The AEX (-2.2%) falters on the weekend. Interest rates are going up and that means bad news for equities. The culprit is the work report that came out at 2.30pm.

Last month no fewer than 263,000 jobs were added in the United States, bringing unemployment to 3.5%. This is the lowest level since 1969. Both figures were better than expected. In 2022, good news sadly means bad news, so the markets took a steep dip on the message.

The stronger the labor market, the greater the upward pressure on wages and therefore the greater the inflation. In all likelihood, the Fed will raise interest rates by 75 basis points at its next meeting in November. More than 82% of analysts now assume it.

Risk-free

is at risk on the financial markets. Rising stocks and companies with a scratch are running out, while defensive ports are limiting the damage.

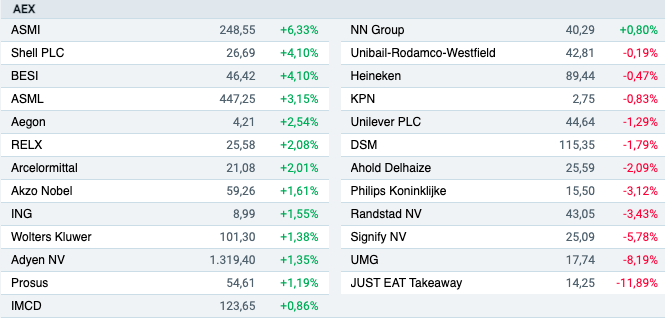

Let’s see the chippers ASMAS (-6.7%) a ASML (-6.1%) precipitate. Boss on boss is Eat takeaway only with a minus not less than 8.6%. Here (+ 0.1%), Unilever (-0.3%) a KPN (+ 0.4%), on the other hand, held up well. The strange one is ArcelorMittal (+ 1.1%).

A share if Philips (-4.1%) you shouldn’t have in your wallet on a day like this. The stock is currently trading at its lowest level since July 2012. In short, more than a decade ago. Painful!

Shell

After a few positive quarters, it was found yesterday that Q3 clearly fared less well Shell (+ 1.4%). Headwinds in various divisions mean the group will not be able to reach consensus.

However, the message leaves the market relatively cold. Yesterday Shell managed to limit the final loss to around 2.5% and today half of the loss has been recovered. That’s in a sharply declining market.

In other words: Shell is once again an outperformer. You can read in the following article whether this profit warning is a reason analyst Martin Crum lowered the price target.

Shell is also struggling with the price of gas #SHELLPLC https://t.co/DC9LqrrQF0

– IEX Investors Desk (@Beleggersdesk) October 7, 2022

Pensions

Administrative expenses paid by pension funds rose to record levels in 2021. The total cost amounted to € 14.5 billion, or around € 700 per person per year. The costs are more than half lower with premium insurers and pension funds.

So Investor Desk Head Erik Mauritz asks: Can’t pension costs be lower?

These retirement costs cannot be lower than IEX Premium https://t.co/hrkauW438m through @IEXnl

– Niels Koerts (@KoertsNiels) October 7, 2022

Annuities

Interest rates are going up. Look especially at the Italian interest rate. No less than 20 basis points are added. Two more days like this and the Italians will have to pay more than 5% interest. More than 10 years ago, this led to panic in the financial markets.

- Netherlands: +12 basis points (+ 2.52%)

- Germany: +12 basis points (+ 2.20%)

- Italy: +20 basis points (+ 4.70%)

- United Kingdom: +11 basis points (+ 4.27%)

- United States: +7 basis points (+ 3.89%)

The weekly lists

- AEX this week: + 1.0%

- AEX this month: + 1.0%

- AEX this year: -19.0%

- AEX reinvestment index this year: -18.0%

Bad end of a good week

European equity markets are turning green this week, but that is entirely due to the sharp rise on Tuesday. This was it bull market bearish? In the end, the victories AEX 1.0%, reasonably in line with the other European indices. Wall Street makes a quantum leap, even as the 1.1% gain drops to Nasdaq what against.

AEX

Shell (+ 4.1%) is simply in the top three of the best AEX funds this week. Especially with profit notice. Chippers are also returning to the surface. In contrast, Eat takeaway only (-11.9%) my eye pain. Another € 0.50 discount and there’s a new one low on the plate.

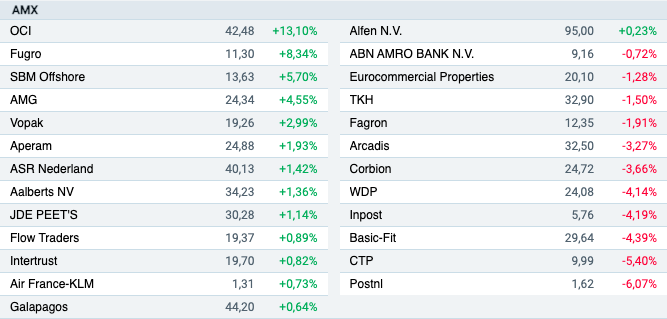

AMX

PostNL (-6.1%) lives up to its name as a weak brother. Short positions have now risen to 5.5%. More painful is that Bank Degroof lowered its price target by nearly 24% to € 2.10. Also Basic fit (-4.4%) is now massively short.

Monday I will arrive with a Premium article on the possible motivations of these shorts. Contrary to this OCI (+ 13.1%) a new one always high on the plate. This is also possible in a market like this.

ASCX

It is administrative chaos a B&S Group (+ 7.6%), but due to speculation on the acquisition the stock is trading higher. On the other hand, the real estate sector is again in bad shape. The culprit is rising interest rates.

Finally, I wish you a good weekend. This week Arend Jan writes the preview