In the event that you intend to rectify or correct a declaration already submitted, before the official submission deadline expires, it is necessary to complete a new declaration, complete with all its parts and any corrections and proceed with sending it again.

The ordinary deadline for declarations relating to the 2023 tax year is 31 October 2024 (unless further extensions by the Revenue Agency). With today’s newsletter we see what the steps are to send a “Correction within the deadlines” with GBsoftware.

“Corrective within the terms” declaration

With the “correct within the deadline” declaration it is possible to declare, within the deadline of the declaration, income or report deductible and deductible expenses previously not indicated or indicated incorrectly in the declaration already submitted.

By submitting a corrective declaration, the taxpayer may find himself in two situations:

- the new model results in less credit or greater debt;

- the new model results in greater credit or less debt.

In the first case, it will be necessary to pay the difference compared to the amount of the credit used to compensate for the payment of the debts arising from the previous declaration and to pay any new debt.

In the second case, it is possible to request a refund for the difference compared to the amount of the credit or debt resulting from the previous declaration or use the new credit to offset further debts.

Declaration “Corrective within the terms” with GBsoftware

To send a corrective declaration within the deadlines with GBsoftware you need to perform the following steps:

- Go to the company concerned, access Management Management, and dehistoricize the declaration by eliminating the “Dehistoricize all” check;

- Modify the declaration, integrating or rectifying the data within it;

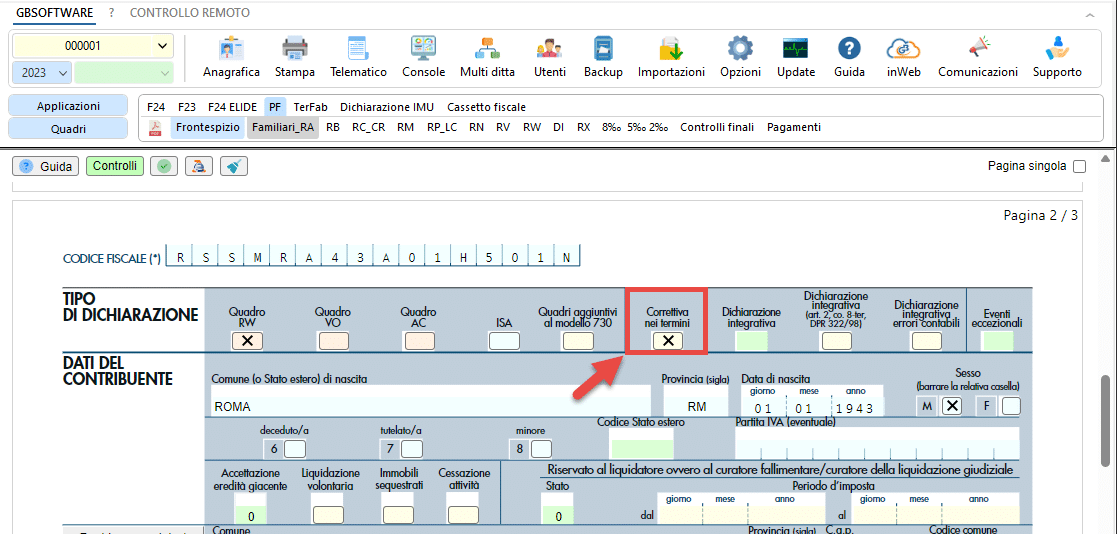

- Go to the title page and check the “Correction within the terms” box;

- Carry out a preventive electronic check of the declaration and, if there are no errors, go to Frameworks and historicize the declaration again by checking “Historize everything”;

- Carry out a definitive electronic check of the declaration and proceed with sending it.

Applications linked to the article

Corrective TAG in the corrective declaration terms of the income model

![]() Print the page

Print the page