Recommended by Daniel Dubrovsky.

Get your free stock forecast.

Global market sentiment was volatile last week – it was a rather disappointing 5 days for Wall Street, with the high-tech focused Nasdaq 100 falling 1.57% while the S&P 500 lost 0.69 %. and FTSE 100 rose 1.46% and 0.92% respectively, while in the Asia-Pacific region, the Nikkei 225 fell 1.29% while the Hang Seng rose 3.85% .

Wall Street’s relatively disappointing performance relative to the rest of the world is likely due to a mix of Fedspeak and economic data. As Fed officials hinted at slower austerity They also highlighted the need for continued interest rate hikes. Meanwhile US retail sales are surprisingly high. It underlines the resilience of the economy in the face of rising interest rates.

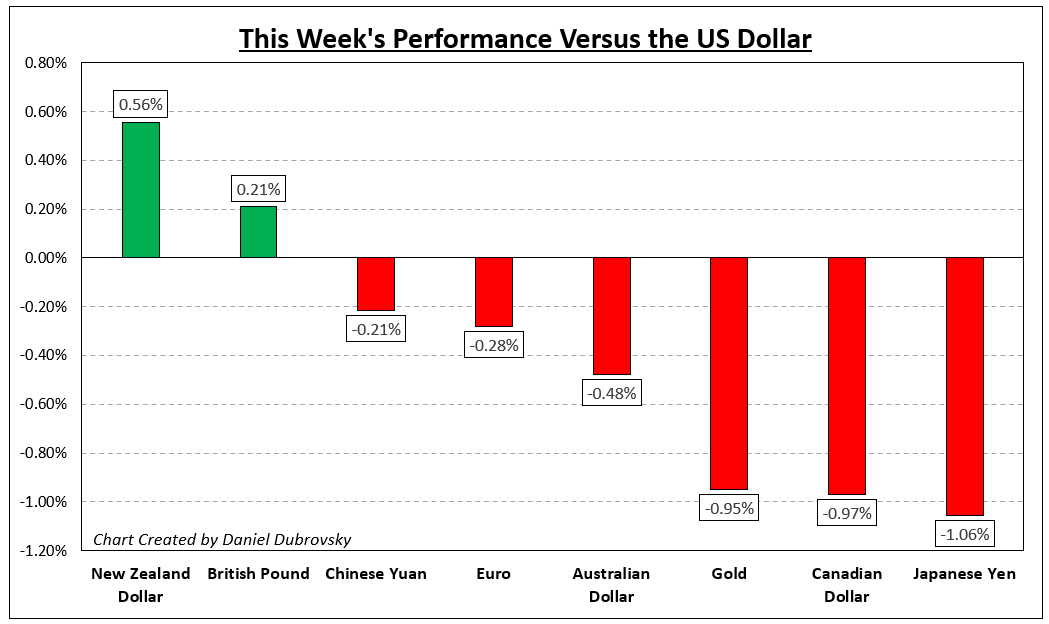

The result of bets on the Fed’s rate hike last week. The US dollar is experiencing some momentum against major currencies – see chart below. poundBritain is largely intact despite UK budget announcements that include elements of austerity to help fight rising inflation. Weak gold and crude oil prices

The markets are entering a limited trading week due to the US Thanksgiving holiday. Even if Wall Street is closed on Thursdays. But activity and liquidity should decrease the day before and after. This does not mean that volatility will be suppressed. But economic evidence is scarce.

The most important event risk is minutes. FOMC This could bolster the case for further tightening, even if it progresses slowly. The equivalent of the European Central Bank is overstepping the limit for the euro. Reserve Bank of New Zealand expected to hike interest rates to 4.25% from 3.50%, paving the way for NZD/USD volatility What else is there for the market next week?

Recommended by Daniel Dubrovsky.

Get your free predictions on the best trading opportunities.

Market Performance – Week 11/21

Basic forecast:

British Pound Weekly Forecast: GBP/USD Repair the last damage

GBP/USD Aiming again for 1.2000 as a stronger Pound and weaker US Dollar both strengthened.

Australian Dollar Outlook: Stuck in US Dollar Maelstrom

The Australian dollar was shaken by the volatility of the US dollar last week. Because of data and geopolitics, there is a market going from pillar to pillar. Keep guessing where the Fed is going.

Euro price forecasts: ECB considers QT against rate hike EUR/USD motionless

A gloomy week for the euro due to EUR/USD Look for a key catalyst as the ECB continues to tug of war between pigeons and hawks.

New Zealand Dollar Forecast: RBNZ Weighs Inflation Against Global Headwinds

Next week, the RBNZ decides to hike 50 or 75 basis points, with forward direction still key. High inflation and deteriorating global trends complicate decisions.

Dow Jones, Nasdaq 100, S&P 500 forecast: Thanksgiving means fluctuation But volatility?

The Dow Jones index, the Nasdaq 100 and the S&P 500 fell last week as Fedspeak and retail sales underlined the canny central bank. Thanksgiving brings cash. But what about volatility?

Technical forecast:

Gold & Silver Technical Forecast: Recent profits at risk as price action implies more lows

Gold and silver enjoyed significant gains towards the end of the year. Both remain at risk of a deep recession in the coming weeks. The dollar index is likely to be the key.

Fixed price Bitcoin (BTC), Ethereum (ETH) – FTX contagion spread

Bitcoin and Ethereum could cushion the steep price drop as technical levels help drive the weekly moves. FTX epidemic spreads to Genesis and Blockfi

S&P 500 and Dow Jones Industrial Average Technical Trends: From Rally to Pause?

The recent rallies in the S&P 500 and the Dow Jones Industrial Average may stall as they test major hurdles. What levels are there? Let’s see.

technical trends GBP/USD: Support signal for a bull market

the increase of GBP/USD Above the key resistance at the September peak, the chances that the worst could break through increase. Which key levels are worth keeping an eye on?

Bearish reversal stall by USDJPY Should Japanese political agencies suffer the most?

The Japanese yen’s recovery stalled last week in the absence of USDJPY Leading with fierce liquidity and other crosses with the yen never really turned heads together, fears that Japanese officials roll back to 150 could start to grow rapidly.

US Dollar Technical Forecast: EUR/USD, GBP/USD, USD/CAD, USD/JPY

The US dollar hit a new low on Tuesday. But the bears failed to take control after that. with a series of higher lows shown in the US dollar on the daily chart through the end of the week.

– Article written by Daniel Dubrovsky, Senior Strategist of DailyFX.com.

— Personal articles compiled by DailyFX team members.

To contact Daniel, follow him on Twitter:@ddubrovskyFX

internal elements

element. This is probably not what you meant to do! Internally load your application’s JavaScript package. replacement item