In 2021 Konstantin Kuzikovs started investing 50 euros a week on the stock market. The goal is to reach a capital value of 36,000 euros within ten years. Raivis Vilūns has also started investing since January, but uses much more profitable and risky financial instruments. You can find out how Konstantin and Raivya’s portfolios are doing in this article and you can learn about the plans and strategies of both investors in the program “Capital of the future“.

The content will continue after the announcement

Advertising

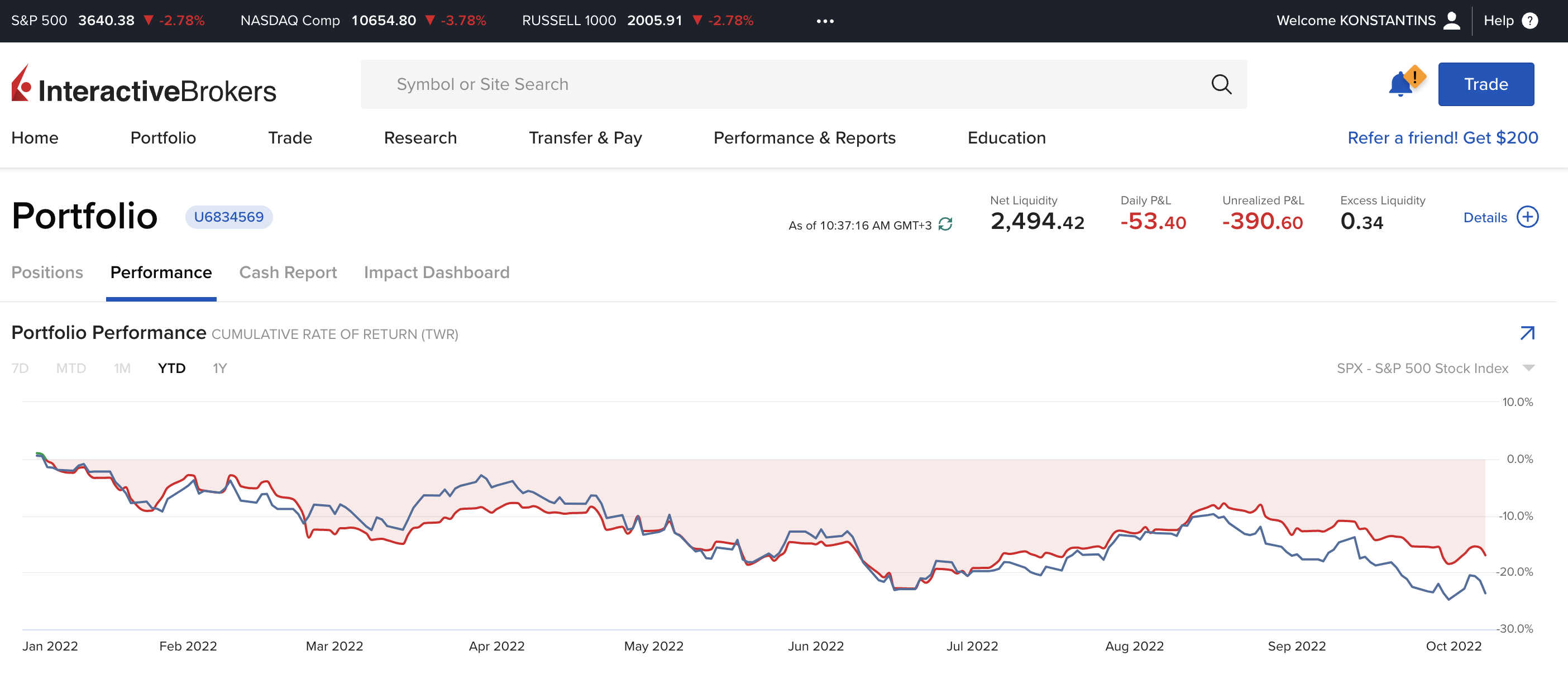

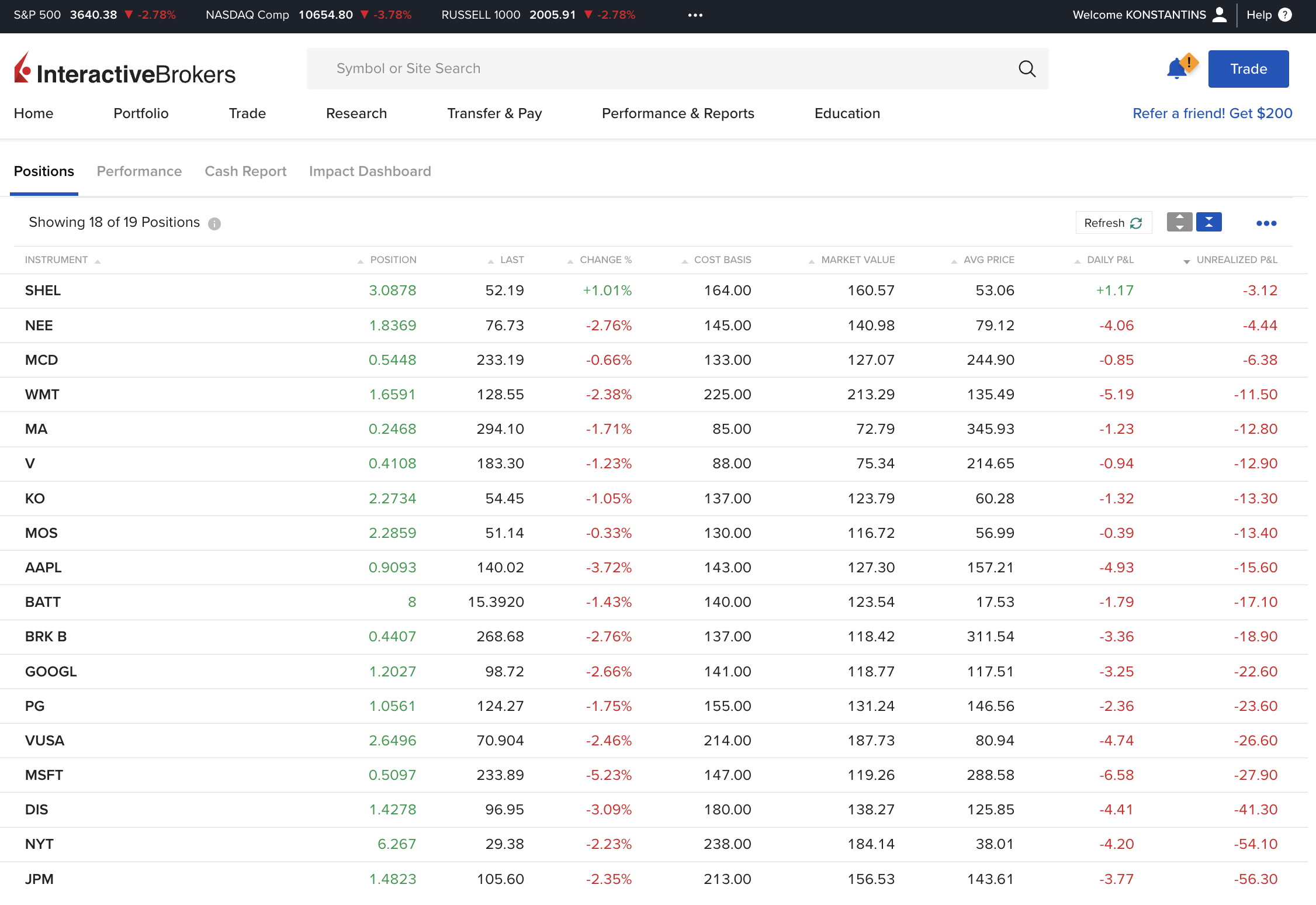

How did the capital of Kuzikov change on 7 October?

- Invested: EUR 2750 (+ EUR 50)

- Capital value: 2,494.42 (+93.85 euros)

- Return on investment: -9.29% (+1.79 percentage points)

