With a verbal order, the former commander of EFKA Univ. Dufexis revoked two documents that put order in the insurance of land workers and caused losses of millions of euros for the public

The scandal is huge and involves losses of tens of millions of euros involving everything from money laundering to tax evasion and tax evasion that were lost on the order (!) of its former commander EFKA Panagiotis Doufexis. He is the person who, as the Documento reveals, gave the verbal order and they were revoked with no. prot. 270673/31.05.2023 two documents that put order in the insurance of land workers with a work stamp. He is the person who acted as an internal enemy for EFKA and AADE, given that the prescribed procedures established by the competent services of EFKA were not applied, completely illegally and illegally by his verbal order.

But Pan. Dufexis is not a random person. This is the director of the office of two former labor ministers, Yannis Vroutsis and Kostis Hatzidakis. The latter placed him in the position of commander of EFKA and, as was known to the residents of the Ministry of Labor and Social Security, he did not do the slightest thing without the consent of the current Minister of National Economy and Finance K. Hatzidakis.

Now, 15 months later and while tens if not hundreds of millions of euros have been lost due to the illegal action of Doufexis, the Minister of Labor and Social Security Niki Kerameos announces that the insurance regime for land workers with a trademark will be changed in September. This is done as, based on the findings of the National Transparency Committee, there is widespread tax evasion, tax evasion and money laundering. In this particular conclusion, 49,000 cases of arbitrariness are recorded which cost the insurance system and the state coffers tens if not hundreds of millions of euros per year.

In order to understand the scope of the illegalities, it is sufficient to mention that the report records cases in which it was stated by the employers that land workers with a single work mark received a fee of 15,000 euros. There is also a case of cashing out a deed worth 500,000 euros. Finally, a land worker has been identified who in 2017 from 29 employers, in 2018 from 58 employers, in 2019 from 35 employers and in 2020 from 42 employers presents himself with total employer expenses approaching 1,000,000 euros! It becomes obvious that there exists and operates a circuit that launders money, evades contributions and evades taxes having, as Documento reveals, the former commander of EFKA and director of ministers G. Vroutsis and K. Hatzidakis Pan as an ally. Dufexi.

A bell was already ringing

There may be an attempt to attribute all of this to the present and to amend the provisions concerning the land workers’ stamp with the submission of the findings by the National Transparency Authority, but much is already known as of 2021. In no. prot. 187522/Σ.60226/25.05.2021 a document of the Non-Employee Contributions Management department describes cases of employees and employers concerning flagrant illegalities and found during inspections.

Specifically, in relation to the workers, the cashing out of an excessive amount of labor stamps as remuneration from an allegedly employed land worker within the year, e.g. 277,000 euros, and cases of persons who, since they have actually redeemed tokens, which indicates their employment, have not submitted an application in order to be covered by the EFKA insurance. On the other hand, for employers, it is stated that there are cases where they have issued for the same year vouchers with exorbitant amounts for persons who have not been insured.

Circuit Ally

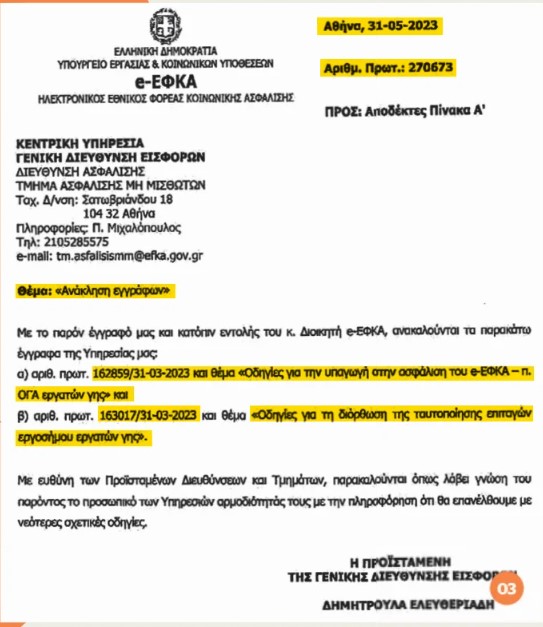

The specific instructions worked for two months and produced tangible results in preventing the circuits. However, as it turns out, the circles had serious foundations in the Mitsotakis government. Documento publishes a document from the same department that established the procedures and erected a wall of prevention in the circuits, in which, as it says, “by order of the commander” the documents are withdrawn! But who gave the order to the commander Pan. Doufexi? As everyone knows, the specific commander was previously the director of the Minister of Labor K. Hatzidakis and from this position he was appointed the commander of EFKA. Is K. Hatzidakis aware of his specific action that opened… avenues for the labor circles for land workers to launder money, evade taxes and evade taxes? Who gives orders to delete the document from IRIDA that sends directly to Pan. Dufexi to the prosecutor, to whom the conclusion of the National Transparency Authority has been forwarded? After all, isn’t it the fault of the cheese pie and the small and medium-sized businesses that were imposed a presumptive tax by K. Hatzidakis for the extensive tax evasion and tax evasion?

