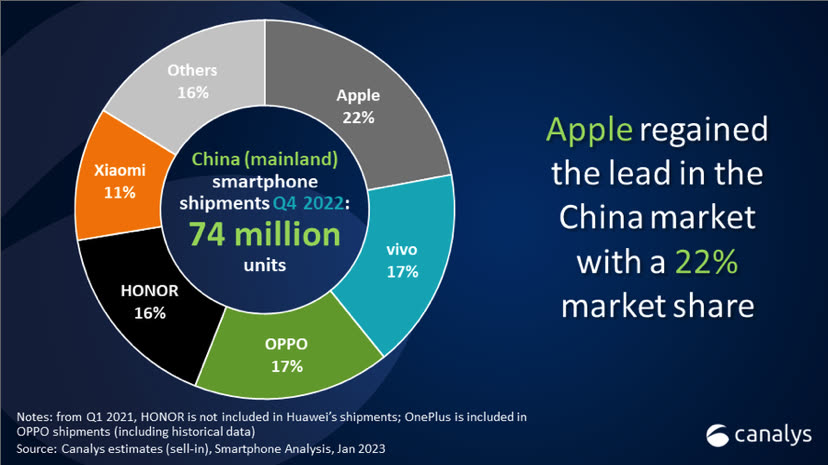

On the tails side, Apple took over the lead among smartphone sellers in China in the last quarter of 2022. On the tails side, Apple, like the entire smartphone market, saw its sales stumble during the year.

Sales in China are always scrutinized with interest and in particular by Apple since this country is its second market behind the United States. The brand is also the only non-Chinese in the Top 5.

In its latest study, Canalys noted that you have to go back to 2013 to find annual sales of less than 300 million units in China. In 2022, 287 million smartphones would have been sold, 14% less than in 2021.

Vivo and Honor are tied with 52.2 million units each, but it’s a big annual drop for the first (-27%) and a big rebound for the second (+30%). Apple rolls right behind them with 51.3 million iPhones sold (+4% in one year).

In the fourth quarter, it was Apple this time that did well. Apple nevertheless suffered like everyone else from falling demand following the very strict health policy in China and the turmoil in the main factory. from Foxconn. 16.4 million iPhone would have been sold for this period, it is a collapse of 24%.

Behind, Vivo, Oppo and Honor are in a pocket handkerchief with more than 12 million units each and annual declines of between 5 and 14%. The biggest loss is for the fourth, Xiaomi, with 8.5 million smartphones and a drop of 37%.

iPhone sales fell in late 2022, but not as much as competitors

Canalys foresees a rebound in 2023, but on tiptoe, as consumer demand returns over the next 6 to 12 months. And a normalization of the situation in the production lines, even if there can be jolts according to the waves of contamination. Apple will announce its financial results for this period on February 2.

In China, the relaxation of the “zero Covid” strategy worries manufacturers