The world financial system is in turmoil. The US Silicon Valley Bank (SVB) has gone bankrupt. Washington Mutual was forced to file for bankruptcy in the wake of the 2008 collapse of Lehman Brothers, making it the largest failure of a U.S. financial institution since then.

New York’s Signature Bank was also forced to shut down on Thursday. It feels like we’ve suddenly been thrown into a combination of the dot-com bubble burst and the global financial crisis.

I would like to look at this situation from a macroscopic context as well. Last week was a historically tumultuous week for Treasuries. Two-year US Treasury yields topped 5% after Federal Reserve Chairman Jerome Powell suggested in congressional testimony that next week’s Federal Open Market Committee (FOMC) could raise interest rates by half a percentage point.

Rice of the week announced on the 9thYields plummet as initial jobless claims show rising unemployment. on the 10th dayEmployment data for February has been released. Nonfarm payrolls rose more than expected, but the unemployment rate rose. Yields plunged sharply when the news about SVB broke.

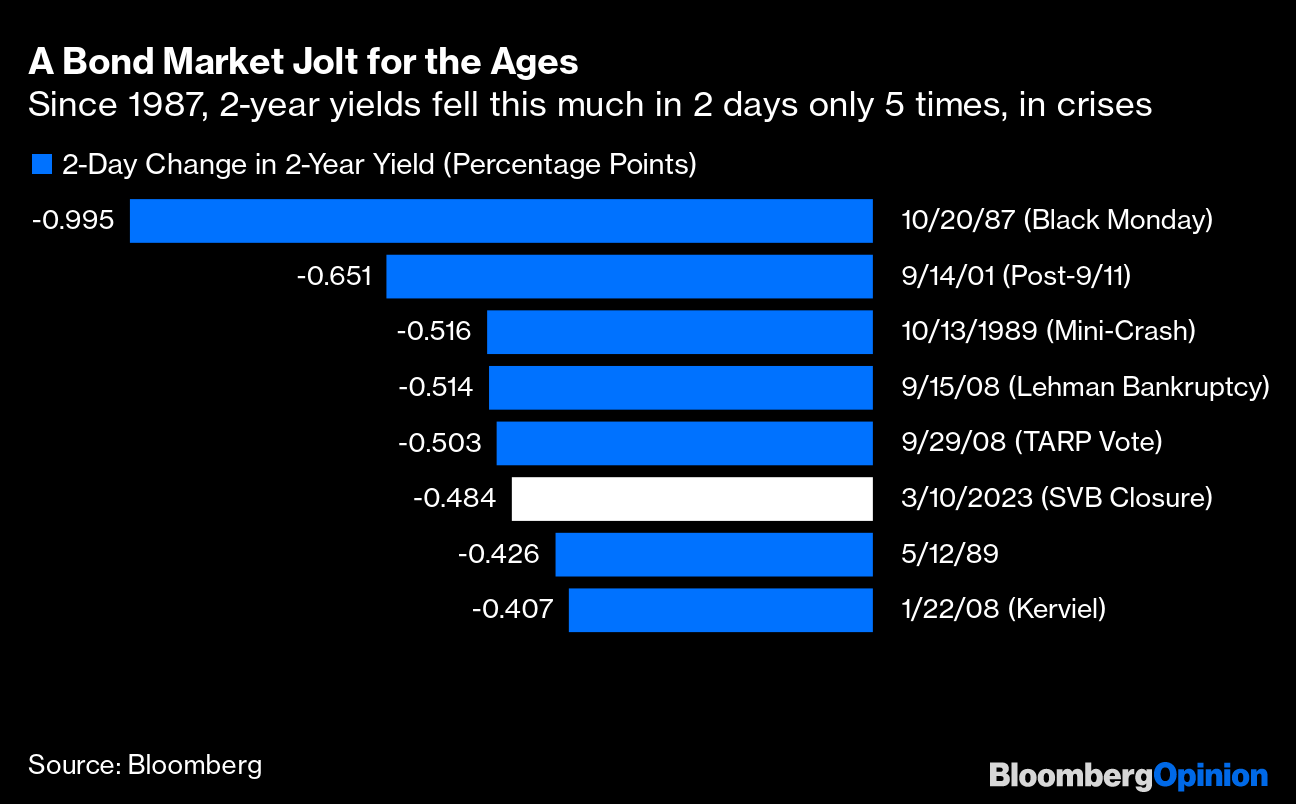

Let’s go back to 1987 and summarize the big two-day drop in the two-year yield. Black Monday in 1987, the mini-crash in 1989, the terrorist attacks on September 11, 2001, the Lehman Shock in September 2008, and the congressional debate on the Problem Asset Purchase Plan (TARP), which includes funds to rescue financial institutions. Crisis situations that remain in recent financial history, such as rejection, occupy the top five places. It was the sixth-largest drop in 2-year bond yields over the two days following the SVB crisis.