The commander recalled

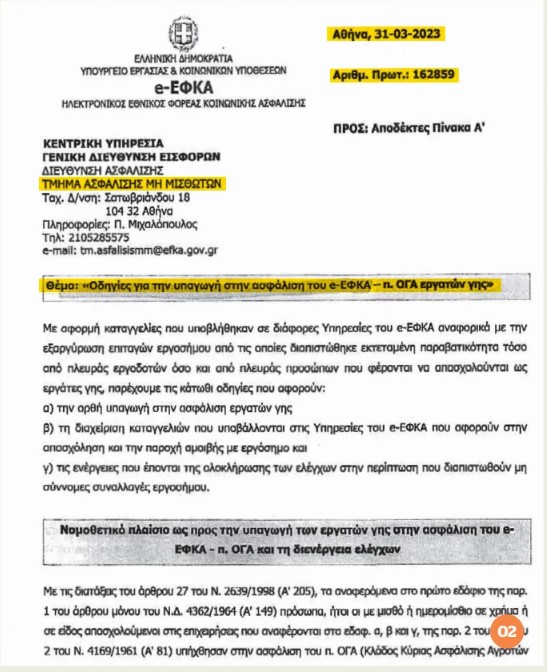

From here on, the Doufexi scandal begins, which through the findings of the National Transparency Authority proves to have been the best ally of the circuit that was set up with the laborers of the land. On March 31, 2023, the same department that checked and found the gross illegalities, i.e. the Non-Employee Insurance department of EFKA, issued the no. 162859/31.03.2023 document entitled “Instructions for inclusion in the insurance of the e-EFKA – ex. OGA land workers”. In this document, after it has been pointed out that there is extensive criminality, instructions are given regarding the correct affiliation of the persons who work, the management of complaints and the actions to be taken when illegal transactions are detected. The document describes the categorization of illegal trademark transactions and also discloses the criteria for conducting checks. As highlighted in this regard, an audit should be carried out for each land workers’ stamp insurance case for which one or more of the following criteria are met. In particular, the check is carried out in cases where the applicant or the already insured as a land worker:

• Is said to have cashed within a calendar month employer’s checks the value of which corresponds to full insurance for the year in question (150 or more days of work within a calendar month).

• The total value of the tokens he has redeemed within a calendar year corresponds to more than 300 working days.

• The permanent residence of the insured as a laborer of land at the time he is alleged to have received emoluments is far from the place where he is alleged to have worked.

• The alleged employer is not insured in e-EFKA – former OGA as a farmer.

• Any complaint questioning the legality of a trade mark transaction in terms of collection or even issuance, involving both the payee and the issuer, is investigated.

In the same document, the justification of the working days in relation to the value of the sales of the produced products is established. Specifically, it states: “In any case where the value of the bonds issued by the agricultural enterprise and redeemed by the persons employed by it in the year to which the audit relates is disproportionate to the value of the sales of the produced products and the receipt of agricultural compensation (e.g. for damages from natural disasters), stamps issued by the audited employer will not be accepted, in their entirety, as evidence of employment of land workers. The same applies in cases of inconsistency between the data declared in E3 in terms of the number of employees and the amount of benefits to them in relation to the EFKA data or those declared by the employer in the responsible statement submitted as part of the audit being carried out”.

However, the EFKA service does not stop there, which knows what is happening since it has already been carrying out checks since 2020 and has sent the findings to the National Transparency Authority. In the same document, he asks the local departments of the EFKA, when offenders are found, to inform the AADE and to send them to the relevant prosecuting authorities to investigate criminal acts in cases where fictitious business transactions are found.

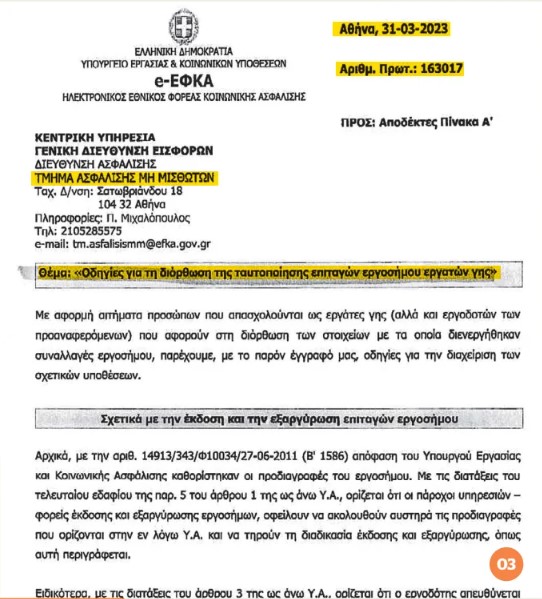

With another document of the same date (prot. no. 163017/31.03.2023) and entitled “Instructions for correcting the identification of land deed checks”, the Non-Employee Insurance department of the EFKA handcuffs the circuits that launder money, evade taxes and evade taxes with the trademark. It describes the cases during the process of redeeming the trademarks that lead to direct control and transmission of data to prosecutorial authorities and AADE. These subcases are:

• Redemption of a bill with a different AMKA from the one registered in the e-EFKA insured registers and which has been attributed to the same insured.

• Redemption of a trade mark with an incorrect AMKA (non-existent in the database of the AMKA – EMAES registry).

• Redemption of a trademark with the same AMKA (with the issue).

• Redemption of a trademark with an AMKA that does not belong to the alleged recipient and is different from the issuing AMKA.

• Issuance of a company’s check with the AMKA of the employee and cashing it with the AMKA of the alleged employer.

As is easily understood, the competent services of EFKA 15 months before the National Transparency Authority delivered the conclusion to Minister N. Kerameos erected such a wall of prevention that all the things described in the conclusion as extensive money laundering, tax evasion and tax avoidance could not be done. It was an internal effort to avoid recording a loss for EFKA and AADE of tens, if not hundreds of millions of euros.

#left #party #trademarks #unchecked #illegally #disappeared #EFKA #decisions