Bank runs, increased Fed resolve on inflation, credit risk, and recession risk. Investors have absorbed many shocks over the past few days. It may be impossible to shake them all off at once.

The problem is that when one threat subsides, another emerges. The economy is either overheating or at risk of worsening from financial stress. Bond yields spike one day on a spiral of inflation fears, then tumble the next on the belief that the Fed will backtrack on struggling banks.

As a result, price volatility across asset classes has increased, and that volatility could continue into another news-filled week.

“It’s impossible to take a position the week of the 12th,” said Jim Bianco of Bianco Research. “What the stock market wants is no spillovers and the Fed to deter aggressive rate hikes. Either one will happen, but not both,” he said.

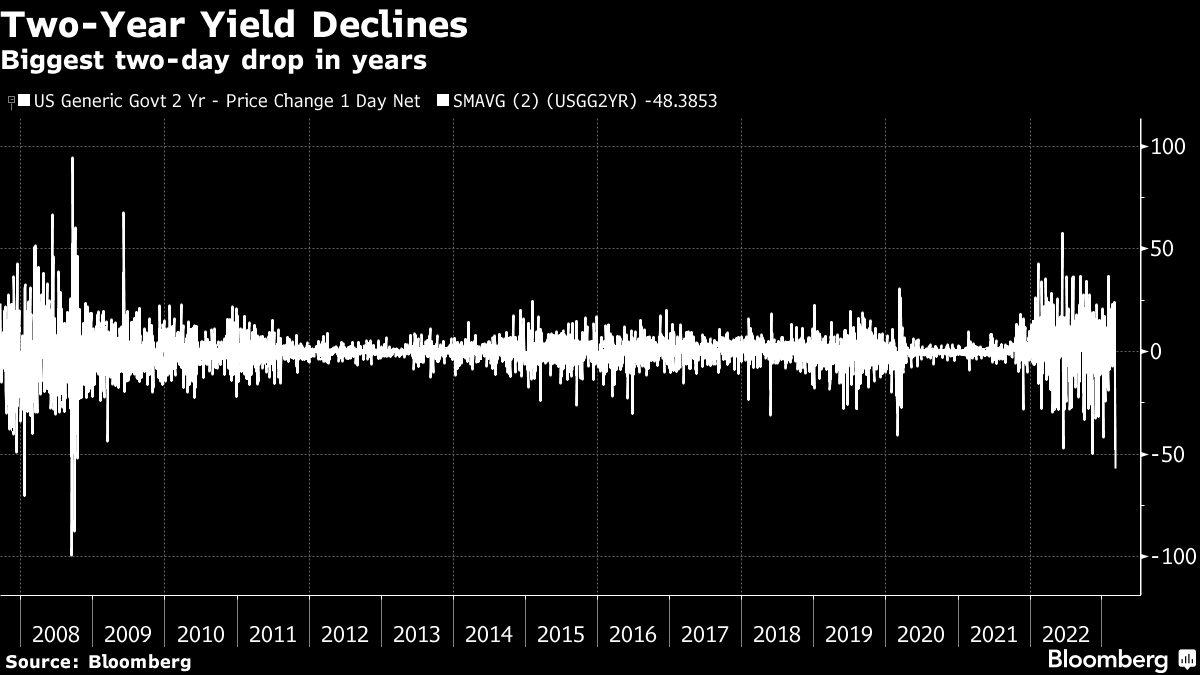

U.S. Treasurys may have been the most shocking move last week, when stocks fell sharply following the biggest U.S. bank failure in more than a decade. U.S. Treasury yields hit their biggest two-day drop since the financial crisis.

Related article

SVB Collapses, Under U.S. Custody – Largest U.S. Bank Collapse in More Than 10 Years (2)

U.S. regulators discuss creation of new fund to strengthen deposit protection – prepare for further bank failures

Ripple of SVB bankruptcy spreads worldwide – UK entrepreneurs ask finance minister to intervene

news-rsf-original-reference paywall">Original title:Traders Brace For More Market Shocks After Week of Wild Swings(excerpt)