While it’s hard to say that SVB alone poses the same level of systemic risk as previous crises, it has helped yields fall sharply for two reasons.

The first reason is that yields have risen sharply in a short period of time, making two-year U.S. Treasuries look more attractive as an investment than it has in years. A 5% return is guaranteed for two years, and if yields fall, the chance of capital gains cannot be ignored. Another is that the SVB crisis may change the minds of the Federal Reserve.

For months, some investors had assumed that the Fed would suddenly turn to cutting rates instead of raising them when the economy turned upside down, but that has always been unrealistic. By their very nature, macro data take time to evolve and central banks can adjust their approach only after the situation becomes clearer.

Rather than the hawkish mistake of having to deal with an unnecessarily bad recession after a delayed rate cut, the FOMC is more concerned about the dovish mistake of premature rate cuts and entrenched inflation. is obvious.

A real reversal of monetary policy requires a threat to financial stability. It is often said that the Fed must tighten until something breaks, but now that something has broken, the FOMC is far more likely to change course.

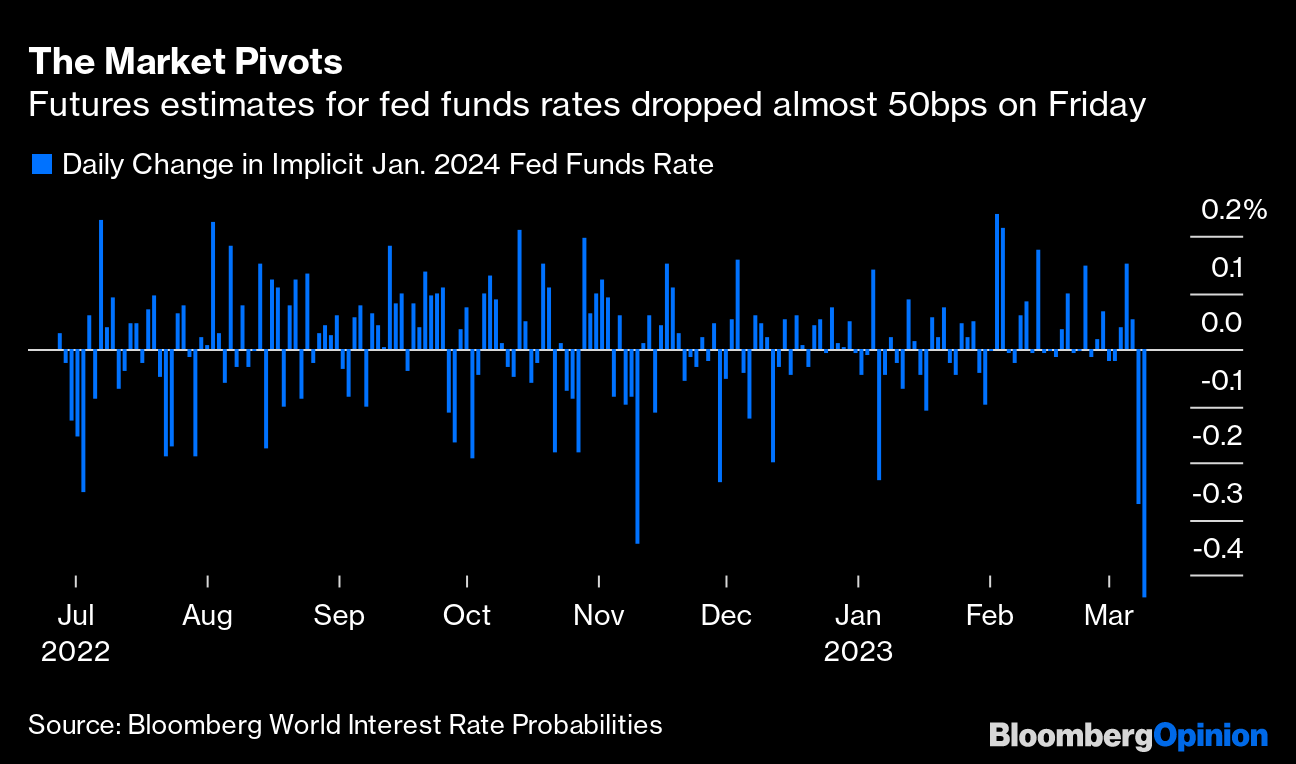

This is clear from the sudden change in the Federal Funds (FF) interest rate forecast created by the function “WIRP = World Interest Rate Forecast Probability” on the Bloomberg terminal.

