Opaque settlement for Attica Financial institution, based mostly on which a “non-public financial institution with public cash” is created, the president of SYRIZA, Stefanos Kasselakis, denounced together with his submit, through which he cites information on the funds paid by the State.

“The State will get rid of 33% of Attica Financial institution having suffered a lack of 800 million euros. People with simply 300 million will discover themselves with 51% of the Financial institution’s shares! Personal banking pillar with funding from the State” he emphasizes characteristically, including meaningfully that “the recipe is understood”.

Quick, however poor in substance and readability, was the response of the Ministry of Finance, which focuses on the truth that the settlement has not but been signed, with Stefanos Kasselakis returning to the problem with a brand new harsh submit.

“There isn’t any opposition.”

“SYRIZA doesn’t kind an opposition.”Effectively, we have seen nearly all of the media holding a fishy silence concerning the Attica Financial institution deal. The deal that creates a non-public financial institution with Greek taxpayers’ cash.

And solely “circles” to… pic.twitter.com/2QGdru4qlQ— Stefanos Kasselakis (@skasselakis) July 9, 2024

The general public curiosity is affected

Together with his first submit, Mr. Kasselakis introduced proof that proves, as he emphasizes, the “opaque settlement” that harms the general public curiosity.

“The trendy Left doesn’t obey pursuits. The highway that results in society’s demand for Change, is the highway of battle – at any value – with the pursuits that have an effect on the Greek taxpayer”, underlines the president of SYRIZA-PS.

Personal financial institution with public cash!

The State owns 72.5% of ATTICA Financial institution, having paid roughly 500 million euros in two will increase in its share capital, specifically:

-153 million within the first share capital enhance on the finish of 2021 and

-329 million…— Stefanos Kasselakis (@skasselakis) July 9, 2024

Ministry of Finance: The settlement has not been concluded

Circles of the Ministry of Nationwide Financial system and Finance characterised the primary submit by the president of SYRIZA, Mr. Stefanos Kasselakis, concerning the upcoming settlement of the shareholders of Attica Financial institution on the merger with Pancreatia Financial institution as incorrect and frivolous.

Particularly circles of the Ministry of Nationwide Financial system and Finance commented that “Mr. Kasselakis is in a rush to denounce an settlement earlier than it’s even signed” whereas it’s identified that “when he reads it he’ll notice that his submit in the present day was utterly inappropriate and frivolous”.

“The federal government persistently serves the general public curiosity and its coverage might be recorded on this explicit situation as nicely. Nonetheless, Mr. Kasselakis needs to be extra cautious when he talks concerning the Financial institution of Attica”, sources from the Ministry of Nationwide Financial system and Finance report.

“As a result of the looting that befell through the days of SYRIZA was one of many predominant the explanation why the Financial institution discovered itself on the point of the cliff with the deposits of Greek residents in danger.”

The primary submit Kasselakis

The president of SYRIZA, Stefanos Kasselakis, with a submit entitled “Personal financial institution with public cash!” states the next:

” The State owns 72.5% of ATTICA Financial institution, having paid roughly 500 million euros in two will increase in its share capital, specifically:

- 153 million within the first share capital enhance on the finish of 2021 and

- 329 million by way of the HFSF & 39.8 million by way of the eEFKA within the second share capital enhance on 23/12/2022.

» Personal people in Thrivest and Pancreatia Financial institution have paid simply 33.8 million and 29.9 million respectively, protecting 21% of the second share capital enhance.

In response to reviews, the conclusion of an “opaque” settlement is imminent, based on which, whereas the State – that’s, the Greek taxpayers – will take part with an extra 350 million in a brand new share capital enhance, it’ll ultimately be discovered – together with the activation of the warrants – to owns solely 33% of Attica Financial institution.

» Quite the opposite, non-public people, who will take part with 300 million euros, will find yourself with a minimum of 51% of the financial institution!

» Let’s make it extra comprehensible.

» The State will get rid of 33% of Attica Financial institution having suffered a lack of 800 million euros.

» People with simply 300 million will discover themselves with 51% of the Financial institution’s shares! Personal banking pillar with State funding.

» The recipe adopted is well-known. The identical factor occurred to the Piraeus financial institution with a €2.4 billion loss for the State, the identical to PPC with a €800 million loss.

» The federal government insists on “investing” our cash and that personal people reap the ultimate advantages.

» The essential precept that the State desires, when it invests, to even have advantages commensurate in worth, in order that the crime of infidelity shouldn’t be established, is catalyzed as soon as once more.

» PS: The trendy Left doesn’t obey pursuits. The highway that results in society’s demand for Change is the highway of battle – at any value – with the pursuits that have an effect on the Greek taxpayer. I name on PASOK to behave accordingly and to “stroll” collectively on this highway. That is additionally the one manner of convergence”.

Kasselakis insists with a second submit

In his second submit on the problem, Stefanos Kasselakis, after leaving sharp factors for the media’s disproportionately severe presentation of the matter, mentions “the deal created by a non-public financial institution with Greek taxpayers’ cash. And solely “circles” to reply from the Ministry of Finance, as a result of the in any other case “robust” minister with the banks, determined to cover. We perceive the ‘nervousness’ of the events concerned to signal the settlement first and be told afterwards.”

