On January 23, 2019, the Supreme Court declared the nullity of mortgage expense clauses in a ruling that established jurisprudence and changed the law. Since March 2019, banks must reliably inform customers of these expenses, but what about all those who paid these costs without being properly informed? From the moment of establishing jurisprudence, the period was opened for all of us to claim them.

You probably have someone you know who has decided to review their mortgage documentation and claim the expenses they paid when formalizing it. If you haven’t done so yet, you may be wondering until when can I claim mortgage formalization expenses? Is it possible to recover mortgage expenses at no cost? What if the mortgage is from 20 years ago or more? What happens if I have already sold the home? To obtain answers to these and other questions that you may have, we have gone to Lawyer Piqueras’ office, from where they have already told us “the countdown has begun: You have until January 24 to get your money back.”

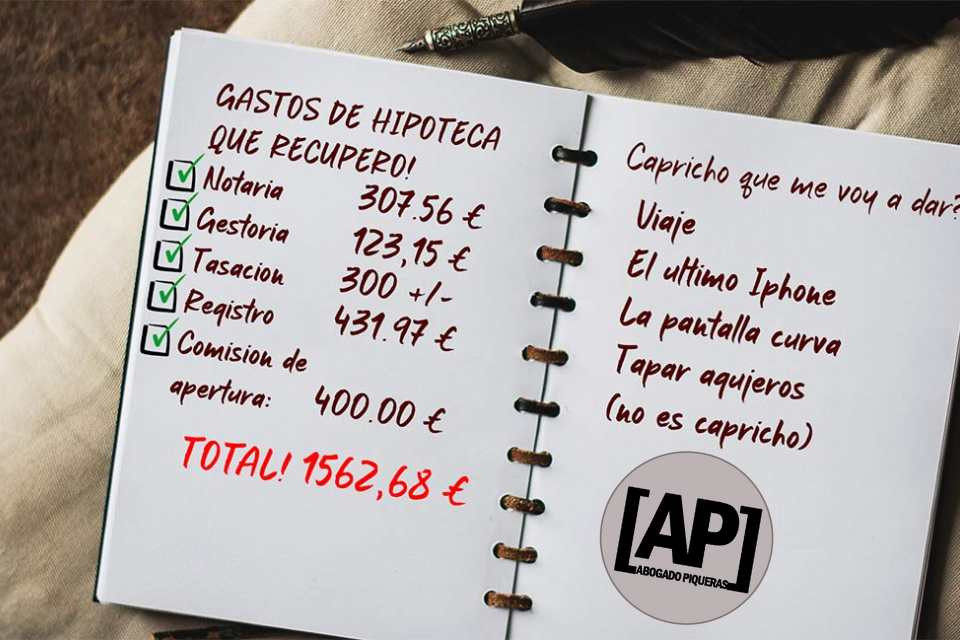

The vast majority of courts rule that formalization expenses must be reimbursed. That is, 50% of the Notary expenses, as well as 100% of the Registration, Management and Appraisal expenses, can be claimed. Regarding the opening commission, although not all courts agree that this is a radically null clause and must be studied on a case-by-case basis, the banks do not have documentation to prove that this commission is justified, hence its nullity. “You can even recover up to 3,000 euros just by providing some documentation,” explains Francisco Piqueras using a simple example: “Luis arranged a loan with a mortgage guarantee in 2011 for a value of 198,700 euros with Ibercaja. In clause 5 it is established that the opening commission is 993.50 euros and in clause 6 that all the costs of formalizing the loan are borne by the borrower, that is, Luis. The notary bill amounts to 642.29 euros, the property registry bill amounts to 145.45 euros, the appraisal bill amounts to 900 euros and the agency bill amounts to 190 euros. Luis has all these invoices, so he will be able to claim 2,550.09 euros back.”

To obtain this refund, the client must file an extrajudicial claim, and then go to the Courts and file a lawsuit. Although it is true that to file an extrajudicial claim it is not necessary to lawyer“we recommend doing so, since this prior step is required by the courts and, if not done correctly, this could slow down the process even more,” explains Abogados Piqueras, pointing out that “right now the most important thing is time.”

In the absence of a ruling from the Supreme Court (TS), the positions are diverse, but the majority criterion among the Provincial Courts throughout Spain is that which considers that said period is five years from when a Judgment declared the nullity of the clauses of bills. Therefore, the initial day is established as the date of the Supreme Court rulings that established jurisprudential doctrine. That is, on January 23, 2019. “If we added to the count the 82 days of state of alarm in which all deadlines were paralyzed, the actions could be prescribed as of April 15, 2024. However, with The declaration of nullity of the State of Alarm decree by the Constitutional Court could also consider the statute of limitations starting next January 24, 2024,” Abogados Piqueras warns.

Today, consumers still have time to claim the expenses derived from our mortgages, although it is true that 2024 is just around the corner. There is only one case in which it cannot be claimed. If you bought the house after March 2019, you will not be able to request a refund since the law changed at that time. Because? As we have already mentioned, with the change in law, as of that date, before signing the mortgage loan deed, the buyer already had to go to the notary to read the clauses and it is understood that he is duly informed, therefore Therefore it cannot be claimed.

The deadlines are shortened and the first thing you have to do if you have decided to claim is to collect the deed and all the invoices derived from it. Secondly, go to a specialized lawyer in this matter to guide and help you with this matter to obtain the most beneficial result. If you have the invoices, you will be able to claim the expenses with a mortgage cancellation, even if you have sold the home and also if it is from 20 years ago or more. Francisco Piqueras encourages us to get to work to recover our money: “Do not hesitate to contact us. We are a firm specialized in Banking and Mortgage Law. We can help you recover the money that you paid unfairly and that belongs to you.”

HOW TO CONTACT PIQUERAS LAWYER?

Go to their website and fill out a form CLICKING HERE

Or contact them:

Phone: 679113162 / 976361283

Email: [email protected]

Pº de la Independencia, nº 22, 7th floor, CP: 50004, Zaragoza.

2023-12-13 11:08:37

#PERIOD #CLAIM #MORTGAGE #EXPENSES #ENDS #TIME #CLAIM