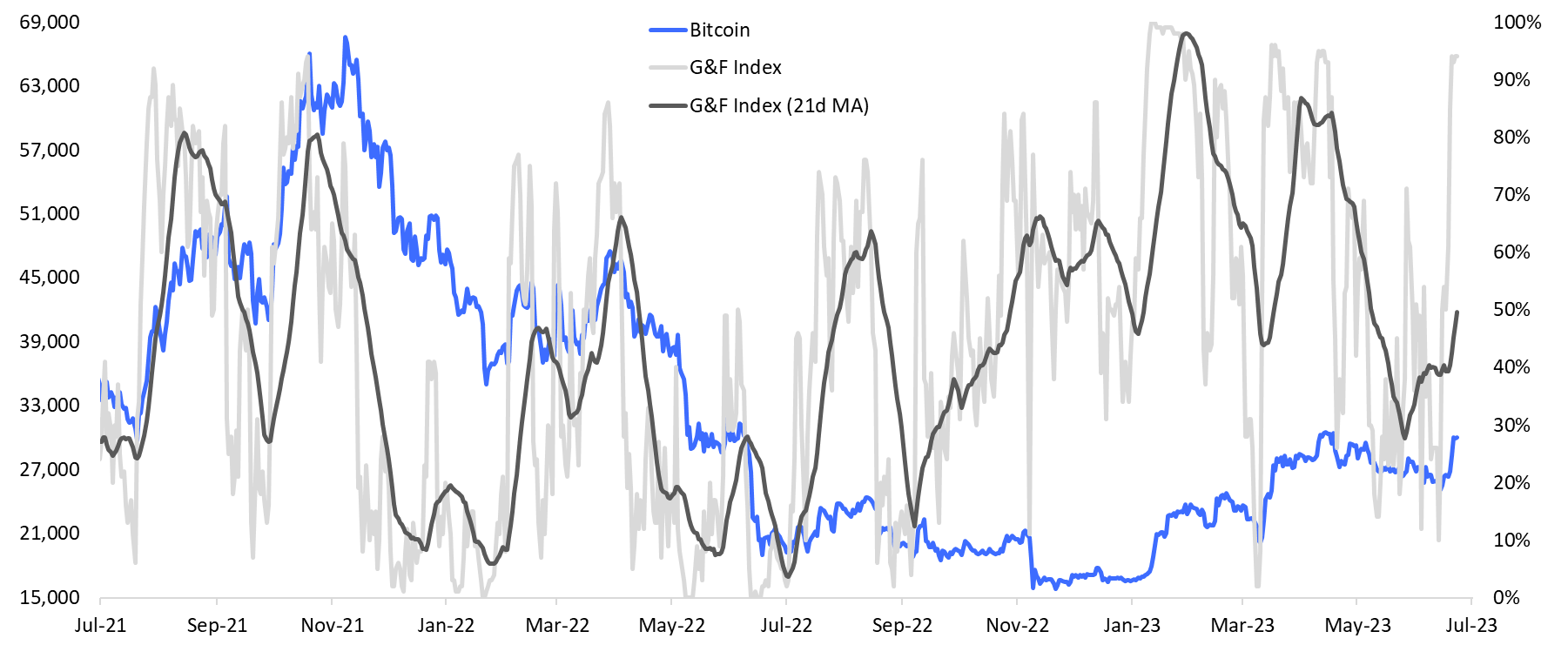

Bitcoin (BTC) has experienced a significant price gain of over 20% since last Thursday, prompting speculation that the rally may soon take a break. Matrixport’s bitcoin Greed & Fear Index (GFI) has surged from under 10% to 93% in just one week, indicating a high level of greed and optimism in the market. Markus Thielen, head of research and strategy at Matrixport, suggests that short-term traders may want to consider locking in some gains at this point.

However, despite the exuberance in the market, the 21-day simple moving average (SMA) of the GFI is still below the 90% mark, indicating that the overall trend for Bitcoin remains on the higher side. Thielen believes that there is still potential for more upside after a period of consolidation to work off the current momentum.

Chart analysts also see potential for a rally to $35,000 and beyond. Market analyst Josh Olszewicz points out that Bitcoin successfully bounced off a previous resistance level and completed a falling wedge setup, suggesting a move towards the mid $30k range. However, he expects heavy resistance and a period of reconsolidation before any further upward movement.

Bitcoin is currently trading at $30,065, according to CoinDesk data. Meanwhile, Ether (ETH), the second-largest cryptocurrency by market value, has gained 15.9% since last Thursday but has underperformed Bitcoin. Ether’s GFI index has not yet reached 90%, indicating that it could continue to rise while Bitcoin takes a breather.

Overall, the market sentiment for Bitcoin remains positive, with the potential for further gains in the near future. However, traders are advised to exercise caution and consider locking in some profits in the short term.

What is the Matrixport bitcoin Greed & Fear Index (GFI) and how does it indicate market sentiment?

Bitcoin (BTC) has been on a hot streak, with its price surging over 20% since last Thursday. This rapid rise has led to speculation that the rally may soon slow down. Matrixport’s bitcoin Greed & Fear Index (GFI) has skyrocketed from under 10% to 93% in just one week, indicating a high level of greed and optimism in the market. With this in mind, Markus Thielen, head of research and strategy at Matrixport, suggests that short-term traders may want to consider locking in some gains at this point.

Despite the excitement in the market, the 21-day simple moving average (SMA) of the GFI is still below the 90% mark. This means that the overall trend for Bitcoin remains on the upward side. Thielen believes that after a period of consolidation to work off the current momentum, there is still potential for the price to continue its upward trajectory.

Chart analysts also see potential for Bitcoin to rally to $35,000 and beyond. Market analyst Josh Olszewicz points out that Bitcoin has successfully bounced off a previous resistance level and completed a falling wedge setup. This suggests that the price may move towards the mid $30k range. However, Olszewicz anticipates heavy resistance and a reconsolidation period before any further upward movement.

As of now, Bitcoin is trading at $30,065, according to CoinDesk data. On the other hand, Ether (ETH), the second-largest cryptocurrency by market value, has gained 15.9% since last Thursday. However, it has not performed as well as Bitcoin. Ether’s GFI index has not yet reached 90%, indicating that it could continue to rise while Bitcoin takes a breather.

Overall, the market sentiment for Bitcoin remains positive, suggesting the potential for further gains in the near future. However, traders are advised to exercise caution and consider locking in some profits in the short term.

Bitcoin’s recent 20% surge in just a week is undeniably impressive. However, it’s important to consider if this rapid growth can be sustained or if a temporary pause is imminent. Taking a breather might be wise to allow for a more sustainable trajectory.