It is getting to be ever more tricky for seniors with AOW or a smaller restricted pension to pay their month-to-month payments. The rationale: higher inflation. “We shower briefly and not each individual working day.”

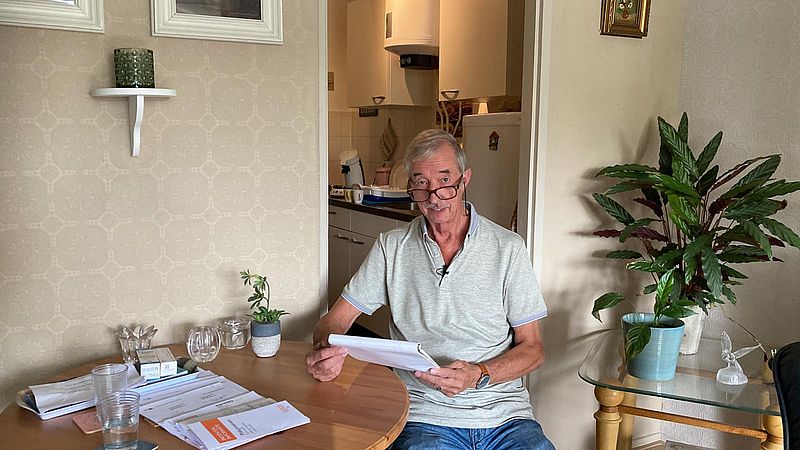

Rob de Graaf (75) from the IJsselmonde district of Rotterdam gets AOW and a small supplementary pension. Just about every working day he encounters that everyday living is getting far more pricey. But he won’t give up.

Make decisions

Searching is a make any difference of decision, claims Rob. “Some groceries have turn out to be particularly high-priced. Some merchandise have a value boost of up to 75 per cent.”

So he no extended normally takes certain solutions, he states. “Like meat. At the supermarket I normally glimpse at the ‘basket’. That is, let’s say, the area in which solutions that have almost expired their expiry date are found.”

“Sort dwelling” at the foodstuff centre

The De Schittering food stuff middle places of work have been opened in 3 destinations in Rotterdam. They are a cross involving a grocery store and a meals counter. Food stuff leftovers are sold there for tiny portions.

Rob likes to appear below far too. “I am a typical at residence. You can find me there about three or 4 situations a 7 days. Bread is dispersed absolutely free at the cashier.”

see also

Loneliness amid the elderly

Rob has to make finishes meet up with on his possess, but he also will help other folks get out of his senior apartment. “Lots of people today have a really hard time shelling out their bills. Often they will not even know they are entitled to energy compensation.”

Also, take note that enjoyable functions are canceled owing to the crown and inflation. “All sorts of fun pursuits have been arranged in 1 space in this article in the condominium. Now it is a great deal a lot less. The loneliness in the apartment is monumental.”

‘We are very frugal’

The Rotterdammer assists his neighbors: Wil (65) and Dirk (67) Geluk. The couple have not but retired and are now dwelling collectively on a WIA allowance. “Anything has gotten a lot more pricey, but we are not complaining,” they say.

“We’re just incredibly frugal. We shower briefly and not each and every working day. We you should not use the dishwasher any more. We are fortunate with our children. The Tv set broke lately. Then they brought a new 1.”

Many retirees get into problems

The Standard Previous Age Pensions Act (AOW) suggests that each individual Dutch individual for 66 decades and 7 months receives a reward from the state. In the Netherlands, 2.1 million households been given an AOW grant in 2017. Of these, 1.9 million households also have a supplementary pension. All around 200,000 households in the Netherlands do not obtain a supplementary pension past the AOW. They have to settle for the AOW profit.

About 113,000 families have what is known as a tiny supplementary pension: a greatest of 250 euros more for each thirty day period. Another 225,000 homes have to get by 250 to 500 per month in addition to their AOW. These groups are strike really hard, since inflation improves their paying, but their money doesn’t raise with it.

–

–

see also

AOW retirees in issues

The Dutch Institute for Finances Information and facts (NIBUD) has been stressing for months that bare minimum wages, but also reduce regular incomes, are enduring economic complications due to inflation.

In accordance to the price range institute, the difficulties are no fewer for people who live only on a state pension or a little supplementary pension.

Earnings ideas offer you no “relief”

Director Arjan Vliegenthart states “all very low-income groups are battling”. “This also applies to men and women with only AOW or a tiny pension.”

He details out that these teams “frequently have bigger healthcare charges”. Also, bettering their income is no lengthier an selection for them, due to the fact they no longer get the job done. “Preparing to make improvements to income by way of cash flow tax thus delivers no ease and comfort for this group.”

–