[세무학회 추계학술대회]

Results of Professor Changseop Lee and Hongmin Jeon’s team estimates

Temporary tax benefits for R&D need to be reviewed

There is also a proposal to “index the increase in tax deduction to prices”

Kang Min-soo “Tax administration needs to change due to low birth rate“

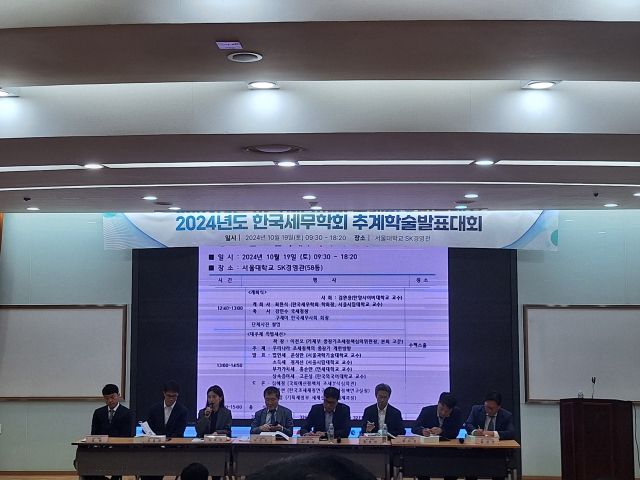

Jeon Oh Lee (fourth from the left), professor emeritus at Sungkyunkwan University Law School, Hyeong Jeong (first from the left), head of the Corporate Tax Division of the Ministry of Strategy and Finance, and Jonghyun Oh (second from the left), head of the tax policy research office at the Korea Institute of Public Finance, held at the SK Management Building of Seoul National University in Gwanak-gu, Seoul on the 19th. People attending the ‘2024 Korean Taxation Association Fall Academic Presentation’ are discussing mid- to long-term reform plans for Korea’s tax policy.

An analysis showed that the additional costs that domestic companies will have to bear due to the Carbon Border Adjustment System (CBAM), which the European Union (EU) plans to implement from 2026, will amount to up to 1.7 trillion won per year. Considering this, it is argued that the government should provide tax benefits to carbon neutrality-related research and development (R&D) to lower the burden on companies.

Professor Lee Chang-seop of the Department of Business Administration at Sejong University and Professor Jeon Hong-min of the Department of Business Administration at Sungshin Women’s University presented the costs to be borne by domestic companies in 2030 based on the basic scenario at the ‘2024 Korean Taxation Association Fall Conference’ held at the SK Management Hall of Seoul National University in Gwanak-gu, Seoul on the 19th of this month. It was estimated at about 1.12 trillion won, or as much as 1.7 trillion won.

CBAM is a system in which the EU imposes a carbon tax on the amount of carbon emissions generated during the production process of products from overseas export companies. Six items are targeted, including steel, aluminum, cement, fertilizer, hydrogen, and electricity, and the EU plans to continue to increase the number of target items. According to Lee Eon-joo, a member of the National Assembly’s Trade, Industry, Energy, Small and Medium Venture Business Committee and a member of the Democratic Party of Korea, there were 1,358 small and medium-sized enterprises subject to CBAM as of last year, and 73.5% of them are exporting to the EU. However, close to 80% of companies do not know about CBAM. Professor Jeon argued, “Direct deductions should be provided for R&D of innovative technologies related to greenhouse gases.”

At the conference on this day, it was also suggested that the deduction amount should be linked to prices in order to rationalize the inheritance and gift tax burden. Go Yun-seong, a professor at Hankuk University of Foreign Studies’ business school, said, “It is reasonable to link prices when determining inheritance and gift tax rates and deduction limits,” and emphasized, “Inheritance and gifts between spouses should be fully deducted without limit.”

Kang Min-soo, Commissioner of the National Tax Service, is giving a congratulatory speech at the ‘2024 Korean Taxation Association Fall Academic Presentation’ held at the SK Management Building of Seoul National University in Gwanak-gu, Seoul on the 19th.

The majority opinion was that corporate taxation should be simplified in line with international trends. Seongman Yoon, a professor of business administration at Seoul National University of Science and Technology, explained, “In corporate tax, we need to consider a single tax rate system that distinguishes between general companies and small and medium-sized businesses, and simplify ineffective tax expenditure items.”

There was also advice that the overall tax system should be revised to accommodate low birth rates and aging population. Kang Min-soo, Commissioner of the National Tax Service, who attended the conference on this day, said in his congratulatory speech, “At a time when the population structure is rapidly changing due to low birth rates and aging, it is timely to prepare a plan to reform Korea’s tax administration in terms of ensuring sustainability.” Hong Soon-man, a professor of public administration at Yonsei University, said, “In an aging society, an increase in value-added tax can be a universal alternative,” and argued, “Increasing value-added tax from 10% to 15% is a long-term alternative.”

An analysis also showed that after the establishment of the local tax office, nearby companies became more inclined to pay attention to tax strategies. Choi Min-joo, an accountant at Samhwa Accounting Corporation, said that after the establishment of the Incheon Regional Tax Office in 2019, companies have become more aware of the policy direction of the tax authorities. He said, “The expertise of (new) local government officials will have a big impact on companies.”