Foto: evening_tao – Freepik.com

September is traditionally considered one of the strongest sales times for the car market in China. New models, fall car shows and increased travel during the national holiday usually contribute to a significant increase in sales. But according to preliminary Pay According to the China Passenger Car Association (CPCA), sales rose just 2% in September compared to the previous month. Given the usual high season, this growth is disappointing.

China: Real estate market changes consumer behavior

Cui Dongshu, secretary general of the CPCA, explains in his analysis that the decline in the real estate market has led to a change in the consumption behavior of Chinese consumers. Since less is being invested in real estate, consumers have more funds available to purchase vehicles. Low-cost models made more affordable by technological advances are driving this development. Instead of just deciding based on availability, buyers today place more value on the quality and functionality of their cars. Government measures that promote consumption further support this trend. Against this background, the figures are all the more disappointing and once again underline the weak consumer mood in China.

Another positive impact on sales of new vehicles comes from scrappage bonuses that have been introduced in many provinces. These rewards encourage consumers to trade in older vehicles for new, modern models, increasing competition and stimulating new car demand. The previous price war, which had dampened buyers’ spirits in recent months, has noticeably eased as a result.

According to CPCA’s own market research, the mood among car manufacturers brightened significantly in September and was more optimistic than ever before this year.

Inventory reduction strengthens the car market in China

In August, car manufacturers delivered fewer vehicles to dealers than were sold to end customers, which led to a reduction in inventories. This trend continued in September and further strengthened the market.

This is also shown by the “Vehicle Inventory Alert Index” (VIA) published by the China Automobile Dealers Association (CADA), which was at 54% in September – a decline of 3.8 percentage points compared to the previous year.

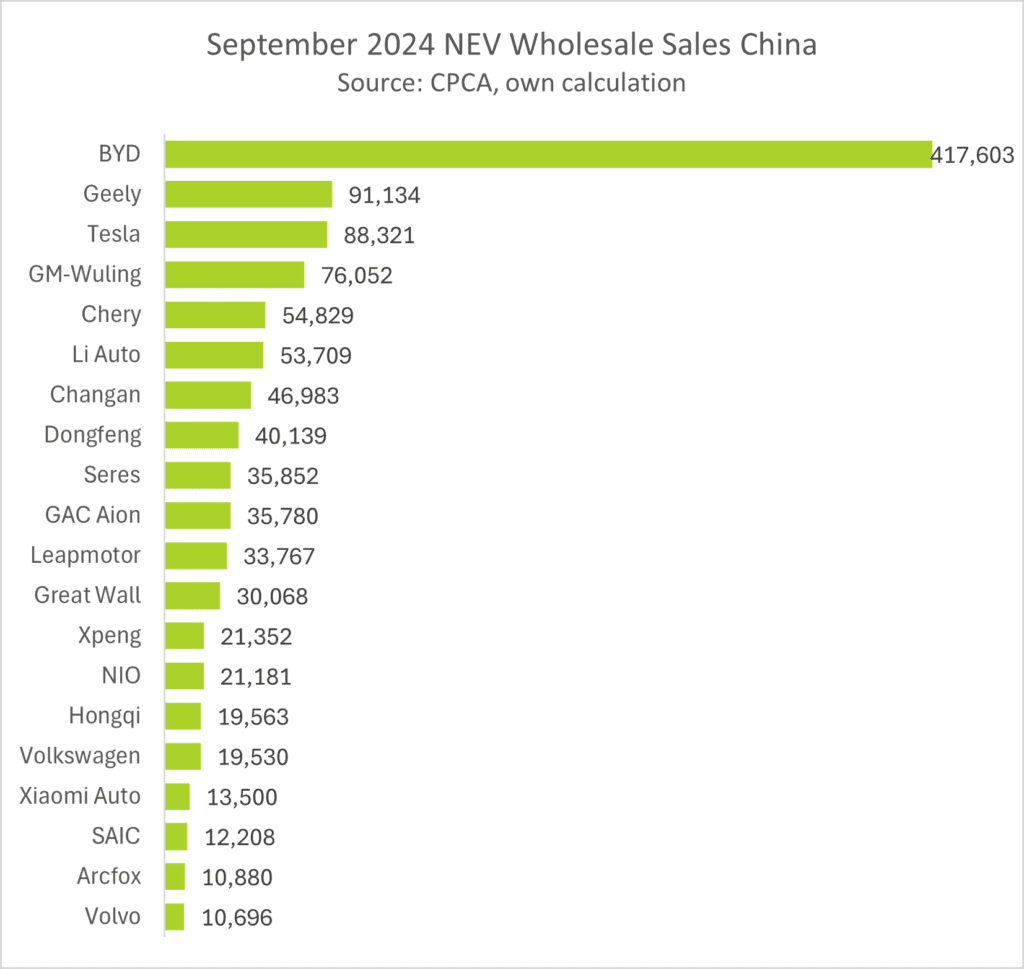

Electric vehicles dominate sales

The demand for cars with alternative drive systems (NEVs) continues to increase. In September, the share of NEVs in total car sales reached 54.3%. The domestic manufacturer BYD stands out in particular, leading the way with 417,603 units sold. Geely takes second place with 91,134 vehicles, while Tesla fell to third with 88,321 units sold. The growing strength of Chinese manufacturers in their own market is clearly reflected in these figures.

