The AEX indication is +0.4% after a somewhat cowardly Wall Street and a lot is happening now and there is a lot to do.

In Hong Kong, prices – Hang Seng +3.9% and Hang Seng Tech Index even +6.4% – are flying on more than better than expected Chinese purchasing managers’ indices, while ours is disappointing. There are figures from ASMI and Just Eat Takeaway and the figure of the day is German inflation. The dollar is weakening and interest rates are rising again.

- European and American open and are just a few tenths up

- In Asia, most indices turn a modest green, but in Hong Kong they surf from the chandeliers above the trading floor

Alibaba +5.2%

Baidu +7,6%

Tencent +7,0%

TSMC +2,2%

Samsung 0,2%

- The volatility (CBOE VIX Index) is -1.2% at 20.7

- The dollar is down 0.3% to 1.061

- Gold is up 0.5%, oil is up 0.8% and crypto is up 2% to 3%

How long will stocks survive this violence…? Interest rates are booming again and already at this hour.

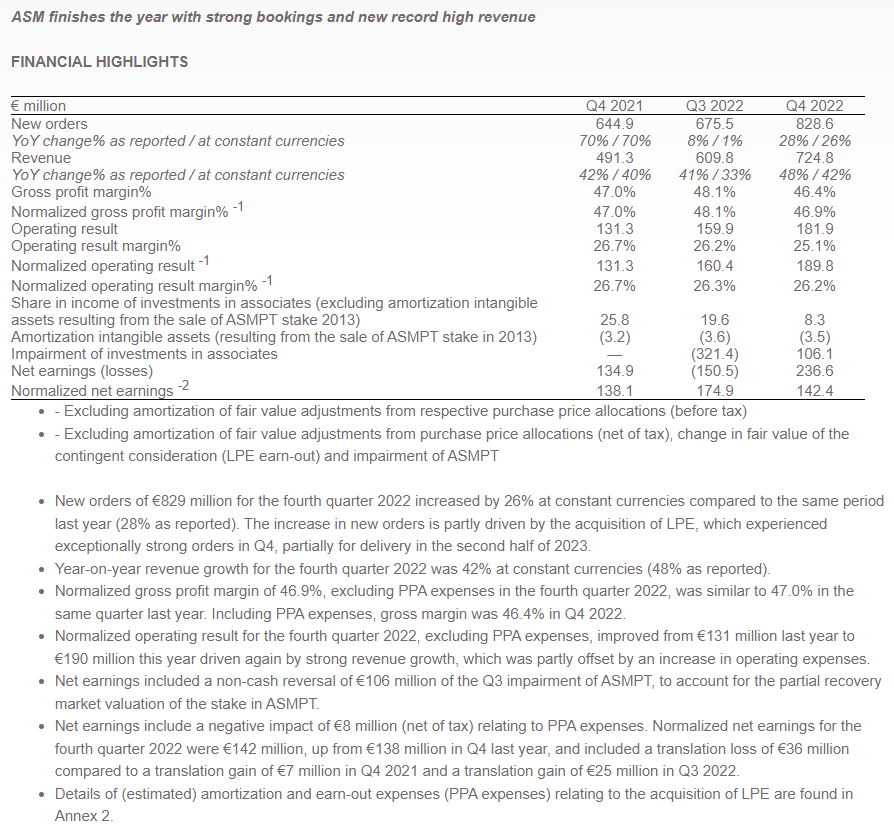

There are annual figures for two popular funds on this site. Last night there was already ASMI, which had already given a nice trading update earlier this year. It is confirmed, but ASMI is very cautious about H2 this year. It is true that the chipper has shown in recent years with those trading updates that it is always being too careful.

The dividend will be maintained at €2.50 and we are not used to that this round. ASMI will invest, according to our analyst Paul Weeteling.

Here is the outlook:

The IEX Investor Desk immediately started calculating. The findings, with price target and advice can be found here.

Just Eat Takeaway rolls out this morning with annual figures and reports a higher EBITDA than in the trading update last month. What weighs more? This, or that the orders and the number of customers decreased by 9% and the gross transaction value per order increased by 10%, say inflation? Or the billion-dollar provisions?

Had those €225 million EBITDA expectations been communicated already? The outlook also has caveats:

With regard to inflation, interest rates, the dollar and the economy, please pay particular attention to the German provisional inflation figures for February today. This is definitely the number of the day for the stock markets (and the ECB).

Tomorrow the rest, but today is of course also purchasing managers indices day, the manufacturing sector over February. China surprises positively and we negatively. So more. Of course, also pay attention to Germany and this afternoon the US ISM Manufacturing Index.

Our Nevi PMI and especially the all-important new orders are the problem. And expensive energy.

Sigh, from the press release.

News, advice, shorts and agenda

The most important ABM Financial news since the Amsterdam closing yesterday with big news Allfunds and Euronext, Shell, Corbion and IMCD. HP did after market Wall Street +3.2% on figures, Rivian -10.1% and AMC -6.4%.

