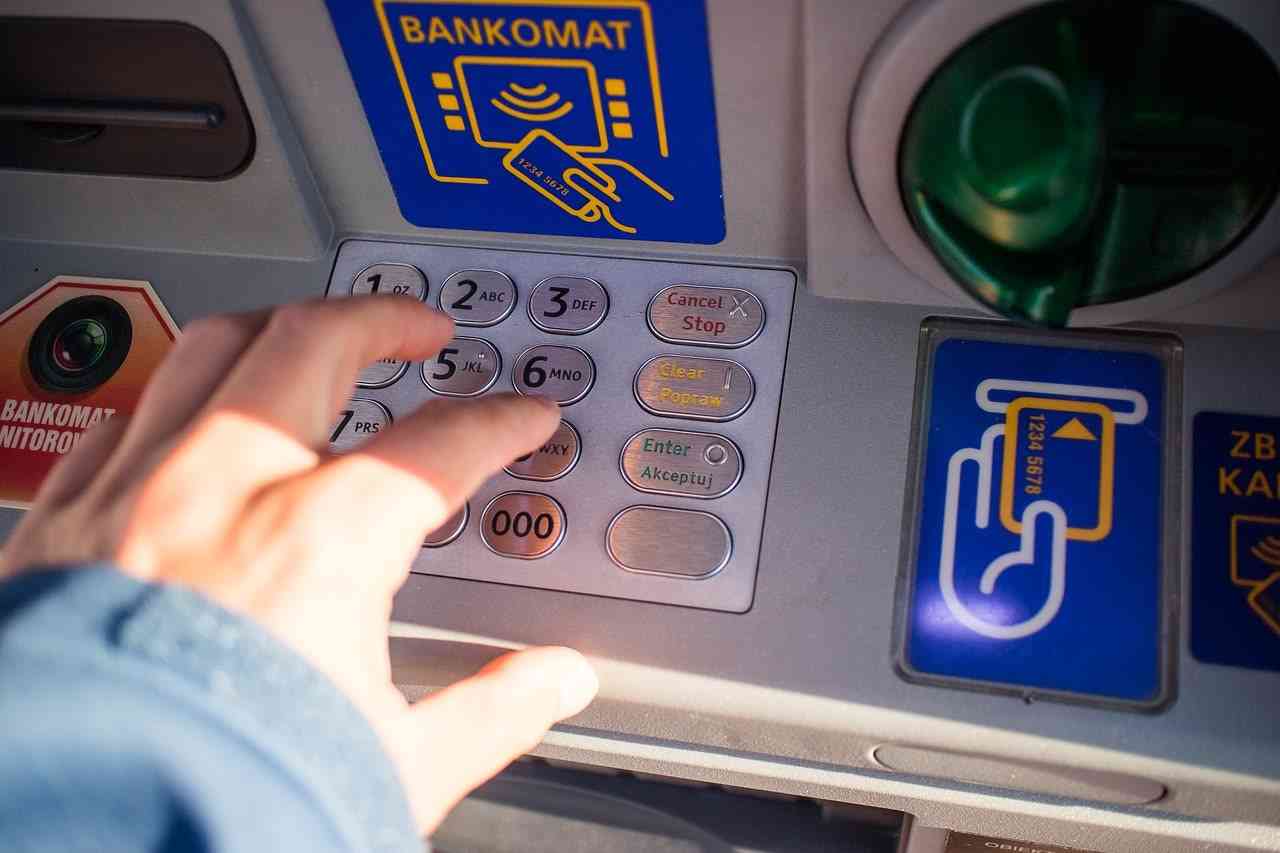

In common terminology, Bancomat is a word used in a very general way to define a technology linked to money but also a defined action which is in most cases the withdrawal of cash, an operation which is now the “main” one but which appears less and less common in recent years.

ATM alert throughout Italy: here’s what’s happening

Cash in a general sense is in fact significantly less widespread than in the past and current conditions show a form of diversity compared to a few years ago. Even a traditionalist nation like Italy has adapted, albeit not very quickly, to electronic money.

Governments in primis but also entities such as banks are now openly increasingly “anti-cash”, as thanks to tools such as prepaid cards and account cards, but also smartphones, now widespread in modern forms equipped with NFC so as to allow contactless payments, paying without using coins and banknotes has already become something current.

But it is not a “habit” as cash represents an important limit in terms of limiting the illicit use of money, such as money laundering and undeclared work.

This was even more evident from the limitation of purchasing possibilities with thresholds defined by the governments that have gradually followed one another, limitations that serve precisely to encourage electronic money to the detriment of cash.

The alert is therefore not such as to be considered with a negative meaning, as by now more and more credit institutions are effectively disabling and decommissioning both branches and ATMs used for ATM withdrawals mainly due to the costs that are often no longer sustainable.

However, it is realistically difficult to think of a “non-stop” disposal in the coming years as a certain number of ATMs remains absolutely essential also by virtue of the diffusion of online banks.

So “no real emergency” even if in the future it will be significantly more difficult to find an ATM than today.