From a sequence standpoint, the market sees it Bitcoin (BTC) look very wholesome. As reported in us earlier article the Market worth to actual worth (MVRV) has cooled from the excessive of $73,000 and BTC has recovered nearly by the ebook in current months. Different essential statistics such because the provision of short-term guardians in revenue/loss ratio have additionally proven patterns much like earlier bullish cycles.

On this article we dive into what may be learn on a sequence and what that tells us about this cycle. If you wish to know extra about chain evaluation, test it out Blocked. This piece can also be appropriate for newbies. Phrases are outlined additional within the textual content.

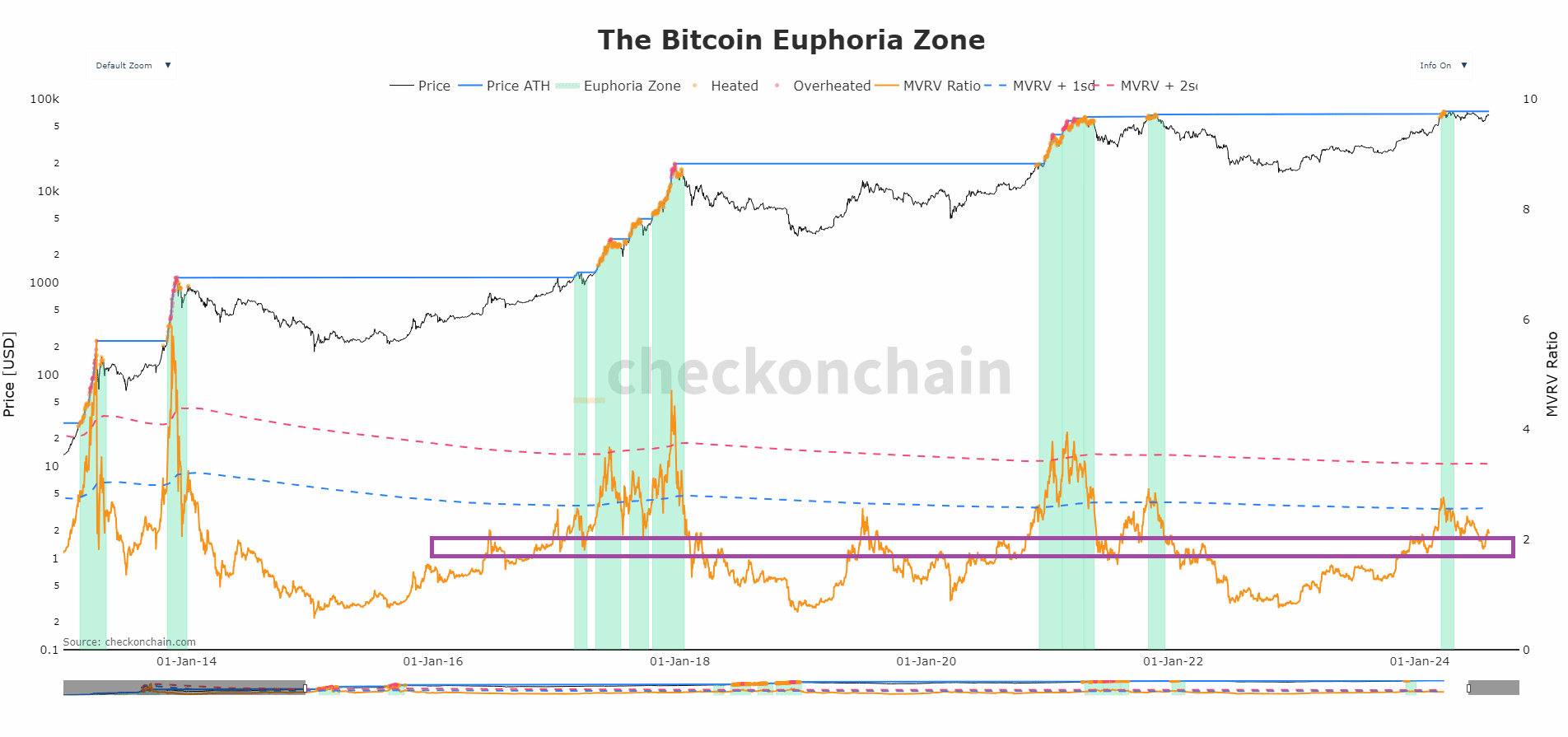

Bitcoins “euphoria” zone

The MVRV ratio is a crucial indicator for assessing the well being of the BTC market. It compares the market worth (present bitcoin worth) with the realized worth (worth at which cash final moved).

The primary chart, titled ‘The Bitcoin Euphoria Zone’, exhibits the MVRV ratio subsequent to the value of BTC over a number of years. Surprisingly, the MVRV ratio rests for one excessive on a regular basis (ATH), a sample seen in earlier bullish phases akin to 2016 and 2020-21. That is indicated within the purple bar. This pause earlier than the rise of the ‘Euphoria Zone’ (characterised by very optimistic sentiments and excessive costs) means that BTC could also be getting ready for one more important rally.