- 07:53 Shell completes sale of Californian project

- 07:41 Corbion expands distribution partnership with Azelis

- 07:27 Just Eat Takeaway sees losses increase

- 07:25 Dutch industry is shrinking faster

- 07:05 Allfunds rejects Euronext takeover bid

- 06:59 European stock markets are expected to open higher

- 06:55 Chinese industry is growing again

- 06:53 Japanese industry shrinks slightly less than expected

- 06:50 Stock market agenda: macroeconomic

- 06:49 Stock market agenda: foreign funds

- 06:48 Exhibition agenda: Dutch companies

- 28 Feb Again red numbers cinema chain AMC

- Feb 28 Disappointing outlook Rivian

- 28 Feb HP suffers from weak PC market

- 28 Feb Wall Street ends a difficult month of February lower

- Feb 28 Stock market update: AEX on Wall Street

- 28 Feb Oil price down in February

- 28 Feb Stock market look: outlook ASMI cautious

- Feb 28 Divided picture Wall Street

- 28 Feb IMCD UK acquires Orange Chemicals

- 28 Feb European stock markets close lower

- 28 Feb ASMI finishes 2022 strong

The AFM reports this shorts:

Fortunately, there is also a nice downward trend at PostNL:

From agenda:

07:00 Just Eat Takeaway – Annual figures

1:00 PM Lowe’s – US Fourth Quarter Figures

22:00 Snowflake – US Fourth Quarter Figures

01:30 Industry Purchasing Managers Index def. – February (Jap)

03:45 Industrial Purchasing Managers Index Caixin – February (Chi)

09:00 Industrial Purchasing Managers Index – February (NL)

09:15 Industrial Purchasing Managers Index – February (Spa)

09:30 Industrial Purchasing Managers Index – February (Ita)

09:50 Industrial Purchasing Managers Index – February final. (fra)

09:55 Industrial Purchasing Managers Index – February final. (Germany)

10:00 Industrial Purchasing Managers Index – February final. (EUR)

10:30 Industrial Purchasing Managers Index – February final. (UK)

1:00 PM Mortgage Applications – Weekly (US)

14:00 Inflation – February vlpg (Germany)

15:45 Industrial Purchasing Managers Index – February final. (US)

4:00 PM Industrial Purchasing Managers Index ISM – February (US)

4:00 PM Jobs – December (US)

4:00 PM Construction Expenditure – December (US)

4:30 PM Oil Stocks – Weekly (US)

And then this

Decreases with a zero before the decimal point:

WATCH: U.S. stocks were subdued on the final trading day of February, and each of the three major indexes ended with monthly declines https://t.co/Pg1DTps6Br pic.twitter.com/twgYBU745e

— Reuters Business (@ReutersBiz) March 1, 2023

Everything was stupid last month:

From stocks to fixed income and commodities, just about everything fell in February, reversing January’s spirited market rallies https://t.co/LOs7kOwxoU

— Bloomberg Markets (@markets) February 28, 2023

The US and China go for it, go ASML!

The Commerce Department released its plans to begin accepting applications for a $39-billion chips manufacturing subsidy program, which will require semiconductor companies to share excess profits with the U.S. government https://t.co/NjUHvdU2ny pic.twitter.com/rud94qobze

— Reuters Business (@ReutersBiz) March 1, 2023

Eat this, ASMI?

HP is sticking by its fiscal year outlook of about $3.25 billion in free cash flow, a sign it expects a PC rebound later in the year https://t.co/MXjgZUN0BH

— Bloomberg Markets (@markets) February 28, 2023

Rivian, we had that too.

Rivian forecast building as many as 50,000 electric vehicles this year, below Wall Street’s expectations, while revenue fell short of estimates https://t.co/WeRumyOZ3W

— Bloomberg Markets (@markets) February 28, 2023

China’s manufacturing activity expanded at the fastest pace in more than a decade in February, an official index showed, smashing expectations as production zoomed after the lifting of COVID restrictions late last year. More here: https://t.co/C11gASlyGk

— Reuters Business (@ReutersBiz) March 1, 2023

Judge for yourself whether this also applies to investing:

U.S. businesses operating in China are increasingly pessimistic about their prospects in the world’s second-largest economy, according to a survey by the American Chamber of Commerce in China. More here: https://t.co/ybUgMkPZzD

— Reuters Business (@ReutersBiz) March 1, 2023

That’s handy:

WATCH: Chinese smartphone maker Realme unveiled the GT3 smartphone which it says can be fully charged in just over nine minutes #MWC23 pic.twitter.com/JwDm2Hj1jV

— Reuters Business (@ReutersBiz) March 1, 2023

We’ve heard it for years, but where is it?

G20 nations could be edging towards tougher regulation of cryptocurrencies. The idea won support from the U.S. and the International Monetary Fund at a summit in India. Here’s a round of the week’s big stories in the world of virtual money pic.twitter.com/PCvMnUtaPj

— Reuters Business (@ReutersBiz) March 1, 2023

What can possibly go wrong…

Leverage is creeping back into crypto even as trader interest remains weak https://t.co/wdVFfducNH

— Bloomberg Markets (@markets) February 28, 2023

Have fun and good luck today.