If you want to invest in artificial intelligence (AI) research, one area to look at is semiconductors. Semiconductors are the building blocks of artificial intelligence applications, so as the adoption of artificial intelligence grows, so does the demand for semiconductors.

Two of the main semiconductor stocks are Taiwan Semiconductor Manufacturing Company (TSMC) a Nvidia. Both companies are quite attractive investment objects, but which one should you prefer?

Business model review

TSMC manufactures, tests and sells semiconductors, or chips, to customers around the world. Its products are used in game consoles, computers, smartphones and high-performance computing applications, autonomous driving and AI markets.

In 2022, the company produced more than 15 million 12 inch electronic wafer equivalent (a wafer is a thin slice of semiconductor). The company has manufacturing facilities in Taiwan, China, and the United States, as well as customer service locations in North America, Europe, Japan, China, and South Korea.

TSMC is the world’s largest “pure play” chip manufacturer. It means that TSMC manufactures chips for its customers only under contract. These customers are mainly chip designers and electronics brands that use semiconductors in their products. Names on this list include Apple, Advanced Micro Devices, Broadcom and also Nvidia. TSMC does not manufacture chips for its own use or under its own brand.

Statistics show that TSMC the market share is 58.5%. The next closest competitor Samsung Electronics the market share is 15.8%.

Nvidia is a completely different business model. Nvidia is a “fabless” chip maker, meaning it designs specialized chips and outsources manufacturing, e.g. TSMC and Samsung. So then TSMC and Nvidia not competitors – rather partners.

Nvidia was a GPU pioneer in the late 1990s. GPUs are high-powered chips designed to quickly render realistic on-screen graphics. With the help of these chips, the quality of video games improved significantly in the early 2000s and beyond.

As a result Nvidia quickly gained a solid foothold in gaming that continues today. Since then, the company has brought its technology to data centers, autonomous vehicles and AI applications.

Semiconductor market outlook

McKinsey & Company In 2021, the world semiconductor market was estimated at 600 billion. in the amount of dollars. The same report predicts that the market will grow between 6% and 8% in the coming years. With such a forecast, the industry will reach 1 trillion by 2030. dollar threshold.

The frenzied interest in the benefits of AI technology will drive this growth. Other positive trends include increased adoption of remote work, autonomous driving innovations, and continued demand for smartphones and cloud computing services.

These trends will undoubtedly benefit TSMCwhich has no worthy competitors in terms of scale and efficiency. Nvidia will also reap rewards if they continue to successfully focus on innovation.

Total return history

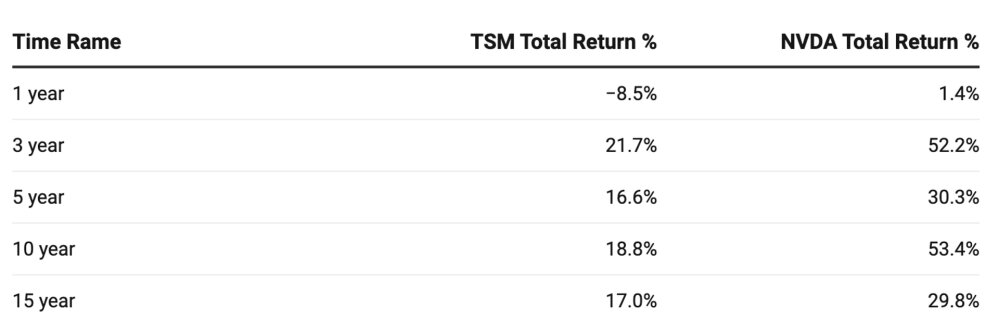

This table shows the total TSMC and Nvidia profit.

As you can see, Nvidia has greatly surpassed TSMC, but this performance has been more erratic. Except for the last year, TSMC overall returns have been fairly consistent. This consistency is fueled in part by the company’s solid dividend.

TSMC annual dividend of 1.82 dollars per share corresponds to a yield of 2.1%. Nvidia also pays a dividend, but it’s a tiny one – $0.16 – for a yield of 0.07%.

Evaluation

Morningstar reports that TSMC the five-year average P/E ratio is 23.1. Currently, the P/E is well below the five-year average – 13.7.

Nvidia The P/E picture looks quite different. The company trades at a price-to-earnings ratio of 132.98, which is at least twice the five-year P/E average of 60.4.

2023-11-24 12:33:01

#Stock #buying #idea #Nvidia #TSMC