Cryptocurrency lending platform BlockFi is set to file for Chapter 11 bankruptcy on Monday, November 28. This is reported Decrypt with link to source.

According to Press releaseBlockFi and eight subsidiaries have filed for bankruptcy for the District of New Jersey.

“As part of its restructuring efforts, the company will focus on recovering all liabilities to BlockFi from its counterparties, including FTX,” the company said in a statement.

BlockFi International Ltd. registered in Bermuda. presented an application to the Court of Cassation for the appointment of temporary liquidators.

“In order to ensure a smooth transition to Chapter 11, BlockFi is filing a number of conventional motions with the court to allow the company to continue in business. These day one petitions include requests to pay salaries to employees and to continue paying benefits without interruption,” the platform said.

BlockFi intends to develop a key employee retention plan to ensure resources are conserved for critical functions.

“The company today also initiated an internal plan to significantly reduce costs, including labor costs,” BlockFi added.

According to the platform, it has $256.9 million available, which “will provide enough liquidity to support certain operations in the restructuring process.”

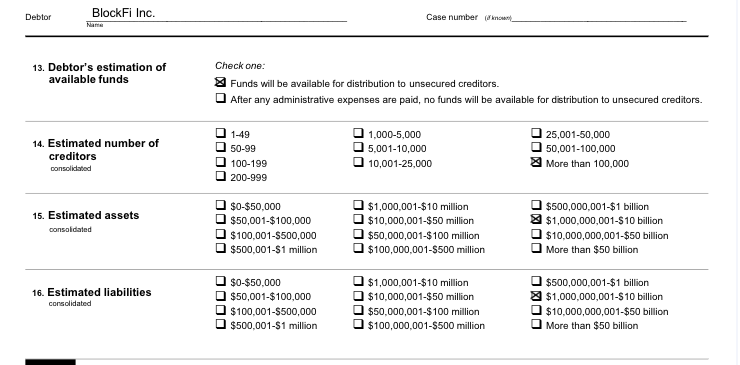

According to application BlockFi has over 100,000 creditors. The company’s assets and liabilities are estimated to be between $1 billion and $10 billion.

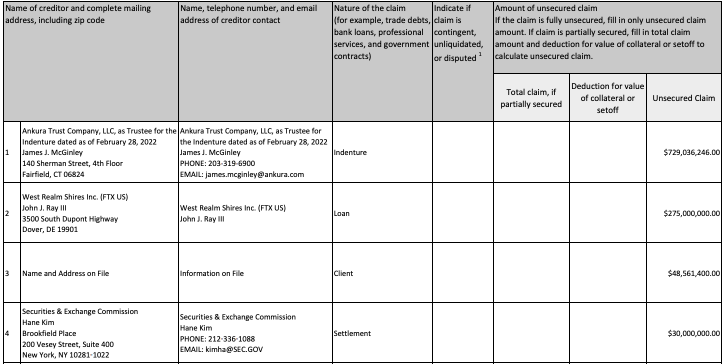

The largest creditors are Ankura Trust Company, LLC (outstanding liabilities of approximately $729 million), West Realm Shires Inc. ($275 million) and the US Securities and Exchange Commission ($30 million). The names of the others are not revealed.

According to the publication’s source, BlockFi will fire most of the team.

On November 8, the founder of the platform, Flory Marquez, announced that all of the company’s products are “fully operational” and the business it doesn’t depend on the Sam Bankman-Fried trade.

However, on Nov. 11, BlockFi he has declaredthat it will not be able to conduct business as usual and will limit operations due to a lack of clarity on the status of FTX and Alameda Research. The platform has suspended withdrawals and advised users to refrain from making deposits.

Same day FTX Group declared bankruptcyand Bankman-Fried stepped down as CEO.

November 14th refuted information that most of its assets are held in FTX. At the same time, the company admitted that the platform has a credit line, introduced the American division of the stock exchange, as well as outstanding obligations from Alameda Research.

Wall Street Journal sources reported it on November 16 BlockFi prepares to apply on insolvency.

Read the ForkLog bitcoin news in our Telegram – Cryptocurrency news, courses and analysis.

Found an error in the text? Select it and press CTRL+ENTER