China Defends Business Practices as U.S. Commerce Secretary Highlights Concerns

SHANGHAI/WASHINGTON, Aug 30 (Reuters) – China has responded to criticism from U.S. Commerce Secretary Gina Raimondo, who stated that American firms had deemed China “uninvestible.” This comes as global investors are turning away from assets in the world’s second-largest economy.

Raimondo’s visit to China is part of the Biden administration’s efforts to strengthen communication, particularly on economics and defense, in order to prevent tensions between the two superpowers from escalating.

While Raimondo emphasized that the United States does not want to decouple from China, her comments shed light on the challenges faced by U.S. businesses in trade and investment flows between the two countries.

In response to Raimondo’s remarks, Liu Pengyu, the spokesperson for the Chinese embassy in Washington, stated that the majority of the 70,000 U.S. firms doing business in China wished to remain, with nearly 90% of them being profitable. Liu also highlighted China’s efforts to further ease market access for foreign companies, stating that China is actively advancing its high-level opening-up and providing a market-oriented business environment governed by a sound legal framework. He added that China will continue to open its doors even wider to the outside world.

The U.S. Commerce Department declined to comment on the matter.

In recent years, global investors have been spooked by China’s unpredictable crackdowns on sectors such as e-commerce and education. As a result, there has been a significant outflow of foreign investment from Chinese assets. This month alone, foreign net selling of Chinese stocks reached a record outflow of 82.9 billion yuan ($11.4 billion). Additionally, foreign direct investment (FDI) in China is at its lowest level in 25 years.

Raimondo is currently in Shanghai for the last day of meetings before returning to the United States. When asked about her message to U.S. businesses in China, she encouraged them to continue investing and growing in the country.

However, during her visit, Raimondo expressed concerns raised by U.S. companies regarding the challenges they face in China, including ”exorbitant fines without any explanation” and raids on businesses. She called for these issues to be addressed and for China to take actions to improve business conditions.

Michael Hart, president of the American Chamber of Commerce in China, stated that businesses have been clear in expressing their concerns to the Chinese government. He emphasized that certain actions, such as raids on companies and restrictions on data flows, are not conducive to attracting additional foreign direct investment.

Raimondo also highlighted the lack of rationale given for Chinese actions against chipmaker Micron Technology, whose products were restricted by Beijing this year. She rejected any comparisons to U.S. export controls.

