Photo: Wirestock-Freepik.com

The euro is under “attack” and pressure is being exerted on the common currency from two sides. The euro could fall further against the US dollar, even towards parity, i.e. an exchange rate of 1:1. We are currently seeing a price of 1.0841. Shortly before yesterday’s interest rate cut by the ECB and Christine Lagarde’s dovish statements (more interest rate cuts are on the way), the price was still at 1.0864. And at the beginning of the month the exchange rate was 1.12. The prospect of further interest rate cuts and Donald Trump‘s renewed presidency opens up a bearish outlook for the euro.

The danger of euro parity is returning

We recently discussed the strength of the dollar over the last two weeks and therefore also the weakness of the euro. Discussions among market participants are now also increasing. The risk of the euro slipping to parity with the dollar is rising in financial markets following this week’s interest rate cut and a stark reminder that a Donald Trump presidency could trigger a global trade war.

Bloomberg reports: Just days after Donald Trump indicated that US tariffs would both against Europe as well as against China and other countries, ECB President Christine Lagarde warned that any trade barriers would pose a “downside risk” to the bloc’s struggling economy. On Thursday it cut interest rates for the third time since June, triggering bets for even more aggressive cuts.

Statements from market participants

The combination of these events sent the euro lower, putting it on track for its third straight week of losses against the dollar and its worst weekly decline against the pound this year. “Euro-dollar parity is definitely a possibility if Trump wins and goes all out on tariffs,” said Michael Hart, senior currency strategist at Pictet Wealth Management. Pictet and Deutsche Bank believe a scenario where a euro is worth a single dollar is no longer far-fetched, while JP Morgan Private Bank and ING Groep see a risk of the common currency falling to that level before the end of the year could.

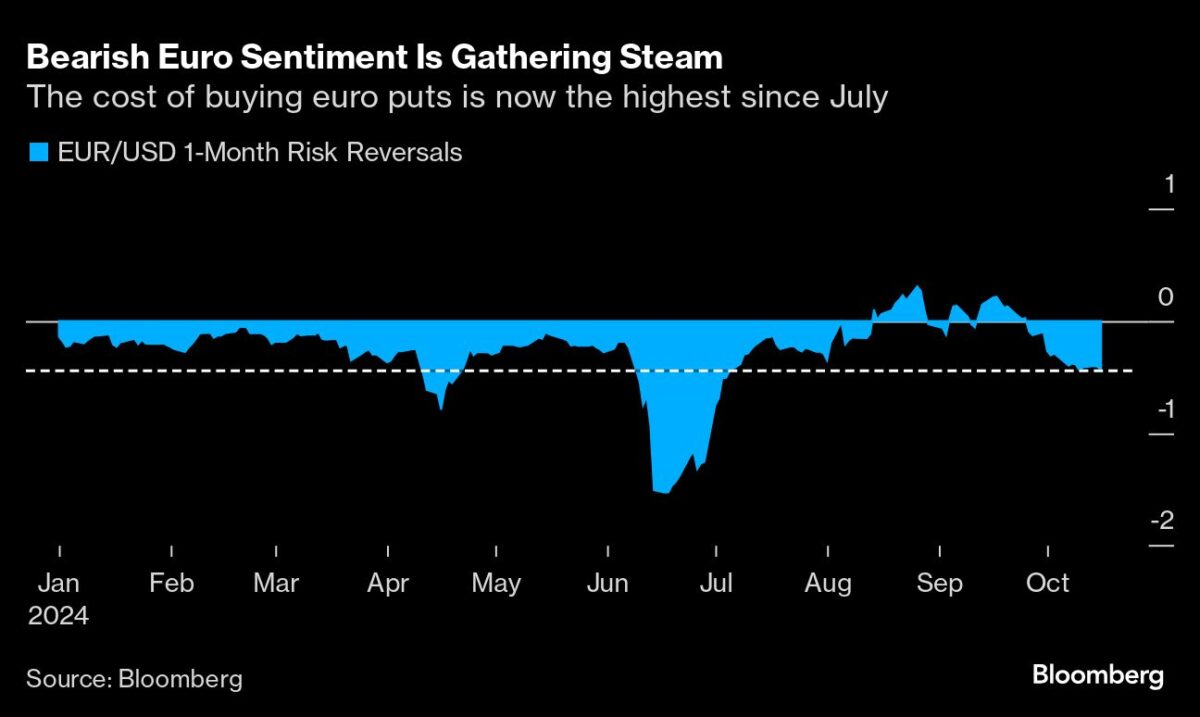

Looking at options market

The deteriorating sentiment is visible on the options market, where traders are increasingly betting on falling euro prices. An indicator of next month’s risk reversal – or how expensive it is to buy options that capitalize on a currency’s gains versus options that bet on weakness – is now the most negative for the euro-dollar pair in three months and shows the willingness to bet on the falling euro.

Options to protect against a near-term weaker euro are focused on a decline to the $1.08 to $1.07 range, according to data from the Depository Trust & Clearing Corporation. Interest in protecting against a drop to $1.05 is increasing, while parity trades represent only a small portion of the total volume for now. “We prefer a strong dollar versus the euro as Europe is sensitive to shifts in foreign policy and the prospect of sweeping tariffs under Trump,” said Aroop Chatterjee, a strategist at Wells Fargo.

The Chinese yuan, Mexican peso and Japanese yen are typically seen as the main lightning rods for new U.S. trade restrictions, but Europe’s weakening economy leaves the euro vulnerable. U.S. tariffs could hurt global trade just as growth slows and central banks cut interest rates.

What Bloomberg strategists say: “Expectations of aggressive ECB monetary easing, coupled with other headwinds, could fuel talk of the euro returning to parity in 2025 – a scenario that markets currently appear to be largely ruling out.”

Nour Al Ali, Macro Markets & Squawk, London.

Money markets are implying a 20% chance that the ECB will make a half-percentage-point cut at the final meeting of the year in December, and are almost entirely priced in for quarter-point cuts at every meeting through April.

Euro: Looking at Trump election and trade war

“An election of Donald Trump and a tariff war are looming, which could force the ECB to take further action to keep the currency weak and remain competitive,” said Kaspar Hense, senior portfolio manager at RBC BlueBay Asset Management.

In an interview with Bloomberg earlier this week, Trump called tariffs “the most beautiful word in the dictionary.” Taking aim at Europe, he added: “You know what’s difficult? The European Union. They treat us so badly that we have a deficit.”

Although the outcome of the election is yet to be seen, George Saravelos, global head of foreign exchange research at Deutsche Bank, says a global trade war involving China would prompt the ECB to cut interest rates more aggressively than markets “This would take interest rate spreads to historic extremes and bring the euro-dollar pair down to around 1.00,” he wrote earlier this month.

FMW/Bloomberg

Read and write comments, click here