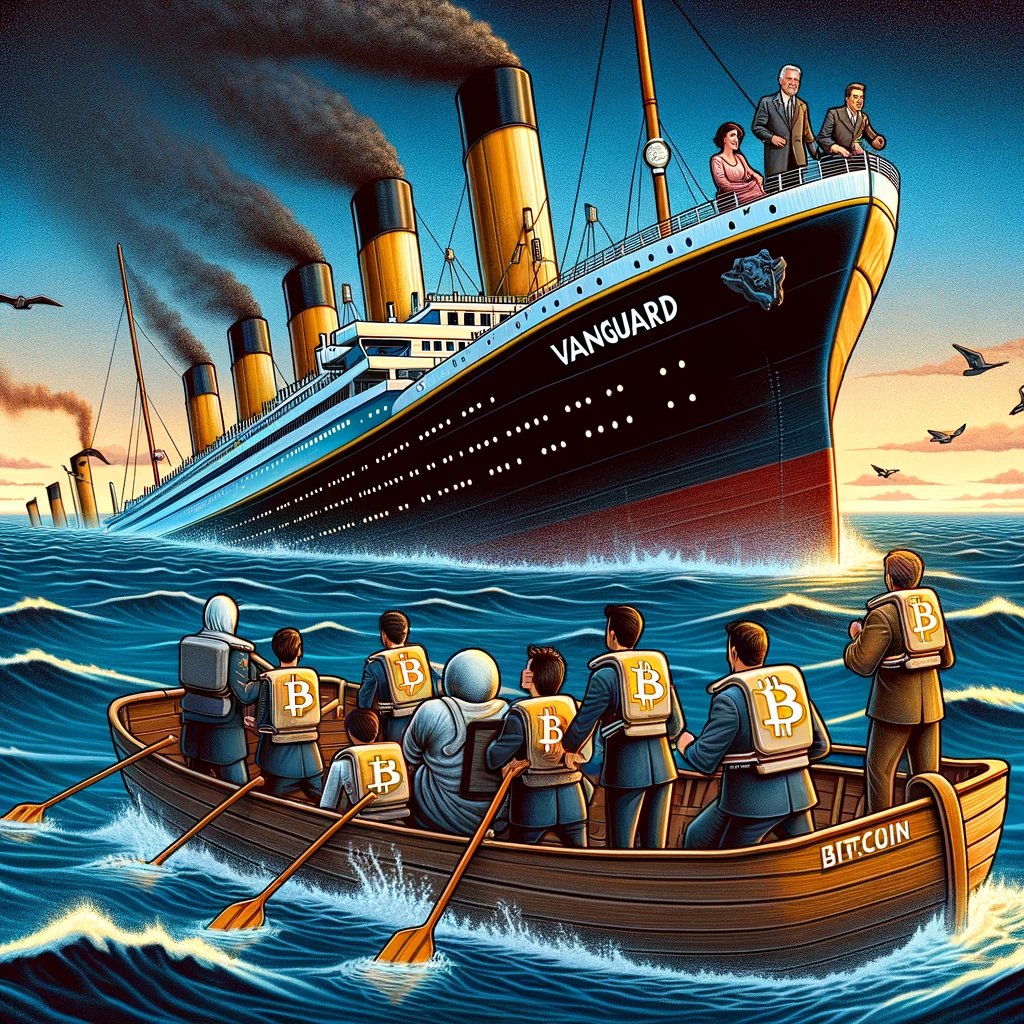

Vanguard, the largest index fund in the United States, chose not to provide Bitcoin spot ETF trading, triggering a strong backlash from the community. Many KOLs said they had closed their accounts with Vanguard and transferred funds.

(Previous summary: Wall Street institutions that “look down on Bitcoin”: Vanguard refuses to trade spot ETFs, Merrill Lynch waits and sees)

(Background supplement: Bloomberg predicts: Bitcoin spot ETF will attract “US$4 billion” on the first day, half of which will come from BlackRock)

The official opening of trading for the U.S. Bitcoin Spot ETF kicked off on the evening of the 11th. However, Vanguard, the largest index fund in the United States and second only to BlackRock in terms of asset management, has chosen not to provide Bitcoin spot ETF trading services to its customers.

Pioneer Group’s customer service department explained this decision:

Due to the “highly speculative nature” and “regulatory uncertainty” of the Bitcoin Spot ETF, this does not fit in with the company’s core philosophy of long-term investment.

The community calls for collective transfer of funds

This move triggered a strong response in the community, and many community KOLs who supported Bitcoin spot ETFs chose to close their accounts at Vanguard Group and switch to other competitors that provide this trading service.

Neil Jacobs, co-founder of FOMO21Shop, did this and expressed his disappointment with Vanguard Group’s decision:

Vanguard’s decision was a bad business choice.

I have a retirement account with Vanguard.

I called them and they said they will NOT be offering ANY of the Bitcoin ETFs.

I’m working on transferring assets out of there and then I will close my Vanguard account.

Terrible business decision by Vanguard.#Bitcoin pic.twitter.com/Q2OFcybqMQ

— Neil Jacobs (@NeilJacobs) January 11, 2024

Likewise, Apollo’s CEO alsoexpressMoved his retirement account from Vanguard to Fidelity and urged others: “If your broker blocks trading in a Bitcoin ETF, close the account and exit.”

CNBC’s crypto trader Ran Neuner alsopoint outFollowing this trend, hesaid: “When investors realized they couldn’t buy Bitcoin, they switched from Vanguard to Fidelity.”

Polygon CEO: Begins to withdraw all funds from Vanguard

In this regard, Polygon CEO Marc Boiron also joined the community’s appeal this morning. He said:

I have a retirement account with Vanguard and now I have started transferring all my money out.

I’ve had my retirement accounts at Vanguard my entire life but just started my transfer of all my funds out of Vanguard.

— Marc Boiron (@0xMarcB) January 12, 2024

In addition to Vanguard Group, there are also other Bitcoin spot ETFs that are also opposed to

In fact, in addition to Vanguard Group banning Bitcoin spot ETF trading, Merrill Lynch has also taken the same position. This is alsocauseThis led to the cryptocurrency community’s boycott of Merrill Lynch.

Rip VanWinkle, a director of Swan Media who once worked at Merrill Lynch, shared his experience and pointed out that he and his colleagues at Merrill Lynch often referred to the compliance department as the “obstructing business department” because the department often restricted the advancement of new business. , just like the trading of Bitcoin spot ETFs is now prohibited.

VanWinkle was critical of the companies’ strategies and wondered how long they would wait before opening Bitcoin spot ETFs for trading. he thinks:

Eventually these companies will give in, but the question is how much will they lose in the process?

I used to work at two of the firms currently blocking access to the #Bitcoin spot ETFs. Merrill Lynch and UBS. At both firms, my co-workers and I used to call the compliance group the “business prevention department”.

True to form, the “business prevention department” is… pic.twitter.com/BECltKj4hl

— Rip VanWinkle ⚡️ (@danieleripoll) January 12, 2024

📍Related reports📍

Wall Street Bull Tom Lee: Bitcoin is expected to reach $150,000 by the end of the year and will rise tenfold in the next five years!

Trading strategy after ETF passes》Analyst: Funds are taking profits, BTC shows signs of top

25% of the female stock goddess’s net worth is “betting on BTC”: Spot ETFs push Bitcoin to reach US$1.5 million in 2030

2024-01-13 04:30:17

#worlds #largest #index #fundVanguard #rejects #Bitcoin #spot #ETF #wave #withdrawals #community