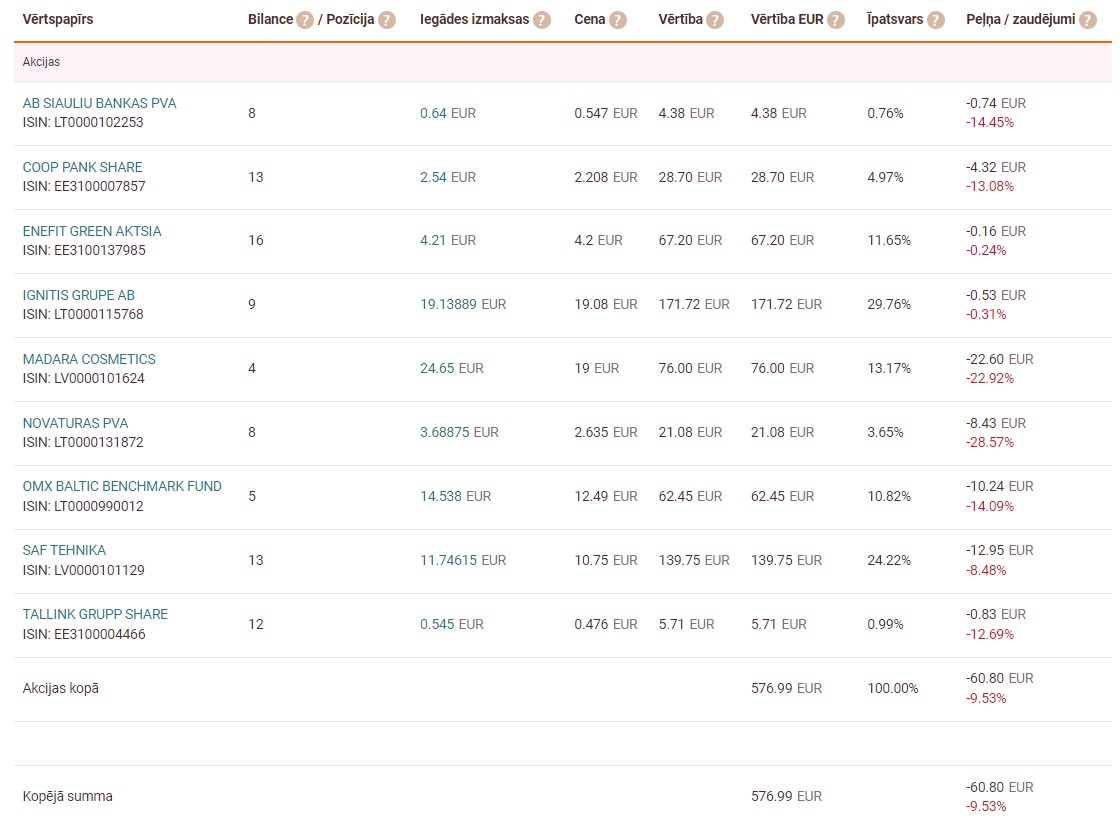

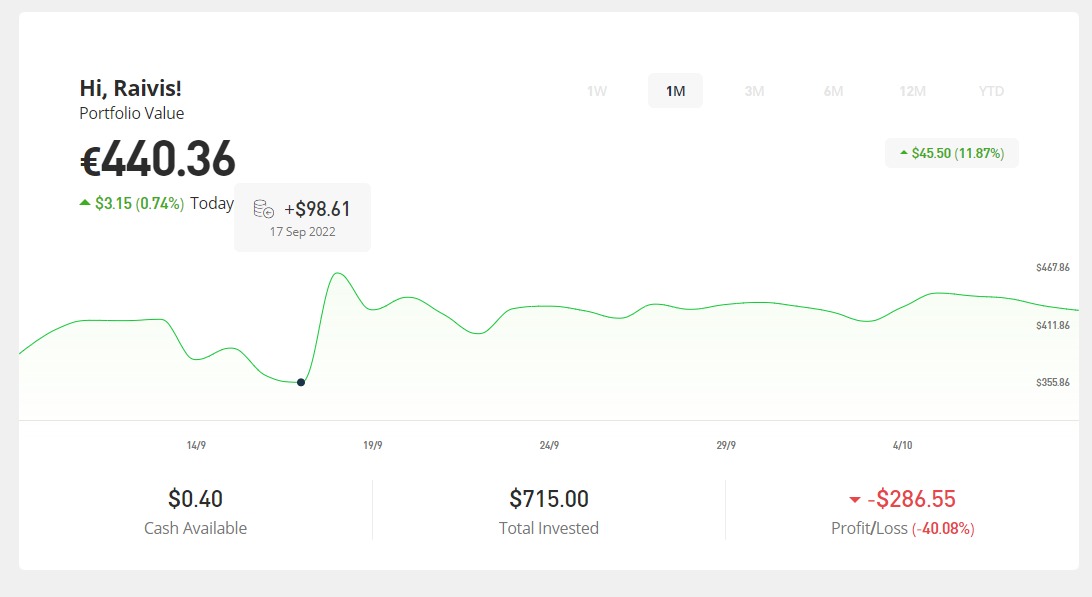

How did the capital of Vilūn change on 7 October?

