An analysis has been elevated that the electric powered car or truck tax reduction clause in the US Inflation Reduction Act (IRA) will at some point be amended. The explanation is that excluding the batteries of the three domestic businesses that have partnered with main US automakers could put a damper on the US electric car or truck industry.

Presently, the three nationwide battery businesses, LG Energy Remedy, SK On and Samsung SDI, have set up joint ventures with Basic Motors (GM), Stellantis and Ford to set up or are constructing a battery plant in the United States. In particular, Ford is a chief in the US electrical vehicle current market. The Ford Mustang Mach E product also took fourth place on the US electrical auto sales chart in the first fifty percent of this calendar year.

According to the US Department of Vitality, the share of domestic battery producers in full US battery production plants will enhance to 70% by 2025. In truth, it suggests that the batteries of the three Korean corporations are equipped to most of electric powered motor vehicles in the United States.

If you appear at the top 10 companies in the once-a-year cumulative battery use of electrical automobiles (excluding the Chinese marketplace) announced by SNE Investigate, there are 3 Japanese battery firms left, excluding the Chinese and Korean businesses. Lithium Vitality Japan (LEJ) and Prime Earth EV Electrical power (PEVE) are even now rated as entry-amount battery technologies, so Panasonic is distinctive in terms of latest technological know-how.

Panasonic provides Tesla batteries, which account for 87% of the complete offer. Panasonic is also intensely dependent on China for the offer of raw materials for batteries. There is just not a large difference among the a few nationwide battery organizations. Also, whilst Hyundai Motor and Tesla are cutting the US electrical automobile industry in two, if tax credits turn out to be unachievable for the three domestic batteries and Panasonic batteries, changing to inexperienced cars in the US is no exception.

Some gurus have recommended that the US authorities are informed of this and undertake a type of “political wait”.

Sung-Hoon Yoon, a professor in the Convergence Engineering Division of Chung-Ang College, stated, “It truly is extremely hard to supply batteries that change Chinese-manufactured uncooked resources in just two decades. There is certainly no way to know. It truly is extremely likely to act forcefully as a variety of political investigation and then steadily revise the monthly bill. “

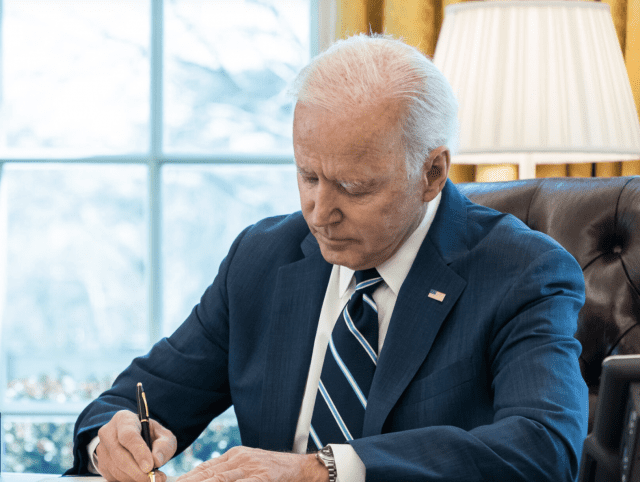

Without a doubt, the US governing administration pushed for the signing of the “IRA” monthly bill despite problems from international locations like Korea and the European Union (EU), but just lately determined to variety an crisis credit channel. tax on electric powered autos with the governing administration.

Relevant Articles

Previously, on 7 (community time), the Department of Commerce, Field and Energy introduced that it had agreed to create a independent bilateral consultation channel with the United States relating to the electric powered car or truck tax credit.

An official from the Ministry of Commerce, Sector and Electricity explained: “It is tough to say that the invoice will be adjusted, but it can be viewed as a optimistic present.”

–