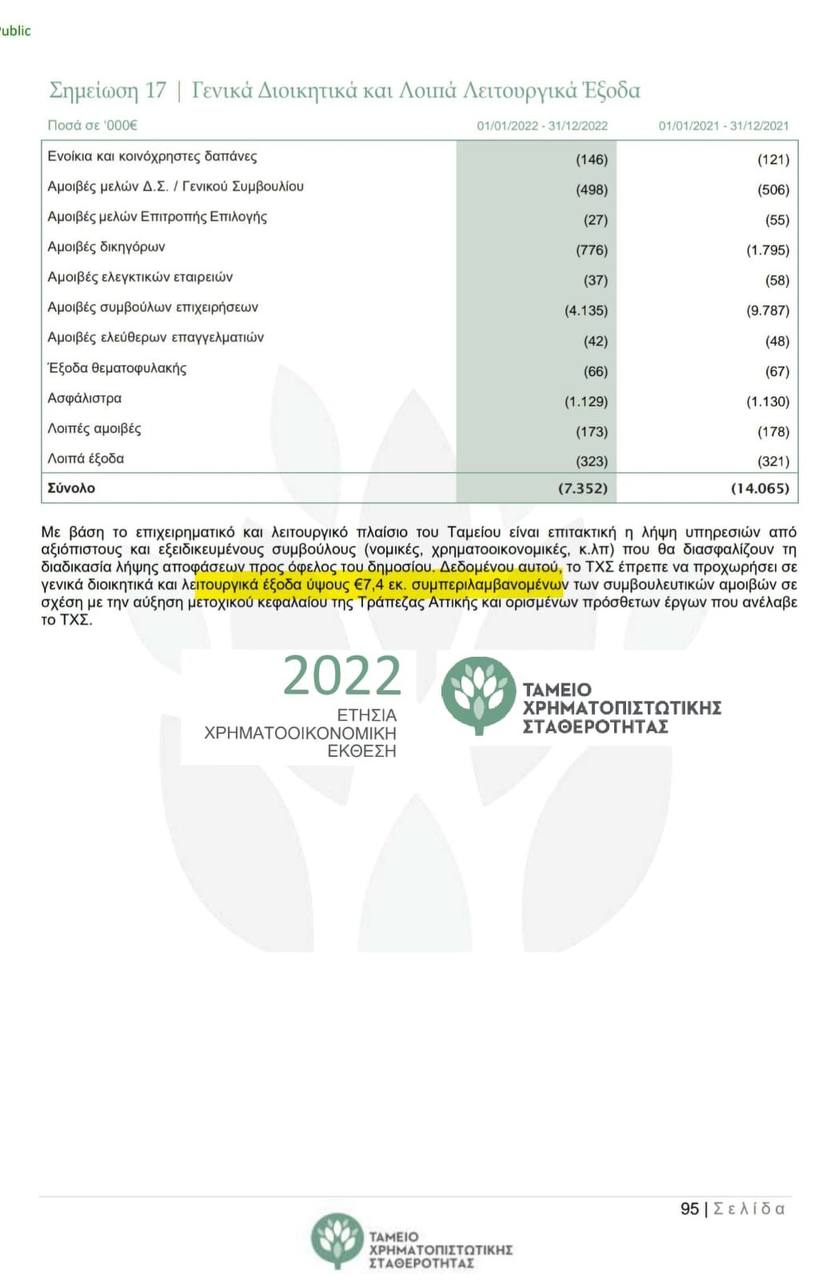

“We’re positive that the consultants who’ve up to now obtained an enormous quantity, as much as €21 million, (see photograph), have completed their greatest in order that the general public is harmed and the non-public particular person wins. And canopy it with a vocabulary filled with phrases to disorient the Greek citizen whose cash is used to create a non-public financial institution.”

“The HFSF Legislation gives for 2 reviews from unbiased monetary advisors, “which affirm that the supposed participation within the issuance of recent shares or different property securities contributes to sustaining, defending or bettering the worth of the State’s present participation within the Financial institution’s capital or the prospects disinvestment from it”.

“Is the worth of the State’s shares in Attica Financial institution actually preserved, protected or improved?” I say it once more. The State will get rid of 33% of Attica Financial institution having suffered a lack of 800 million euros. People with simply 300 million will discover themselves with 51% of the Financial institution’s shares! Personal banking pillar with State funding.

PS1: The Financial institution of Attica, as I discussed, shouldn’t be the one case the place the Greek authorities was broken. Extra examples will comply with tomorrow.

PS2: In the long run, we walked the trail of battle with pursuits alone. The place have the remainder of the centre-left events disappeared to?’ says Mr. Kasselakis.

He additionally accompanies his submit with particular monetary information from the HFSF.

Battle with entanglement and pursuits – Invitation to PASOK for collaboration

The willpower of the president of the official opposition to conflict with the entanglement and the pursuits that nurture it, is emphasised by Koumoundourou, commenting on the persistent posts of the president on the problem of the merger of Attica Financial institution with Pankritia Financial institution.

Actually, this transfer by Mr. Kasselakis is estimated by Koumoundourou to have taken the “system” abruptly. Commenting on the reply from circles of the Ministry of Finance, they emphasize that they didn’t discuss concerning the “snuff field”.

Kasselaki’s posts, they add, have a double goal, thus explaining the invitation – problem of the president of SYRIZA to PASOK.

On the one hand, as they are saying from Koumoundourou, Mr. Kasselakis is sending a message to the circles of the entanglement that he’s unyielding and then again he’s “squeezing” PASOK on the identical time, calling it to comply with the identical path.

“That is additionally the one path of convergence,” notes Stefanos Kasselakis in his submit, thus consolidating, based on Koumoundourou, the primacy of SYRIZA-PS within the progressive arc.

#Opaque #settlement #Attica #Financial institution #damages #State #SYRIZA #complains #Ministry #Finance #evades #substantial #reply

/img-s3.ilcdn.fi/99175d4c2fc1f684764ea4603fc4d3f02c12b1b0a5161382f76c89ccc40f8f0b.jpg)