The United States and its allies are setting up to restrict the value of Russian oil, but it has been documented that Russia has taken the guide in turning its notice to Asia, not to point out advertising at a discounted of just 30%. .

The conflict among Russia and Ukraine has pushed up world oil selling prices and sanctions imposed by Western nations around the world have not impacted Russian oil exports, which are expected to improve substantially this calendar year.

As a final result, the United States and its allies plan to restrict the price of Russian oil, minimizing Russia’s gains from its all-crucial oil exports and depriving the Kremlin of the capacity to finance its war in Ukraine.

Profits from Russian oil exports are anticipated to rise this yr. The image displays the Rosneft oil storage tank.

–

On Aug.24, Bloomberg quoted a Western formal as declaring that Russia has attained out to many Asian international locations to explore the risk of signing prolonged-term oil contracts at hefty discounts.

He mentioned on condition of anonymity that in these original conferences, Russia has offered savings of up to 30 p.c to some Asian buyers, potentially related to the latest G7 discussions on EU sanctions on Russian oil to restrict Russian oil selling prices. They can enable 3rd parties to far more conveniently buy Russian crude when it matches the minimal selling prices established by Western countries.

Russia could also attempt to obtain different prospective buyers for the oil it now sells to Europe.

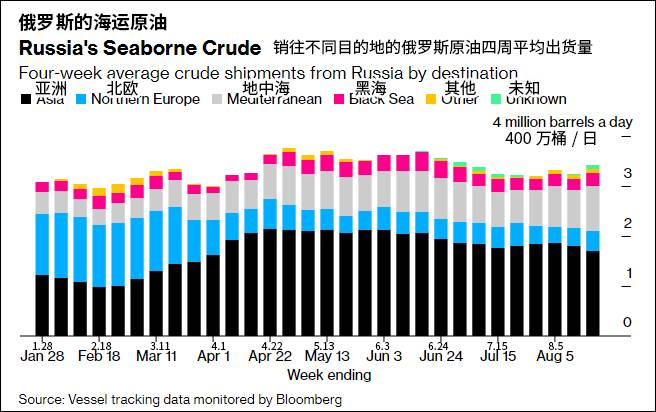

Asia is now the major customer of Russian oil. (Bloomberg)

–

Indonesian tourism minister Sandiaga Uno reported on social media more than the weekend that Russia had made available to sell oil to the country “at a cost 30% under global current market price ranges.” He extra that President Joko Widodo was looking at the proposal “but there are variances. It is feared that we will be impacted by the US ban”.

The sixth spherical of EU sanctions incorporates a ban on Russian oil and a ban on 3rd international locations from working with the insurance policy and monetary companies of EU firms for this reason. The ban will go into outcome on December 5, but US officials worry that the latest framework will push oil rates drastically, instead offering Russia a boon.

During this period of time, some European countries have advocated an exception to the insurance plan ban when oil is traded down below an internationally set limit. Officials pushing for the strategy hope it is in area before EU sanctions on Russian oil go into result in early December. US Treasury Secretary Yellen hopes the price cap will deprive Russia of substantially-required profits and decrease world oil costs as EU sanctions arrive into influence.

–

But other countries reported such a sanction-free of charge method would only do the job if major Asian potential buyers of Russian oil, particularly India, agreed to take part.

German Chancellor Scholz stated that the proposal was significantly talked about in the G7, but it is a elaborate problem: “If only the G7 international locations concur, it will not perform. We also will need the cooperation of other international locations.”

This week, US Treasury Undersecretary Wally Adeyemo is back again in India. He advised an function in Mumbai on Wednesday that the coalition to established rate boundaries on Russian oil had expanded, with many nations around the world signing up for.

It is not distinct what the position of most Asian international locations on the prepare is, but couple have publicly expressed their guidance. India is reluctant to join the value cap system since Indian marketplace gamers concern losing a lot more potential buyers when it arrives to obtaining Russian crude at a low cost, in accordance to folks familiar with the frame of mind of Indian providers.

Proponents of the program, on the other hand, argue that even if significant consumers of Russian oil did not formally join the selling price cap coalition, this could support minimize Russia’s earnings, as countries will attain added leverage in trading. of oil contracts with Moscow.

US officials have signaled that they intend to limit oil rates slightly earlier mentioned Russia’s marginal charge of creation, though the final amount will depend in part on world oil costs when the ban goes into effect, according to the report cited by persons who they are acquainted with the issue.

–

On the EU side, the Hungarian authorities has explained it will oppose any oil price tag caps, sources say. The US media think this implies that the strategy could confront another complicated political battle.

–