Aiming to fully lift restrictive monetary policy by the end of 2025 to levels that no longer constrain demand in order to boost the economy, the ECB will accelerate interest rate cuts in the coming months.

That’s according to Bloomberg’s poll of reputable economists, in the wake of similar statements by the bank’s top executives, who have voiced an intention to ease monetary policy more quickly – always provided the economic data allows.

After all, one of the main findings of the previous ECB Board meeting in September was that “inflation had recently fallen somewhat faster than expected”.

With inflation now below its 2% target, analysts see the ECB cutting the deposit rate by 25 basis points and by the same amount at each meeting until March. From then on, investors expect two more reductions, specifically in June and December, with the final destination of the interest rate at 2%.

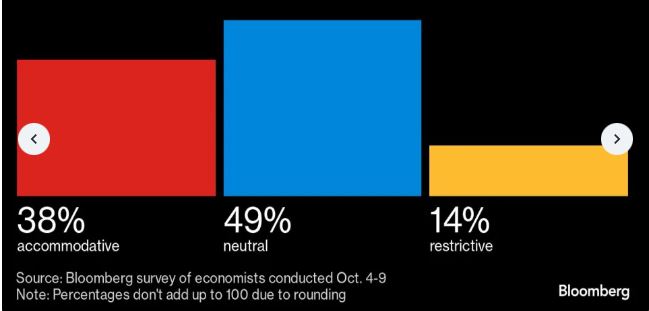

Also, half of the economists surveyed expect interest rates to be neutral by that point, while about 2 in 5 expect them to be low enough to encourage economic expansion. The previous poll predicted that the current rate cut cycle would end at 2.5% in September 2025.

Caveats

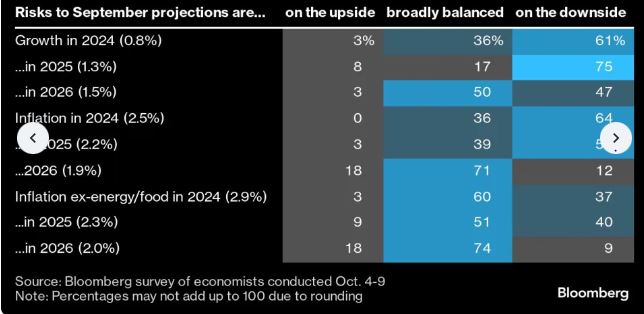

Many respondents, however, warned that a return to 2% inflation is not yet assured.

While the labor market shows signs of easing, unemployment remains at an all-time low. Wages are also still growing at a healthy pace and — underscoring that wage pressures won’t ease easily — German public sector workers are looking for an 8% boost even as the country’s economy shrinks for a second year.

“The ECB’s main challenge continues to be to simultaneously manage downside risks to growth — which have intensified — against persistent upward inflationary pressure from high wage growth,” said Bill Diviney, senior euro zone economist at ABN Amro. . “But the balance of risk appears to have tipped clearly towards growth concerns.”

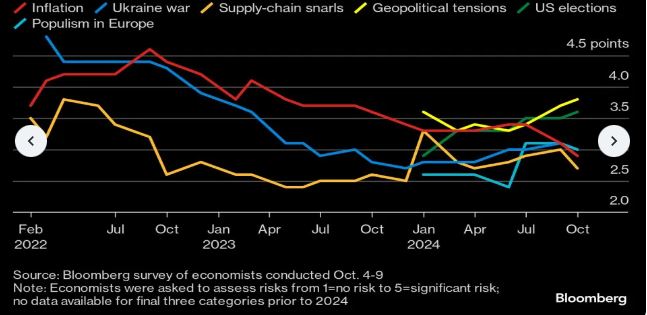

Indeed, hope for a recovery in household spending and investment—as well as a recovery in global trade—is fading. And on top of all that, survey respondents see Europe’s biggest economic risks as coming from geopolitical tensions and the potential return of Donald Trump to the US presidency.

Through this lens, the Chief Risk Officer of AlphaTerra Capital, Andreas Koutras, considers that the ECB is “behind the curve”.

The analyst is among 49% of economists who predict that interest rates will neither stimulate nor limit the economy through the end of 2025. The majority see the neutral rate — which can only be estimated and cannot be measured — between 2% and 2.25%.