- Invested for the moment: 2702.52 euros

- Capital value: EUR 2403.03

- Return on investment: -12.47% (-0.23% for the week)

What happened to the market during the week?

The S&P 500 started October with a gain of 5.7%, the best result for the first two trading days of the fourth quarter in the history of the market. However, not everything is that simple. There were two reasons for the hike: Monday’s manufacturing data and Tuesday’s US employment data gave investors hope that the Federal Reserve might slow rate hikes. However, let’s not forget that the market already saw a similar rally a few months ago as more positive-than-expected inflation data emerged and stock prices rose. At that time, the FRS did not change its plans.

It is also worth mentioning that the S&P 500 lost 9.34% in September. Whenever (excluding 2008) the market lost 7% or more in September, the shares rebounded in October. But this does not mean that the bear market trend ends, it is still a temporary positive movement.

The Baltic stock markets continue to decline. As mentioned above, until the global economy starts to recover, nothing will change significantly even in the Baltics. The entry of “Indexo” on the stock market next week could offer a small local jolt, however, if there is a rise, it will be in the short term.

Regarding cryptocurrencies – there are no significant changes, however, it seems that the rapid decline that was observed last week has stopped. While the “greed and fear” indices of investor sentiment show that the markets are still very cautious, the week saw a slight “Bitcoin”And consequently the rise of other cryptocurrencies. Returning from 18 thousand to about 20 thousand.

Portfolio changes

The common situation with Kuzikov shares is as follows:

- There are no stocks with positive returns yet.

- The total return on the joint portfolio is now – € 390 (+ € 27).

During the week all shares showed a decline in value, the record holders were “Shell“(Shel) with + 0.33% and” NY Times “(NYT) with + 0.24%. The biggest drop in value was shown by” Coca-Cola “with -0.10% and” Nextera Power“(NEE) at -0.08%.

The situation with Vilūn Baltic shares is as follows:

- All positions are negative

- Total portfolio negative growth is -9.53%

- “Enefit Green” shows the best result unchanged for several weeks

The situation with Vilūn’s cryptocurrency wallet is as follows:

- All three cryptocurrencies – “Bitcoin”, “Ethereum” and “Solana” show a decrease in value

- The biggest drop in value is “Solana” (-50.40%)

Kuzikov continues to follow portfolio diversification and will increase the share of ETFs

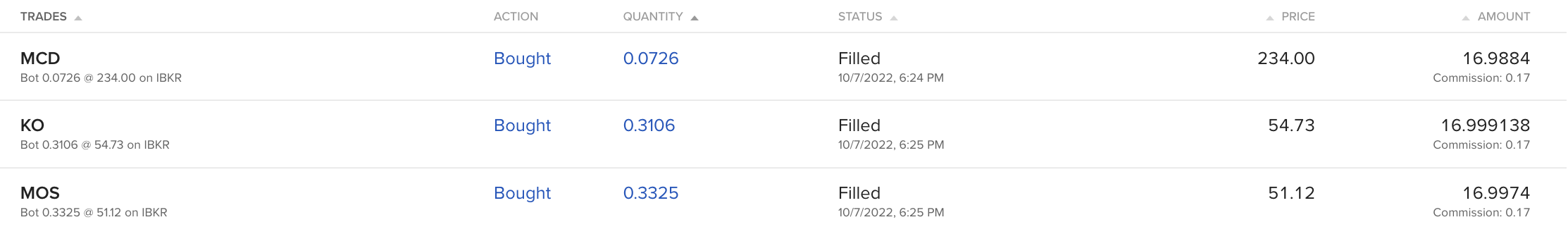

“As expected, I bought shares in the food segment. I noticed that the share of ETFs in my portfolio is below the expected 20%. It is currently 17.03%. Therefore, my next investment will be in this segment. ETF copying “S & P500” already occupies 43% in this segment, this time I will only invest in Berkshire Hathaway and “L&G Battery Value-Chain”. This will allow me to balance the proportions between all 3 stocks in this segment. “

Vilūn will increase the stake in its Baltic stock portfolio

“I will continue to slowly increase the shares of companies listed on the Baltic stock exchange in my portfolio,” says Vilūn