Fig. 1: Wholesale sales of NEVs in China in September 2024. The figures for SAIC Volkswagen and FAW Volkswagen have peaked. Source: Cui Dongshu

Volkswagen found it difficult to assert itself in this highly competitive market. With 19,530 units sold, the German automobile giant is only in 16th place. This highlights the crisis facing Volkswagen, which has so far failed to consistently align its strategy with electric vehicles and remain competitive against strong Chinese competition.

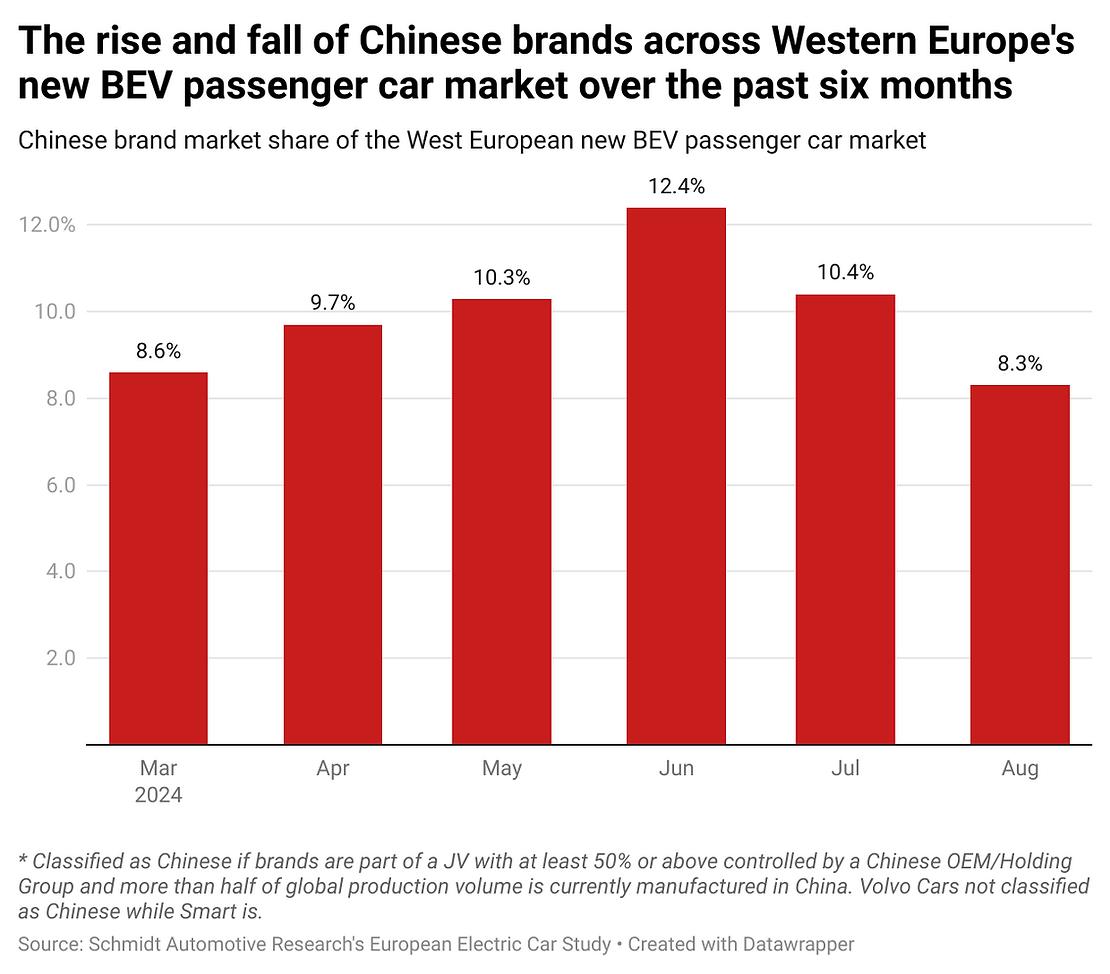

Punitive tariffs in Europe are leaving their mark on Chinese car manufacturers

The discussions about the introduction of punitive tariffs on Chinese cars are leaving a clear mark on sales figures. While Chinese car manufacturers still achieved a market share of 12.4% in the European BEV market by June 2024, this fell to 8.3% in August. Chinese manufacturers are finding it difficult to gain a foothold, particularly in Germany. In September their share of new registrations was less than 1%. At the same time, the share of fully electric vehicles (BEVs) in Germany rose to 16.5%, overtaking the diesel share (14.9%).

Fig. 2: Share of Chinese car markets in Western Europe. Source: Schmidt Automotive Research

Optimistic prospects for the next few months

Despite the weak sales figures in September, the CPCA and CADA remain optimistic for the coming months. Cui Dongshu expects investors to invest more of their profits in vehicle purchases from the stock market’s soaring he expects. At the same time, ongoing scrappage bonuses and the incentive to replace older models should continue to support the market. As Cui Dongshu’s commentary suggests, much over the next few months will depend on what further stimulus is announced to fuel consumption.

Read and write comments, click here