannot be a panacea. Song Ki-jong, head of the financial rating department 1 at Nice Credit Rating, said, “There will be limits to the stimulus package as the dynamism of China’s private sector has disappeared and a quick recovery cannot be expected,” adding, “A stimulus package that combines monetary easing and fiscal expansion must be implemented to avoid the liquidity trap.” “It could create an inflection point in the failing economic situation,” he said.

There is also an analysis that even if the government spends money, the warmth may not be transmitted to the upper neck. Choi Seol-hwa, a researcher at Meritz Securities, said, “China’s fiscal expansion appears to be focused on resolving local government debt,” and analyzed, “It is highly likely that at least 5 to 6 trillion yuan will be invested in the coming years.” Injecting finances into resolving debt rather than investing in infrastructure, which is expected to have an immediate effect on stimulating the economy, will not lead to the creation of meaningful new demand for investment and consumption.

Samsung Securities emphasized that “the Chinese government must solve the two tasks of economic stimulation and structural reform,” and that “the success or failure of the economic stimulus package depends on the ‘strength of fiscal stimulus.’” He added, “If the scenario of Donald Trump coming back to power becomes a reality, Chinese policy authorities will have to present a stronger economic stimulus package to build a firewall.”

![[网球]WTA Finals Women’s Singles Group Stage: Paolini VS Zheng Qinwen Highlights [网球]WTA Finals Women’s Singles Group Stage: Paolini VS Zheng Qinwen Highlights](http://p1.img.cctvpic.com/photoAlbum/templet/common/DEPA1565254619482142/tiyu.jpg)