–

–

Bitcoin and Ethereum updated local lows after the Fed meeting, hackers stole $ 160 million from Wintermute, Cardano developers triggered the Vasil update and other upcoming events of the week.

Bitcoin and Ethereum have updated local lows

This week, the major cryptocurrencies updated their local lows since June. Bitcoin quotations on Thursday 22 September descended at $ 18,125 and Ethereum at $ 1,220.

The prerequisite was the meeting of the US Federal Reserve System on 21 September. Regulator lifted up the key rate range immediately of 75 basis points, down to 3–3.25%.

At the time of writing, Bitcoin is trading close to $ 19,000, while Ethereum is trading close to $ 1,315.

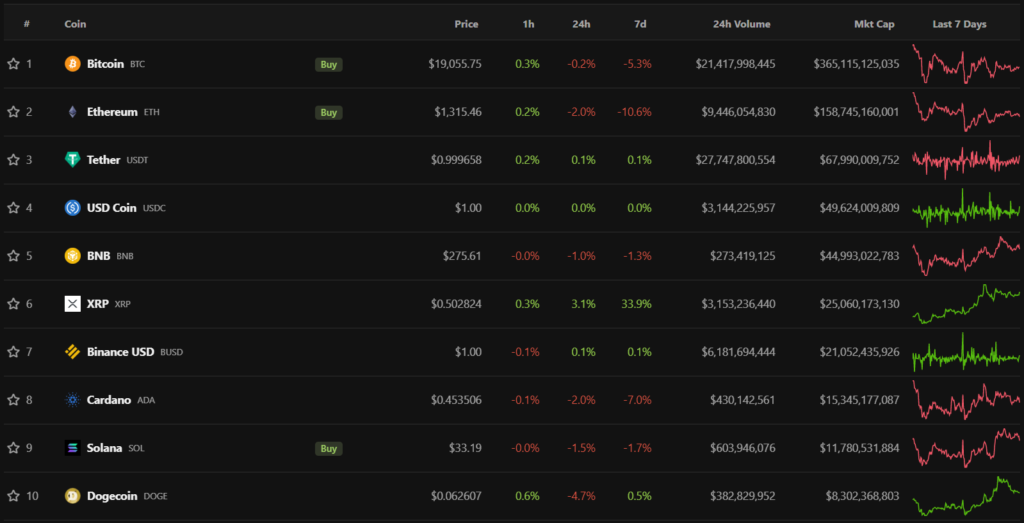

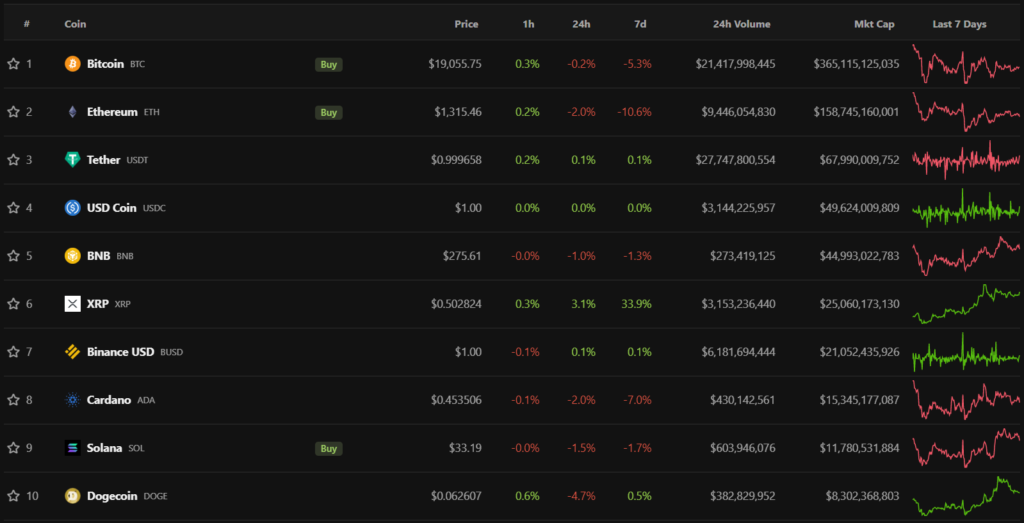

Flagships have traditionally dragged the rest of the market with them. Almost all cryptocurrencies in the top 10 by capitalization were in the red zone. The exceptions are XRP (+ 33.9%) and Dogecoin (+ 0.5%).

Total cryptocurrency market capitalization was $ 974.75 billion, while Bitcoin’s dominance index fell to 37.5%.

Hackers stole $ 160 million worth of assets from Wintermute

September 20 Market Maker Wintermute lost assets worth $ 160 million following a hacker attack. Platform CEO Evgeny Gaevoy pointed out that the goal was DeFi operations, while the OTC and CEX modules work as before.

Later it became known that the striker took advantage vulnerability of the Profanity tool to generate vanity addresses containing words, names or phrases. The problem had previously been felt by 1-inch researchers.

Almost 20% of the blocks in the updated Ethereum are created using MEV-boost

After Ethereum’s switch to Proof-of-Stake (PoS) algorithm, 18% of blocks in the network generated using MEV, providing validators with additional staking rewards. Thanks to MEV-boost, the entities using it were able to get 122% more profit. The blocks they generated contained 41.4% more transactions.

