who was going to say it Twitter, a value punished by the market with annual lows last February and far from most of the investors that Elon Musk would have become, first in April and, above all, then in October, in the great repulsion of the action. He also remembers that if Musk’s offer is ultimately successful, Twitter will be deleted from Wall Street.

Some titles, however, that mere mortals on Wall Street consider untouchable due to the staggers that are occurring as a result of the operation. But which are clearly favorable in the face to the lucky ones who bought under those € 54.20 per share that the richest promises of the world per share, and that still present, after the collection of earnings on the day of the announcement of their return to operations, an acquisition opportunity with certain earnings on Wall Street.

But with Musk you never know, as happened with the backtracking due to the fraud allegations to the “bots” of the network, with this alleged deception that have brought the directors of Twitter to court, who have yet to decide what will happen on the matter, although it is possible that, if all goes well, an agreement will be reached to fire them. The truth is that October 17th was the date to close a deal where everyone provided their current Twitter address as a seller, but the judge on Monday postponed the hearing to October 28 to try to reach an agreement.

Be that as it may, Twitter shares are the big winners of that accepted initial offer at $ 54.20 per share in total, Purchase of 100% of the company for $ 44,000 million, who came to reactivate intraday on the day of the announcement up to 22% of the value, which closed that session with advances close to double digits. Obviously, think that now, pending that offer, that will be your highest price at all levels of the market.

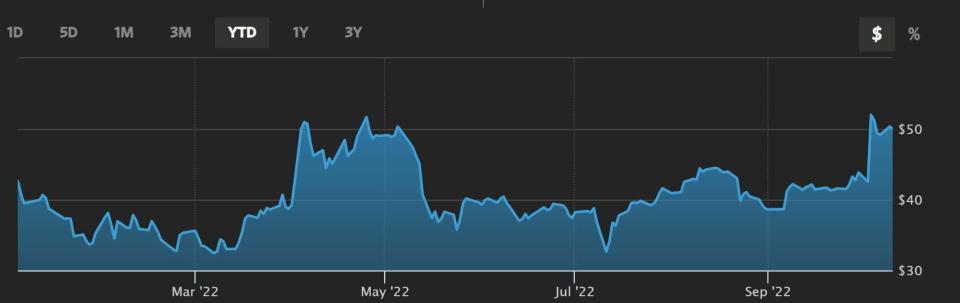

In fact, in his price chart we see that the value has dropped 3.58% in the last week, with a month of improvement of 20.12%, as well as in his quarter where his advance reaches 47.2%. , while, progress so far this year has reached 16%.

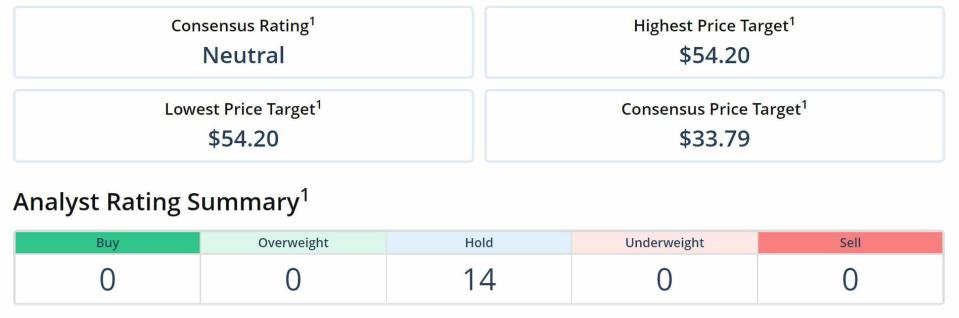

Therefore, their subsequent recommendations are limited to the market. We see it hand in hand Citigroup which remains neutral on value but improves from 40 to 54.2 dollars per share your target price. From Rosenblatt, the same speech as his PO’s previous $ 37 to $ 54.2 with neutral advice that reaffirms the value.

His analysts believe the best thing about Elon Musk’s renewed offering is his statement of expectations indicating that, this time around, the deal will be completed. That yes with the expectations of a significant change within Twitter, with tweet editing being even implemented in countries like Canada or Australia with Musk wanted. Requests that would join the increase in characters, the reduction of content regulation and the return to the network of former president Donald Trump, who had also asked the founder of Tesla.

According to Tipranks, who marks in the offer the price estimated by Musk, both minimum and maximum, with a recommendation of neutral, while showing the consensus average of the value over the past six months.

But there will also be losers in this operation. Teslafor instance. From Wedbush they point out that there are no new sales announced of the value, as was the case in April with the sale of shares in the electric vehicle company, but that its interest in advancing the offer will hurt Tesla. Or as its flagship analyst Dan Ives points out “is that the big concern is that he juggles too many balls at the same time” because they believe that the Twitter acquisition does not benefit Tesla’s investors in the future.