2022-12-20 11:11

publication

2022-12-20 11:11

The Bank of Japan shocked financial markets with an unexpected change in monetary policy. The decision by the “world’s last printers” caused a slight panic among investors.

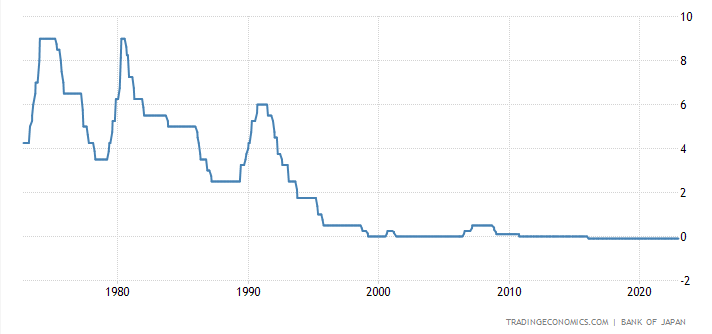

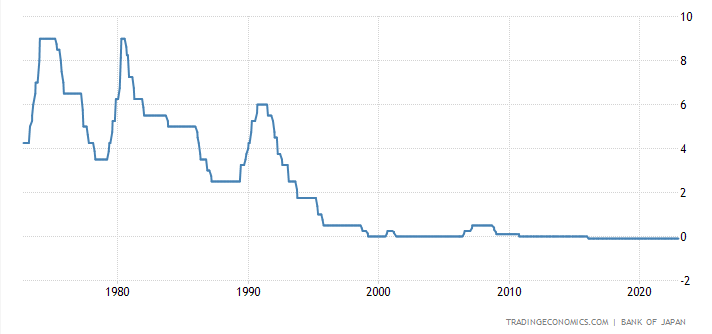

After the December board meeting of the Bank of Japan, no one expected any changes. Haruhiko Kuroda’s team has accustomed us to stubbornly stick to an extremely loose monetary policy without looking at the rest of the world. For years, the BoJ kept short-term interest rates below zero and controlled the yield curve by setting the desired yield on 10-year government bonds at 0%.

And it is this last parameter that has changed today. The Bank of Japan increased the allowable deviation of 10-year yields by 25 bps. up to 50 bps In practice, this meant raising the long-term interest rate from 0.25% to 0.50%. For the Bank of Japan had created trillions of yen in the previous monthskeep government bond yields artificially low.

The reaction of the debt market was immediate. The yield on 10-year samurai stocks rose from 0.25% to 0.45% before falling to around 0.4%. An increase in yields signals a decrease in the market price of fixed coupon bonds. This is the highest yield on 10-year Japanese government bonds since 2015.

A strong reaction was also observed on the foreign exchange market, where the yen appreciated against the US dollar by more than 3%. USD/JPY fell from over 137 to 132.12 yen to the dollar. The Japanese currency is still trading nearly 13% lower than at the start of the year.

Defeat without harakiri

– Today’s step is aimed at improving the functioning of the market and thus at reinforcing the effects of the easing of our monetary policy.

Therefore, it is not an increase in interest rates – in this twisted way, the head of the Bank of Japan, Haruhiko Kuroda, tried to explain today’s decision. At the same time, the Bank of Japan At the same time, the Bank of Japan increased the scope of monthly purchases of treasury bills (QE) from 7.3 trillion to 9 trillion yen.

The thing is, it wasn’t the market that was wrong, it was the BoJ’s monetary policy that bordered on insanity. The Bank of Japan stubbornly kept interest rates near zero even as CPI inflation in the Land of the Rising Sun rose to 3.7% in October, hitting its highest level in more than 30 years. The BoJ’s 2% inflation target was already exceeded in April. It is also obvious that December the Bank of Japan’s de facto decision is an interest rate hikealthough President Kuroda swears that this is not the case.

– This change strengthens the sustainability of our monetary policy framework. This is absolutely not something that would lead to an abandonment of yield curve control (YCC) or lax policy,” Kuroda said.

The market, however, thinks differently, as evidenced by the strong appreciation of the yen against the dollar and the almost 2.5% drop in the Tokyo stock exchange. Analysts are dominated by rumors that this is the beginning of the normalization of monetary policy in Japan, which this year is opposed by the entire economically developed world. In the US, the Fed has raised interest rates by 425 bps since March, the Bank of England by 300 bps. and also the European Central Bank has decided to move by 250 bp. In all of these countries, official CPI inflation is well above the 2% target and does not appear to be returning to it any time soon.

“This decision raises the question of whether this is the first step towards normalizing politics,” said Moh Siong Sim, a currency strategist at Bank of Singapore, as quoted by Reuters. “Maybe it’s a small step to test the strategy and see how the market reacts,” added Bart Wakabayashi of Tokyo’s State Street branch.

Christopher Colany