- CEZ shares continue to support liquidity, dealing with over 58% of the total 3.2 billion for the week. CZK

- after IPO will start trading on the START market on Monday shares HARDWARIO

- luck fee MPs are expected to start debating on Tuesday afternoon

- economic results

published by MONETA on Thursday morning

Prague Stock Exchange also in the last week it continued to undergo significant changes and intraday. Often also in the light of similar developments on foreign markets, but this time also influenced by important internal stimuli. Specifically, the next event dani from the unexpected

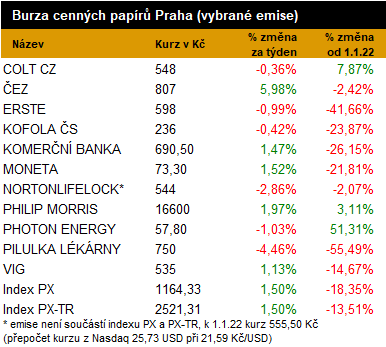

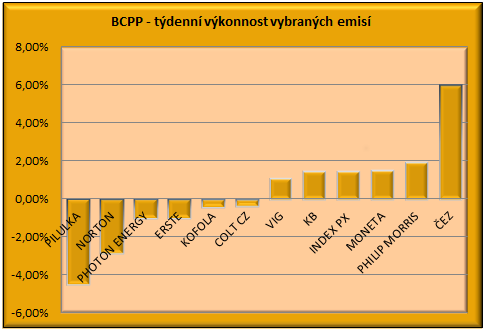

profitsor the so-called luck fee. Daniwhich in its final form will greatly affect the entire series companies exchanged Prague Stock Exchange. The nervousness was heightened over the course of the week by various statements from government politicians, which would rather deserve a regulatory form of publication. Also, uniform so that investors have more confidence in their decisions and capital market it has not lost credibility. PX index was repeatedly at a loss during the week, but also up to over 2.5% profitsfinally ending up 1.5% to 1,164 points compared to the previous Friday.

In particular, they played an important role Actions OVERwhen excessive profitsthat is them taxation touches on this more evidently energetic companies. News that would luck fee

should have covered again this year, logically sent the title further south. It was already trading at 723 mid-week CZK, which is the lowest since the end of November. In other words, more than 40% lower than this year’s highs in June. In the end, though Actions OVER with a closing price of 807 CZK it became the most profitable stock of the week and thus also the backer of the index.

He confirmed the official release of the government meeting on Wednesday

taxation to future ones profits. Different attitudes in government distant however, as if continuing to persist, investors subsequently began to view the issue as settled. However, it will only be clear when everything is hammered by the legislators, primarily in the Chamber of Deputies. The process is expected to begin on Tuesday afternoon during the deliberations tax package. Actually it should be decided not long in advance. governmental parties, with the majority in the vote, they must again deliberate on the given topic, shortly before the morning, in order to finally unify the position. Since the legislative council of the government on Thursday retroactive taxation this year profits in fact he did not throw it off the table, the risk of spitting in the owners face companies they still persist. TO OVER it is possible to integrate the information of the Beneš chief on TV in Otázky V. Moravec, who mentioned a strong orientation towards core future. Completion of not only the next 5th block Dukovany, but also the 6th ov Temelin block 3 and 4. And also small modular blocks. He also mentioned the upcoming international arbitration on Gazprom for non-fulfillment of contractual deliveries gas. He estimates that the damage is at least hundreds of millions more crowns.

In the context luck fee bank stocks also showed volatility. Actions FIRST in their home country, Vienna, they actually confirmed the level at 25 EUR as a distinguished technician border, which prevented them from trying to go north, or eventually drove the week in the red. Homemade Actions KBwhich are currently the biggest influencers in Prague with their weighting over 24%.

stormlikewise aim for the technical level of 700 CZK. In the light and in the vision

dividends they were trading at nearly 4-month highs up to 708.50 CZK, however, just like in June or September, they did not reach the top. Among the banks, they actually showed the highest volatility Actions CURRENCY, which he kept trying to inhale. Over the week, however, their exchange rate was in a wide range of 71.50 – 76.60 CZK.

During the volatile intraday development, they actually successfully tried to take a break from the 3 month lows Actions FILIPPO MORRIS, which in the end already have six growth sessions in a row. And they became the second most profitable stock of the week.

They found themselves at the end of the opposite week Actions PILLwhich have returned to those of this year, which is more than 20 months minimum. Similar minimum they are already slightly detailed

Actions KOFOLA, which thus tries to find the bottom. New then for overview included Actions NORTON LIFELOCK lost compared to last Friday mainly due to the realization of its price against the home Wall Street, the strengthening also played an influence

crowns to the dollar. Already Nasdaq however, they continued to rise to 6-week highs.