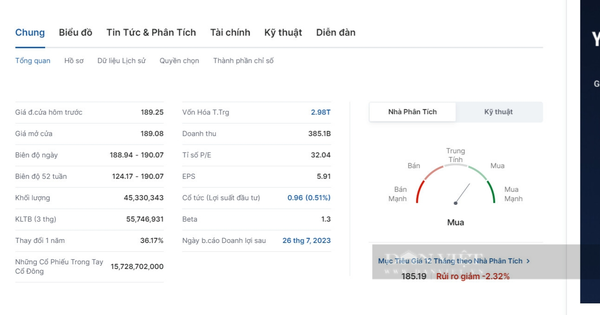

After a period of not much volatility, Apple’s share price recently set a new record after closing the trading session on June 28. Opening the session at $187.93 per share, Apple recorded a peak gain of $189.9 and closed at the end of the day at $189.25, bringing the company’s market capitalization. company reached 2,977 billion USD.

After the June 28 trading session, Apple shares closed at the end of the day at $189.25. Screenshots.

This is the second time Apple’s market capitalization has nearly touched the $3 trillion mark. Earlier in January 2022, Apple once set a market capitalization record of $ 3 trillion in a short time of day trading and returned below that level after closing the session. However, by the end of 2022, the situation is not very positive when Apple loses $ 1 trillion in market capitalization due to limited supply of iPhone 14 Series causing sales congestion.

And despite the massive setbacks late last year, it seems likely that Apple will pass the $3 trillion valuation mark in the near future and once again position itself as the most valuable company on the Streets. Wall. The impetus for the stock price growth has been since the launch of Apple’s Vision Pro augmented reality headset on June 5.

Experts say the launch of VR / AR glasses is the riskiest bet in Apple’s history since the iPhone was introduced more than 10 years ago. Vision Pro glasses are expected to go on sale early next year for $3,499. Meanwhile, in the next few months, Apple will launch 4 new iPhone models with the change of USB-C port instead of Lightning due to pressure from EU regulations.

The new iPhone 15 series is expected to share the same front design with the Dynamic Island cluster instead of being decentralized and only available on the Pro series like the iPhone 14. 9to5Mac news site adds that the iPhone 15 Pro and 15 Pro Max generations will be next. The first is equipped with a periscope lens system that increases optical zoom.

Apple’s share price growth comes after shares of many large technology-related Wall Street companies rebounded strongly this year, amid speculation that the US Federal Reserve Fed) is nearing the end of the interest rate hike cycle and has high expectations about the potential of artificial intelligence technology.

In the first six months of 2023, Apple’s stock rose 46%, while Nvidia’s stock surged 185%, making it the first chipmaker with a market capitalization of more than $1 trillion. Shares of electric car maker Tesla and social networking giant Meta Platforms have more than doubled this year, while shares of Microsoft are up 40%.