The price decline is clearly noticeable in Zurich and in the lakeside communities. (Image: Shutterstock.com/Mario Krpan)

The Zurich home ownership index is (slightly) negative for the first time since 2017: in the third quarter, home prices fell by 0.1 percent compared to the previous quarter. In the “lake” region of the city of Zurich and Zurich’s lakeside communities, they fell by 1.8 percent. The ZKB also calculates the imputed rental value in its real estate barometer.

The fractional decline in the Zurich home ownership index is due to the development of the attractive “lake” region, as the Zürcher Kantonalbank (ZKB) explains in its quarterly real estate monitor. In the city of Zurich and Zurich’s lakeside communities, home prices fell by an average of 1.8%.

However, homebuyers as a whole cannot hope for a sharp decline in prices. The ZKB notes that the supply situation remains tight and limits the scope for negotiation for attractive properties. Compared to the previous year, the index is still 2.5 percent higher.

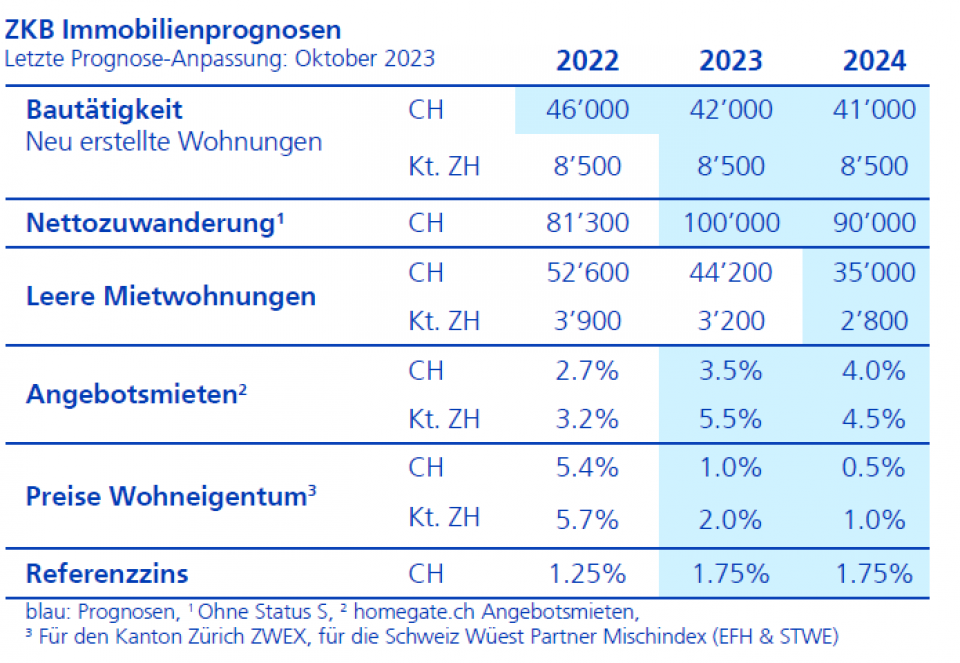

The level remains robust. “Even after the first negative sign since 2017, the Zurich housing market is far from seeing prices fall across the board,” writes the bank. The market is supported not least by the shortage of rental apartments. This will become more pronounced in the next few years (see table).

On the other hand, liquidity on the housing market has decreased significantly. In the third quarter, transactions in the canton of Zurich fell by 18 percent for condominiums and by 22 percent for single-family homes compared to the same quarter in the previous year.

At the same time, slightly more homes are being advertised on the major real estate platforms. In today’s interest rate environment, not every property finds a buyer so quickly. “The longer the marketing lasts, the more likely it is that the sellers’ price expectations will fall,” comments the ZKB

Abolition of imputed rental value?

In their latest quarterly real estate barometer, another topic is discussed: the imputed rental value. The bank is investigating the question of what consequences an abolition would have on the real estate market and whether home ownership without the imputed rental value – introduced in 1934 by emergency law to improve the health of the federal budget and incorporated into regular law in 1958 – would be even more desirable?

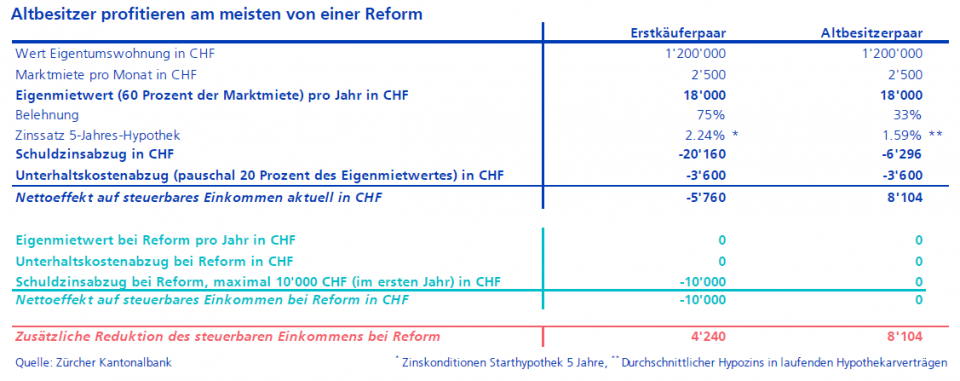

For new buyers, the imputed rental value is better than its reputation in the current interest rate environment, the bank argues. This shows a simple calculation:

The typical buyer of condominiums in the canton of Zurich has a financial advantage with a loan-to-value of 75 percent, a five-year mortgage and an apartment for 1.2 million francs in today’s regime – the deduction options for interest and maintenance would reduce the imputed rental value of 18,000 Swiss francs by 5,760 francs (see table at the end of the article).

With the planned loss of the imputed rental value, no maintenance costs can be deducted, but first-time buyer couples are allowed to offset a maximum of 10,000 francs in interest expenses in the first year. This would initially make them slightly better off.

Impact on supply and demand would be small

For other buyers, however, the financial calculations after the reform would be to their disadvantage, according to the bank. The loss of the imputed rental value will not give a boost to demand.

Old owners are more likely to be looking forward to the abolition of the imputed rental value. If taxation were to be abolished today, your taxable income would fall by around 8,100 francs. This is for an average apartment and an average loan-to-value ratio of 33 percent.

With asset returns, the financial equation would be even more attractive for older property owners. The older property owners would therefore be very happy about the loss of their own rental value. But will that make them sell less often? Hardly, says the ZKB. The financial disadvantage caused by the taxation of the imputed rental value during negative interest rates did not lead to more sales. “Family and emotional factors are more important in this decision than calculations with a calculator,” the bank concludes.

2023-10-12 17:07:30

#Real #estate #prices #Zurich #Lake #region #pressure