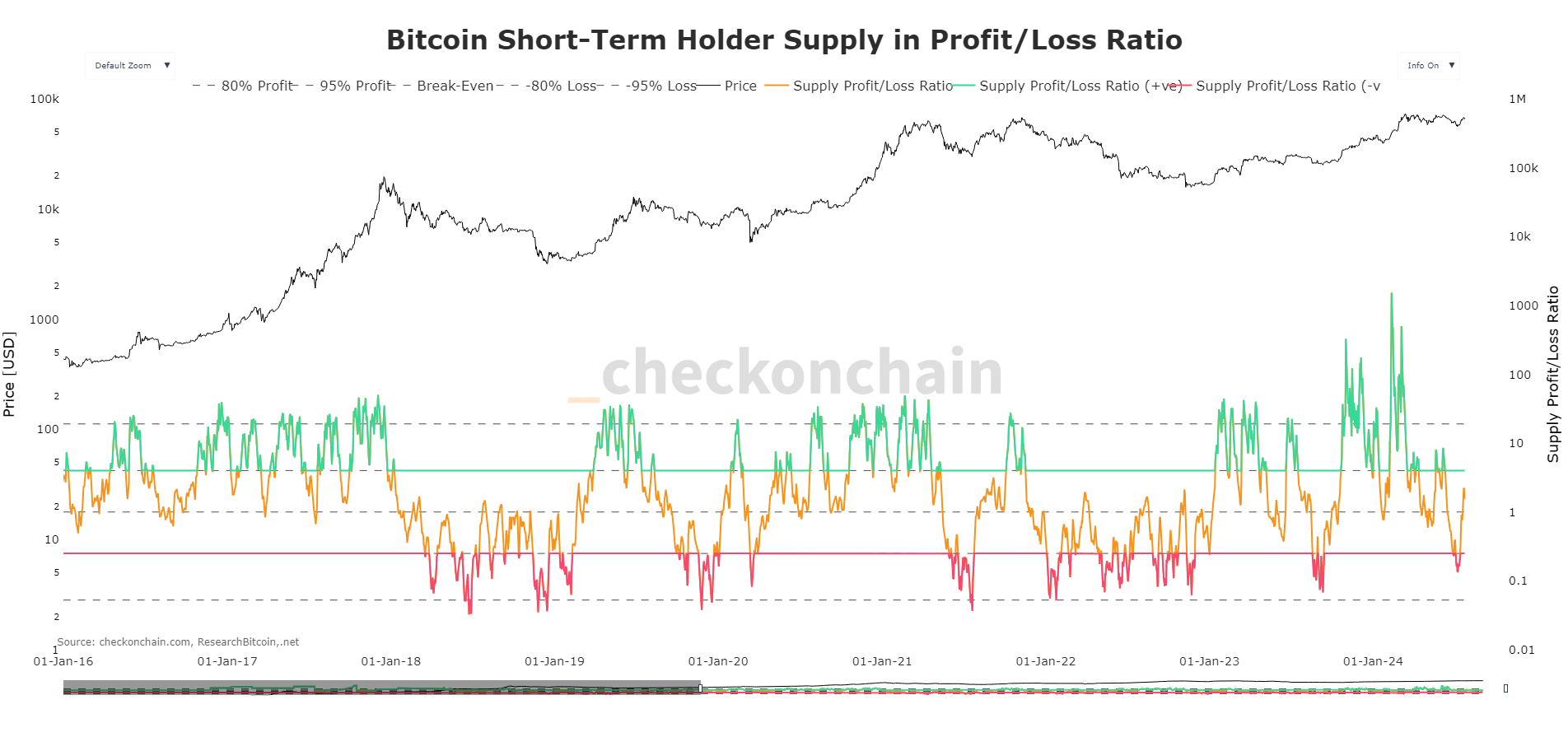

What’s the short-term Bitcoin holder provide in revenue and loss ratio?

The second chart, “Bitcoin Brief-Time period Holder Provide in Revenue/Loss Ratio,” offers an outline of the profitability of short-term holders (STH). This statistic is essential as a result of it displays the sentiment and monetary well being of buyers not too long ago. This group reacts extra shortly to modifications available in the market.

The graph reveals a number of essential observations:

Lows 2019 and restoration 2020: After the lows of 2019, shares of short-term holders noticed a wholesome restoration in 2020, much like the present market circumstances. This restoration interval laid the muse for the following bull run.

2021 ‘Pretend ATH’: The 2021 peak, also known as ‘false ATH,’ confirmed a spike within the revenue of short-term holders, adopted by a pointy decline. The present market seems to be recovering from an identical sample seen after the 2022 lows and the August 2023 rally.

Publish-ETF correction: Following the correction following the ETF information, the revenue/loss steadiness of short-term holders has recovered to ranges beforehand seen in earlier bull runs. This means a optimistic development.

General, a optimistic development appears to be growing and numerous indicators present a optimistic image. If you wish to know extra about chain evaluation, test it out Blocked.

Publish Views: 0

2024-07-28 17:12:59

#Bitcoin #worth #getting ready #Euphoria #Zone

:watermark(https://f.pmo.ee//logos/4238/c14433e7c257b86e167cf144389f5071.png,-2p,-2p,0,18,none):format(webp)/nginx/o/2024/07/26/16245296t1h6806.png)