Jakarta, CNBC Indonesia – Lender Indonesia (BI) built a shock. Unexpectedly, Governor Perry Warjiyo and colleagues resolved to raise the benchmark desire rate.

“The Bank Indonesia Board of Governors (RDG) assembly on August 22-23, 2022 made a decision to elevate the BI 7 Working day Reverse Repo rate by 25 basis factors (bps) to 3.75%, the deposit fascination charge of 25 bps at 3%, and the deposit facility fascination fee of 25 bps at 3%. Lending Facility interest is 25 bps at 4.5%, “Perry reported in the course of a push conference immediately after the RDG. yesterday.

This choice is outside of anticipations. The market place consensus compiled by CNBC Indonesia and Reuters the two estimates that MH Thamrin will maintain the BI 7 Day Reverse Repo charge at 3.5%. Degrees that have not altered because February last calendar year.

ANNOUNCEMENT

Scroll to resume written content

–

|

Sumber: Refinitiv- – |

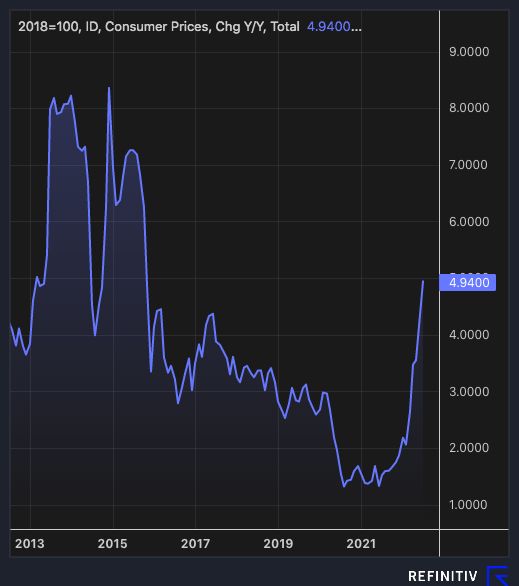

Perry claimed that one particular of the causes for boosting the benchmark curiosity level was a preventative evaluate versus anticipations of an accelerating amount of inflation. For information and facts, nationwide inflation in July 2022 arrived at 4.94% Calendar year just after 12 months (12 months more than 12 months), the maximum due to the fact 2017.

Sumber: Refinitiv- Sumber: Refinitiv-– |

“The final decision to raise the curiosity level as a phase preventive And much-sighted to mitigate the danger of climbing main inflation and inflation anticipations owing to increasing unsubsidized gas price ranges and inflation volatile foodin addition to strengthening the rupee’s exchange fee stabilization coverage so that it is in line with its basic worth in the confront of higher uncertainty in world money markets, in the midst of significantly solid domestic economic expansion, “Perry explained. .

–