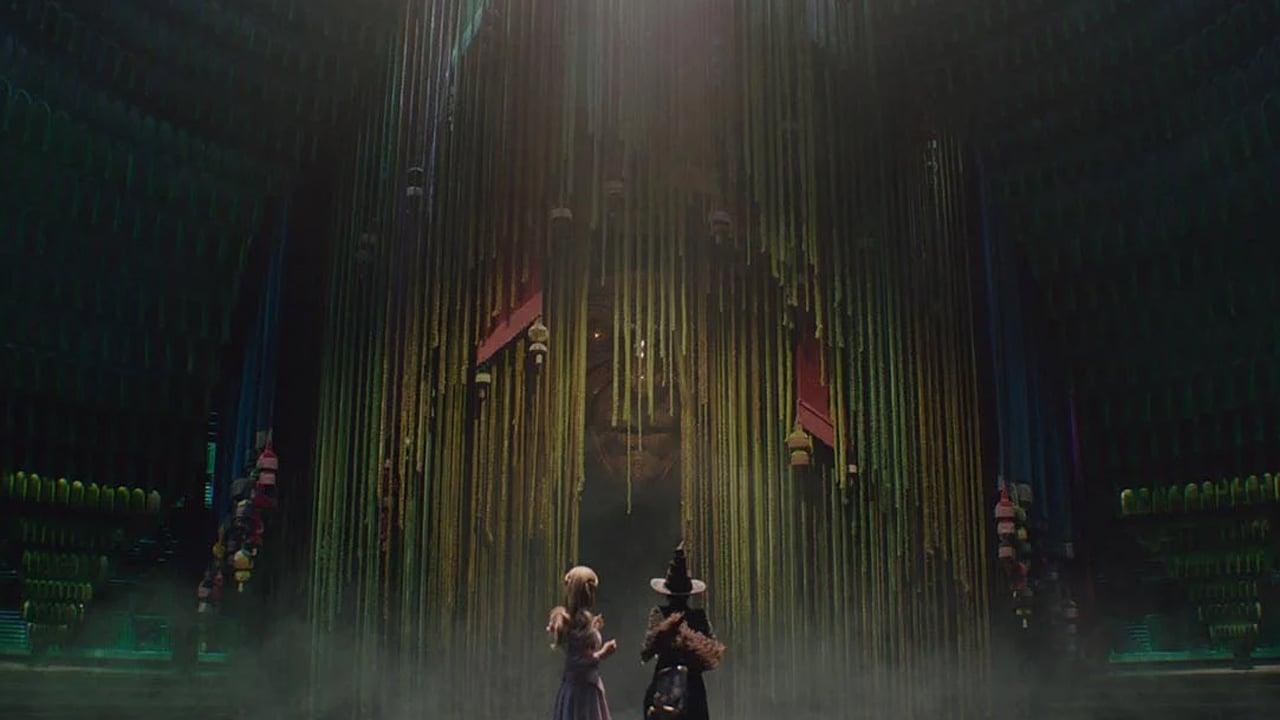

Anyone who owns a property – like here on Gertrudenstrasse or Marienstrasse – will receive a new property tax assessment at the beginning of the year. How high it will be is currently being decided. © Sven Betz

3 min reading time

When the city sends out property tax notices in January, it will probably be more expensive for some homeowners. However, it is still not clear how high the amounts will ultimately be. Because while the tax office has long since sent out the new measurement amounts, the city still has to determine the assessment rate by which this measurement amount is multiplied in order to turn it into a tax assessment. Politicians should decide on this in December. Until then, the administration will not provide any guidelines. The complex issue should only be discussed in advance in the parliamentary groups’ budget meetings, said Mayor Jürgen Bernsmann in the BBV interview.

As is well known, property tax reform is currently underway nationwide. The old measurement data on the value of the individual properties came from 1964. After all homeowners answered online questionnaires about the type and size of their property, the tax office sent out the new notices. However, it turned out that commercial properties were valued significantly lower than before the property tax reform. Since the total amount of tax revenue for the cities should remain the same, this would mean that homeowners would have to pay significantly more.

The solution could be a split assessment rate: the measurement amount of a commercial property would then be multiplied by a different value than that of a residential property. The municipalities have to decide for themselves whether they want to do this. “This means that the risk of litigation in the event of possible lawsuits does not lie with the state, but with all municipalities in North Rhine-Westphalia,” criticized Mayor Jürgen Bernsmann in his budget speech on Wednesday evening.

Example of a single-family home

The state has now informed the city of Rhede what a tax rate would have to look like so that 4.8 million euros in property tax revenue end up in the city treasury again in 2025 – the same amount as before the reform. It would then be “revenue-neutral”. If the assessment rate is not split, then according to the state calculation it would be 812 percent for all Rheder property owners. Previously the value was 625. If, for example, the tax office determined a measurement amount of 95 euros for a single-family home, the tax would be 812 percent of 95 – i.e. 771.40 euros per year. The differentiated assessment rate for Rhede determined by the state would be 723 percent for residential properties and 1,130 percent for non-residential properties. For the single-family home in the example that would be 686.85 euros and therefore 84.55 euros less.

The new measurement amounts will shift the tax burden on the property owners anyway. Some will pay significantly more in the future, others less. But it’s not right to talk about winners and losers, Bernsmann said on Wednesday. “Those who now have to pay more have benefited over many years from the fact that the assessment regulations were not adjusted and thereby saved money,” said the mayor. “The other group paid too much for years.”

Reform is under criticism

In view of great public criticism and legal uncertainty, the administration assumes that there could be a redistribution between property types and changed measurement notices nationwide over the next year. Politicians should therefore adopt their own statutes on the issue of assessment rates outside of the budget statutes. This could then be adjusted by the middle of the year. The budget for 2025 includes property tax B with a total volume of 4.8 million euros.

Neither the administration nor politicians like to deal with the issue of property taxes, said Bernsmann, “because it is not a winning issue.” When municipalities consider a tax increase, there is unanimous resistance, including from the Taxpayers’ Association. Although everything has become more expensive, there is a prevailing expectation among the population that “the tasks and services of the municipality, such as the maintenance of the infrastructure, educational institutions, green spaces or social facilities, should no longer cost the taxpayer despite the general increase in costs”. The administration is doing everything it can to “ensure that a tax increase remains the last resort and only comes when there is no other option.”

To the home page