According to Glassnode’s observations, four days after the Ethereum blockchain’s transition to the Proof-of-Stake consensus algorithm, the daily issuance of coins decreased 92% – from 48,400 ETH to 3893 ETH. The increase in network activity led to higher fees, which made the second largest cryptocurrency deflationary in a short period of time.

Cybersecurity company BlockSec discovery an exploit related to the fork of Ethereum PoW (ETHW). According to the researchers, the OmniBridge system smart contract for Gnosis Chain did not correctly validate the chainID parameter. Thanks to this, the attackers were able to get an additional 200 ETHW by sending a similar amount to WETH. The developers of the PoW fork pointed out that the problem is in the contract, not the new blockchain.

SEC and Ripple propose to end the XRP state case

SEC and Ripple Labs introduced summary motions of judgment in the event of a possible violation of the Securities Act. The plaintiff and defendant explained that the judge had sufficient information to do so.

Subsequently the company CEO Brad Garlinghouse informedthat the case will not go to a jury because the dispute is primarily about law enforcement.

The Cardano network activates the Vasil hard fork

On September 23, the Input Output Global team was successful activated Vasil update on Cardano mainnet. The upgrade will significantly increase the performance and potential of the blockchain by increasing throughput, improving script performance and efficiency, and reducing costs.

MicroStrategy buys 301 BTC for $ 6 million

MicroStrategy, analytics software provider He earned an additional 301 BTC for $ 6 million. Company founder and former CEO Michael Saylor said the purchases were made between August 2 and September 19 at an average price of $ 19,851. At the moment, MicroStrategy and its subsidiaries own 130,000 BTC, which is about $ 4 billion spent.

The head of FTX announced the presence of another billion dollars for the purchase of crypto companies

FTX CEO Sam Bankman-Fried in an interview with CNBC mentioned willingness to spend “about a billion dollars” on cryptocurrency companies and projects.

Subsequently, the media, citing sources close to the exchange, reported that FTX expects attract 1 billion dollars and confirms the estimate of the previous round of financing at 32 billion dollars At the same time, the terms have not been final and negotiations are underway.

Media: Binance has faced “xenophobia” in the struggle for Voyager Digital resources

Binance’s participation in the auction for the assets of bankrupt cryptocurrency lender Voyager Digital has been questioned due to national security concerns. Exchange representative declaredthat “xenophobia” is at the center of the discussion on a possible blocking of the transaction by the Committee on Foreign Investment, despite Binance being a Canadian company, wholly owned by a citizen of this country.

It has also been learned that Alameda Research, associated with FTX CEO Sam Bankman-Freed, will repay a $ 200 million debt to Voyager Digital. She is I’ll pay 6553 BTC, 51 204 ETH and slightly lower amounts in other tokens. The agreement will be concluded by September 30th.

What to discuss with friends?

- Wrong Binance paid 4.8 million users of HNT for $ 19 million.

- FT discovery South Korea’s request to Interpol regarding Do Kwon.

- SEC accused YouTube blogger Yan Balinu participates in an unregistered ICO.

- WhiteBIT they became Netflix cryptocurrency partner.

Jess Powell resigns as CEO of cryptocurrency exchange Kraken

Kraken co-founder Jess Powell will leave office of chief executive officer and will assume the chairmanship of the board of directors. He has led the platform since its founding in 2011 and remains its largest shareholder. The company will be headed by COO Dave Ripley.

In the United States, they considered a bill to prevent the avoidance of sanctions via bitcoin

United States House of Representatives supported the Russia Cryptocurrency Transparency Act, designed to prevent Russia and Belarus from evading sanctions with the help of cryptocurrencies.

The U.S. Treasury and State Department must report to Congress on any attempts to use digital assets to circumvent Russia and sanctioned restrictions, as well as their interaction with DeFi exchanges, wallets, exchanges and platforms .

Binance will introduce a trading fee for Terra Classic once trader quorum is reached

Binance exchange to introduce underwriting of the transaction tax for transactions with Terra Classic (LUNC). If the trading volume of the program participants reaches 50% of the total assets on the platform, the commission will be distributed to all clients, said the head of the company, Changpeng Zhao.

Binance will begin taxing program subscribers when their trading volume with LUNC reaches 25% of the total asset on the platform. After reaching the 50% level, the commission will be distributed to all traders on the exchange who interact with Terra Classi.

Also on ForkLog:

- Michael Saylor planned a new high for bitcoin within four years.

- In the UK suggested simplify and speed up the withdrawal of cryptocurrencies.

- Binance added the possibility of verification through Diyu.

- Head of JPMorgan named cryptocurrencies through “decentralized Ponzi schemes”.

What else to read?

Understood as the global financial crisis to influence on the cryptocurrency market, how long the fall can last and how strong it will be.

ForkLog understood in the particularities of MakerDAO founder’s controversial idea about decoupling the $ 1 DAI stablecoin. We identified the main opposing forces within the project and assessed the potential risks associated with the proposal.

New cards released Cash tornado and the reasons for its block, blockchain Filecoin and gaming platform Chilliz. Also explained, what is MEV on the Ethereum network and how it will change after switching to PoS.

In traditional summaries we have collected the main events of the week in the areas IT security And artificial intelligence.

The decentralized finance (DeFi) sector continues to attract more attention from cryptocurrency investors. The most important events and news of the last weeks ForkLog collected in a digest.

Read the ForkLog bitcoin news in our Telegram – News, courses and analysis on cryptocurrencies.

Found an error in the text? Select it and press CTRL + ENTER

–