“Significant Uncertainties”

The fragility of the eurozone economy “supports arguments for a faster pace of easing,” said Dennis Shen, economist at Scope Ratings, adding that there are also “significant uncertainties” after next week’s meeting. In the US, there is the matter of the economy, the Fed’s decisions and who will take over the presidency. Elsewhere, escalating tensions in the Middle East could push up energy prices.”

“Inflation remains far from defeated,” said Dennis Shen, an economist at Scope Ratings, saying the economy still has elements that make it “fragile.” “This should force the ECB to remain cautious in its decisions to cut interest rates,” he stressed.

With that caveat, around two-thirds of respondents expect the ECB to reiterate next Thursday that the board will keep policy sufficiently “tight” for as long as necessary to ensure inflation reaches – and remains – at 2 % medium term. This, as inflation fell below 1.8% in September for the first time since 2021, but officials have warned it will pick up again in the coming months, especially as pressures on the services sector continue to linger.

On a similar note, HSBC’s Fabio Balboni commented: “While we expect the ECB to accelerate the pace of cuts in the coming meetings, uncertainty remains over the landing zone of inflation next year.”

Inflation containment – Not below 2%

“The ECB achieved a higher level of confidence in reaching its 2% inflation target faster than expected, which is consistent with faster rate cuts in the near term,” Hugo Le Damany and Francois Cabau of AXA Investment Managers told Bloomberg. But they added that “this does not mean they want to go below 2%, so they will have to manage medium-term expectations to get ahead of a market assessment of too many cuts.”

Officials’ messages – “Hawks” that became “doves”

The ECB’s overly restrictive interest rates could drive inflation below target, Bank of Greece governor Giannis Stournaras warned in recent days as a member of the ECB’s board, predicting two more rate cuts this year and further easing of monetary policy in 2025. .

Giannis Stournaras has backed two more rate cuts of 25 basis points each before the end of the year, the first at the ECB meeting next week in Slovenia and the second at the last meeting for 2024 in December, given that the latest figures on economic activity and inflation are better than expected.

“Even if we have a 25 basis point cut now and one more in December, we’ll be back to just 3% [για το επιτόκιο δανεισμού]which remains in extremely restrictive territory,” Stournaras told the FT, adding that further easing of policy in 2025 is likely.

He pointed out that “the indicators [οικονομικής] confidence levels are right between life and death” and “inflation is falling faster than we forecast [της ΕΚΤ] September,” adding: “The latest figures suggest we may reach 2% in the first quarter of 2025.”

“If inflation continues its downward path towards the 2% target, why should it not decrease? [το επιτόκιο] at every meeting?’ he said characteristically.

“We’re all looking at the same data that shows we’re on track to reach 2% [για τον πληθωρισμό] by mid-2025, if not earlier,” he said.

“Otherwise,” he added, “we risk taking the economy down a lot and undershooting the inflation target,” pointing out that doing so would mean a return to the “old problem” of very low inflation. “Nobody wants that,” he stressed.

At the same time, even the staunchest advocates of tighter monetary policy now see the need for further cuts in lending rates in the eurozone immediately, as inflation shows signs of abating and the economy needs a boost.

Joachim Nagel, who heads Germany’s powerful central bank, the Bundesbank, appears to be among the hawks who are changing their stance and are now predicting a further cut in borrowing costs even next week at the European Central Bank’s meeting on October 17.

Before Nagel, the central banker of France had also sent a message of a new interest rate cut. The ECB is very likely to cut interest rates at next week’s meeting, was the message sent by Francois Villerois de Gallo, against the background of the development of inflation in the euro zone which fell below the 2% target in September. He expects that in 2025 structural inflation will also register a decline. The head of the Bank of France also pointed out that market expectations for inflation in 2025 are below 1.8% – lower than the ECB’s forecast.

The minutes of the ECB for September

Yesterday, one week before the monetary policy meeting, the minutes of the previous meeting were released. ECB policymakers on September 12 appeared pleased with the fall in inflation when they met, but argued for a gradual easing due to lingering domestic price pressures.

“The key path to 2% was largely dependent on the growth of lower wages as well as an acceleration of productivity growth to rates not seen for many years and above historical averages,” the ECB minutes said. .

“Therefore, we are required to closely monitor whether inflation will stabilize on time to the target. The risk of delays in achieving the ECB’s target was considered to warrant some caution to avoid a premature return to restrictive policy,” they add.

SOURCE: ot.gr

#Interest #rates #analysts #reduction #ECB