–

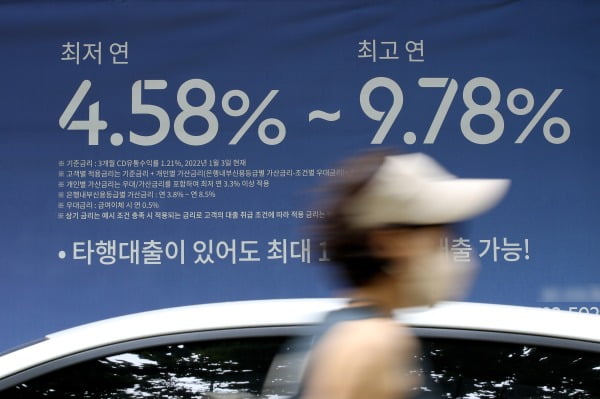

The monetary authorities have indicated the probability of extending the disclosure of the interest rate difference among bank loan and deposit launched in the banking sector to other sectors. Additionally, they actively stated issues about facet results this kind of as optical illusions.

On the 25th, the Financial Expert services Commission, the Fiscal Supervisory Assistance and the Federation of Banks stated in an explanatory doc: “As this is the first time comparative disclosure of the curiosity fee change concerning financial loan and deposit has been applied, it is applied generally to banking institutions with a substantial variety of people and a superior social interest. “We will look at it in consideration of the attributes and impact of just about every sector,” he said.

The money authorities have also clarified the issue that an optical illusion effect could arise mainly because sight deposits are excluded from the calculation of the change in curiosity charges among deposits “.

Toss Bank’s personal loan-to-deposit interest charge change (5.6% factors) rated 1st in the comparative announcement of the big difference in desire charges amongst deposits and financial loans issued in early July. This is owing to the point that the curiosity amount on sight deposits (a recurrent banking e-book of deposits and withdrawals), which has an annual desire rate of 2%, was not mirrored in the knowledge.

The authorities stated: “This advancement in disclosure of fascination level info is component of a reaction to the criticism that bank deposit premiums do not sufficiently replicate modifications in current market interest fees.” .

He ongoing: “In the case of banking companies actively lending to very low- and medium-credit rating debtors, the ordinary curiosity amount big difference concerning bank loan and deposit may appear to be relatively substantial.”

Reporter Chae Seon-hee, Hankyung.com [email protected]

–