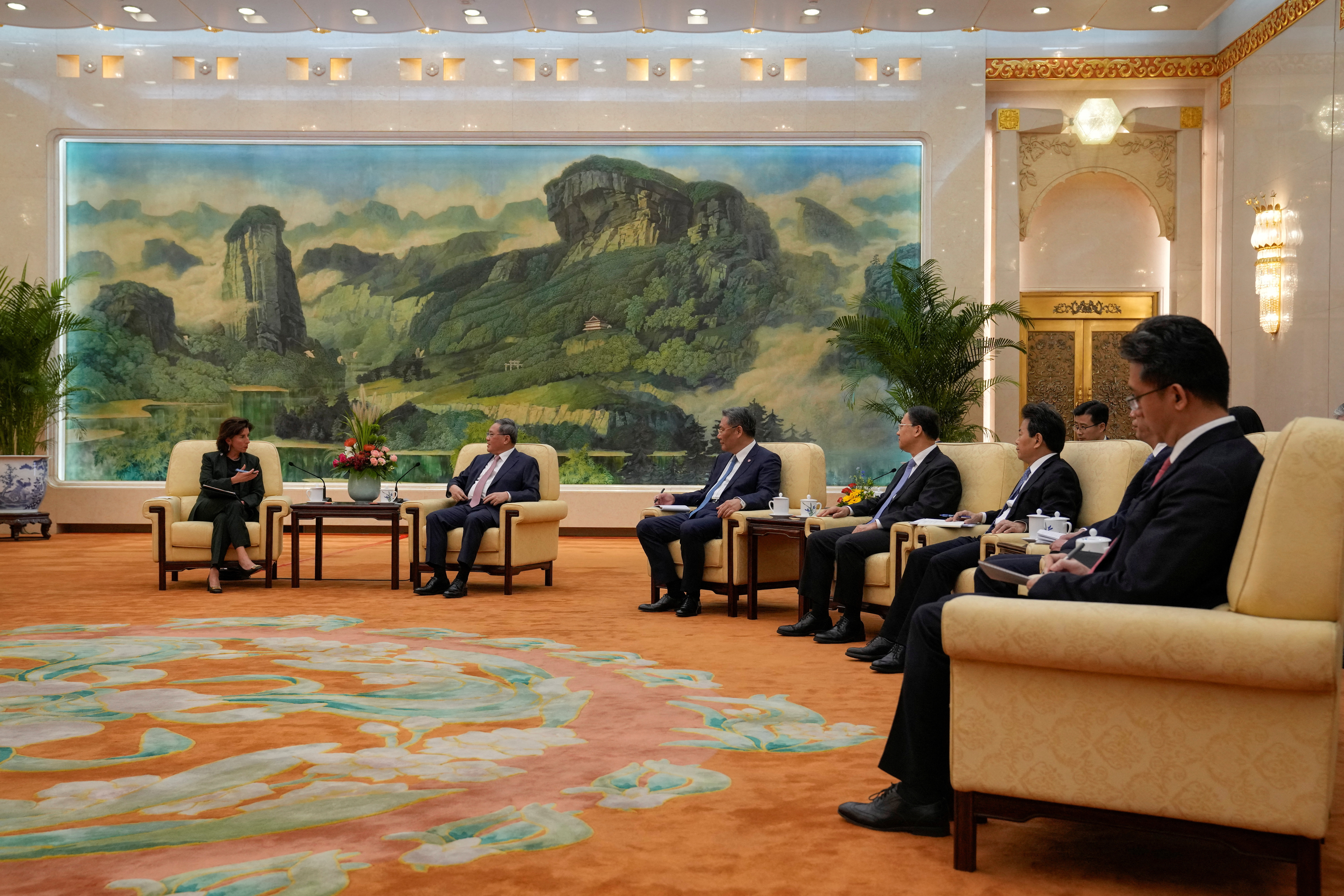

During her visit, Raimondo met with Shanghai Party Secretary Chen Jining, where she expressed her desire to work together to create a more predictable business environment and a level playing field for American businesses. Chen emphasized the importance of a stable relationship between China and the United States, stating that Shanghai has the highest concentration of U.S. businesses.

Raimondo’s itinerary also includes visits to New York University’s Shanghai campus and Shanghai Disneyland, as well as a press conference at a Boeing Shanghai facility.

Raimondo has previously accused China of blocking tens of billions of dollars in deliveries of Boeing airplanes to Chinese airlines. She raised concerns about the airlines’ refusal to accept delivery of Boeing 737 MAX airplanes during her visit but did not receive any commitments from Chinese officials.

Reporting by David Shepardson in Shanghai and Andrea Shalal in Washington; additional reporting by Nicoco Chan and Jason Xue in Shanghai and Joe Cash, Martin Quin Polland, and Yew Lun Tian in Beijing; Editing by Sandra Maler and Robert Birsel

Our Standards: The Thomson Reuters Trust Principles.

What are the challenges faced by U.S. businesses operating in China, particularly in terms of market access and regulatory framework?

Businesses. She emphasized the need for China to address these issues in order to maintain a healthy business environment and attract foreign investment.

In the face of criticism, China defended its business practices and asserted that the majority of U.S. firms operating in the country wished to continue their operations. The Chinese embassy spokesperson highlighted China’s efforts to ease market access for foreign companies and create a market-oriented business environment governed by a sound legal framework. China also pledged to further open its doors to the outside world.

The concerns raised by U.S. companies reflect the challenges they encounter in navigating trade and investment flows between the two countries. China’s unpredictable crackdowns on sectors such as e-commerce and education have led to a significant outflow of foreign investment from Chinese assets. Foreign net selling of Chinese stocks reached a record outflow this month, while foreign direct investment in China is at its lowest level in 25 years.

Raimondo’s visit to China is part of the Biden administration’s efforts to strengthen communication and prevent tensions between the two superpowers from escalating. While she reiterated that the United States does not want to decouple from China, her remarks shed light on the obstacles faced by U.S. businesses in the country.

As Raimondo concludes her meetings in Shanghai and prepares to return to the United States, she encouraged U.S. businesses to continue investing and growing in China. However, she also expressed the concerns raised by U.S. companies regarding fines without explanation and raids on businesses, calling for China to address these issues in order to ensure a favorable business environment. The U.S. Commerce Department declined to comment on the matter.

This is a concerning turn of events for the global investment landscape, especially considering China’s influence in the global economy.

It’s important for investors to closely analyze the factors that led to this statement and assess the potential consequences for their investment portfolios.