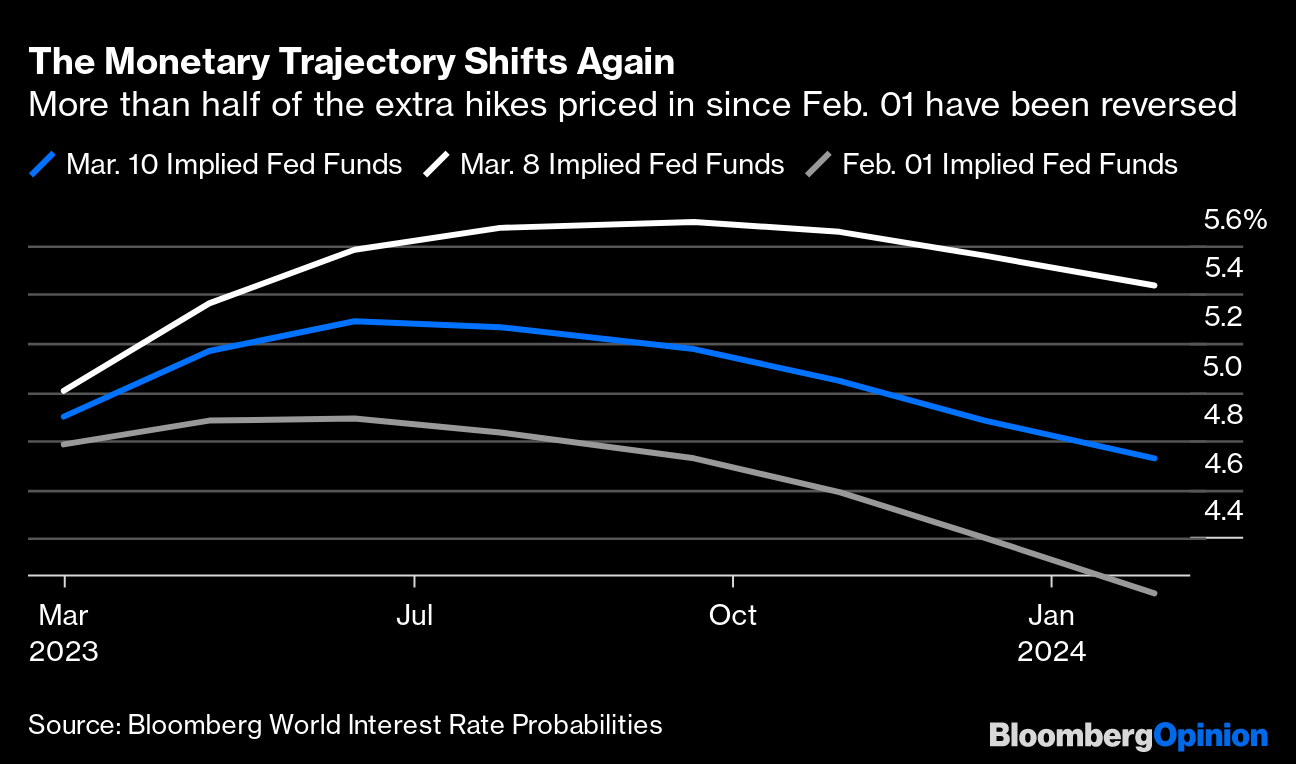

The chart below illustrates the WIRP data from a different angle. Each line is the market’s forecast for the federal funds rate, and the bottom line is the forecast just after Powell’s press conference on February 1. It suggests that the federal funds rate will drop well below 4.5% by January next year.

The top line is Chairman Powell on the 7th of this monthInterest rate forecasts after testifying before Congress. And the middle line is the federal funds rate forecast as of Oct. 10. The outlook is for interest rates to be somewhat lower than previously anticipated.

The immediate reaction from the overnight index swap (OIS) market is that next week’s FOMC rate hike of 0.25 points is overwhelmingly likely, and the possibility of a 0.5 points hike can be ruled out. rice field.

“Traditionally, one channel of monetary tightening is that leveraged financial institutions get into trouble,” said Gerard McDonnell of 2V Research.

Banks will have to offer higher interest rates to attract deposits, which will squeeze profits and tighten lending terms. This will tighten financial conditions and reduce inflationary pressures. An emphasis on rules not to bail out banks or depositors could be an alternative to additional federal funds rate hikes.

However, that would mean that deposits over $250,000, which the FDIC does not insure, would be reimbursed, according to Ed Yardeni, president of Yardeni Research, a research firm. There is a risk of a shift to almost certain too-big-to-fail banks and government bonds.

In short, it’s a risky situation. However, it is possible that the Federal Reserve will take bank failures as evidence that monetary policy is working, and that the tightening that it thinks is necessary going forward will be less.

(John Orser is senior editor covering markets and columnist for Bloomberg Opinion. Prior to joining Bloomberg, he worked for the Financial Times, where he was the head of the Lex Column and chief market commentator. The content does not necessarily reflect the opinions of the editorial department, Bloomberg L.P., and the owners.)

Original title:SVB Fallout Puts Fed Rate Pivot Back in Play: John Authers (excerpt)

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

![[Column]Revival of the Fed’s reversal scenario due to bank failures – Authors [Column]Revival of the Fed’s reversal scenario due to bank failures – Authors](https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iiIYPWN07nFM/v1/1200x800.jpg)