Canadian Dollar Talking Points

USD/CAD is trading at a new monthly low (1.2789) as it marks the series of highs and lows after the Federal Reserve Interest Rate Decisionand new data prints from the US and Canada could weigh on the short-term outlook for the exchange rate amid the ongoing shift in monetary policy.

Fundamental Forecast for the Canadian Dollar: Neutral

USD/CAD depreciates for the second week as the United States Gross Domestic Product (GDP) Report shows that the US economy is in a technical recession and the outlook for weakened growth could continue to generate headwinds for the dollar as it puts pressure on the Federal Open Market Committee (FOMC). ) to slow down its bullish cycle.

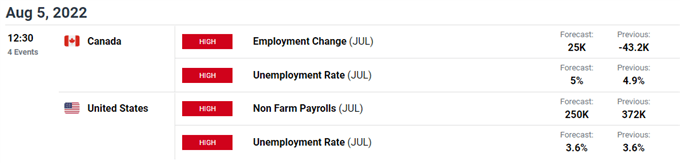

However, the update to the Non-Farm Payroll (NFP) report could encourage the FOMC to make another 75bp rate hike in the next interest rate decision in September as the economy is expected to add 250,000 jobs. in July and a positive development could stem the recent decline in USD/CAD as the Fed’s goal of implementing a highly restrictive policy increases.

At the same time, a rebound in Canadian employment may affect USD/CAD as the Bank of Canada (BoC) decides «anticipate the path to higher interest rates”, and an improvement in the labor market could lead to a knee-jerk exchange rate reaction with both central banks on track to further tighten monetary policy in the coming months.

Until then, USD/CAD may find it difficult to maintain its position as it goes through a series of ups and downs, but another unexpected contraction in Canadian employment could produce a bearish reaction in the Canadian dollar, as it curbs speculation of another increase in the BoC rate of 100 basis points. .

That said, USD/CAD may continue to depreciate while trading at new monthly lows in late July, but new data prints from the United States and Canada may influence short term outlook for the exchange rate in the context of the ongoing change in monetary policy.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

–

If you want you can make us a donation for the work we do, we will appreciate it very much.

Wallet Addresses:

– BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

– USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

– BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

– DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

You can also follow us on our social networks to keep abreast of the latest posts on the web:

– Telegram

Disclaimer: In Cryptoshitcompra.com we are not responsible for any investment of any visitor, we simply give information about Tokens, NFT games and cryptocurrencies, we do not recommend investments

– element inside the element. This is probably not what you wanted to do! Upload your app’s JavaScript bundle to element instead.