A lot of attention and indignation about Leemans’ bridging pension and the pension bonuses in parliament, much less attention for the billion-dollar bill that is coming up in pensions or outrage about the fact that the government is not working on a serious pension reform. And in the meantime, we are gradually becoming the weak brother of the Club Med countries in terms of public finances.

In all the fuss about the improper use of the bridging pension by trade union boss Marc Leemans and the improbable pension bonuses in parliament, the real pension challenge is in danger of being lost sight of. In the coming decades, we in Belgium will face an additional bill of many billions in pensions. And while other European countries with shaky public finances have already brought their future pension bills under control, we continue to wait for a serious pension reform.

New attempt at pension reform

The federal government can try again in the coming weeks to make something of the pension reform announced at the start of the legislature. Surprisingly enough, pensions minister Lalieux’s attempts so far have shown no attention at all to the budgetary side of the pension challenge. On the contrary, the previous proposals slightly increased the future pension bill. The only reason why there is now a new attempt is because 850 million euros of European recovery money has been blocked until there is a sufficient pension reform. Against this background, the minister has already indicated that she wants to make an effort to make the reform budget neutral. This mainly illustrates the unlikely denial of the budgetary challenge posed by pensions.

According to the Study Commission on Aging, annual public expenditure on pensions will be 2.1% of GDP higher by 2050 than today. This corresponds to an extra 12 billion (in today’s euros) per year. And that’s not the only extra bill coming our way. Annual healthcare spending is projected to increase by $13 billion by 2050. And those are optimistic estimates. If productivity growth continues to disappoint in the coming years, the bill could also rise twice as high. The aging bill is not a distant future, by the way. By the end of the next legislature, an extra 8 billion euros will have to be found for pensions and care (on an annual basis). The next legislature will also start with a budget deficit of around 32 billion.

Gradually the weak brother of the Club Med

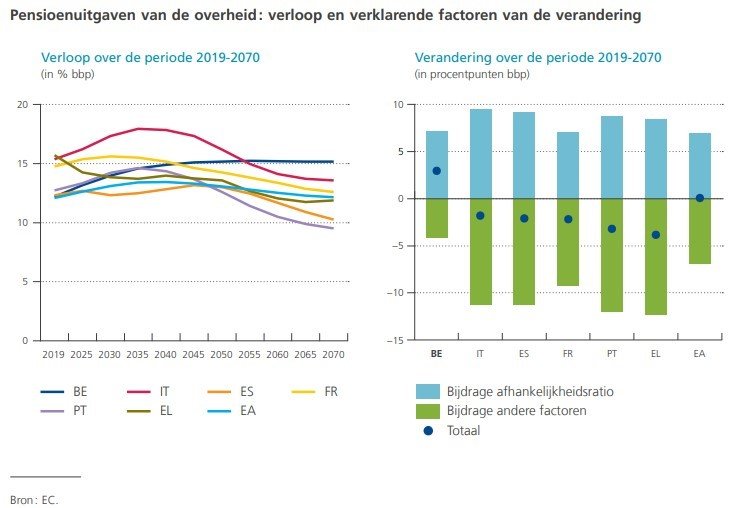

In terms of public finances, Belgium has been one of the Club Med countries for some time now, the European countries with an uncomfortably high public debt, in particular Greece, Italy, Portugal, Spain and France. And so also Belgium. In fact, of the Club Med, Belgium, together with France, is currently the country with the largest budget deficit. And even more remarkable, the other Club Med countries have already brought their future pension bills under control. In each of these countries, government spending will decrease in the coming decades, mainly due to pension reforms. Belgium has not yet really intervened in this area, which means that pension expenditure in our country will continue to rise in the coming decades.

In the long term, we will have to do something anyway to bring the increase in expenditure due to the aging population under control. The sooner we start doing that (we’re way overdue already), the better. This government has also lost years in that area, but taking real steps now is still better than waiting for the next government. But a budget-neutral reform is obviously not a solution in this case. The possible interventions are known: reviewing the method of calculating civil servants’ pensions, including capping the highest civil servants’ pensions, limiting assimilated periods (which today account for a third of pension accrual in the private sector), no longer providing financial incentives for early retirement, a correct bonus-malus in the pension calculation…

The pension challenge facing us involves many billions (per year), which should put the hassle about that one-off 850 million European money into perspective. Ignoring that budgetary side in the context of the pension reform is simply incomprehensible, and simply irresponsible policy.

Bart Van Craeynest is chief economist at Voka and author of the book Back to the facts