-

–

Shazia Majid

—

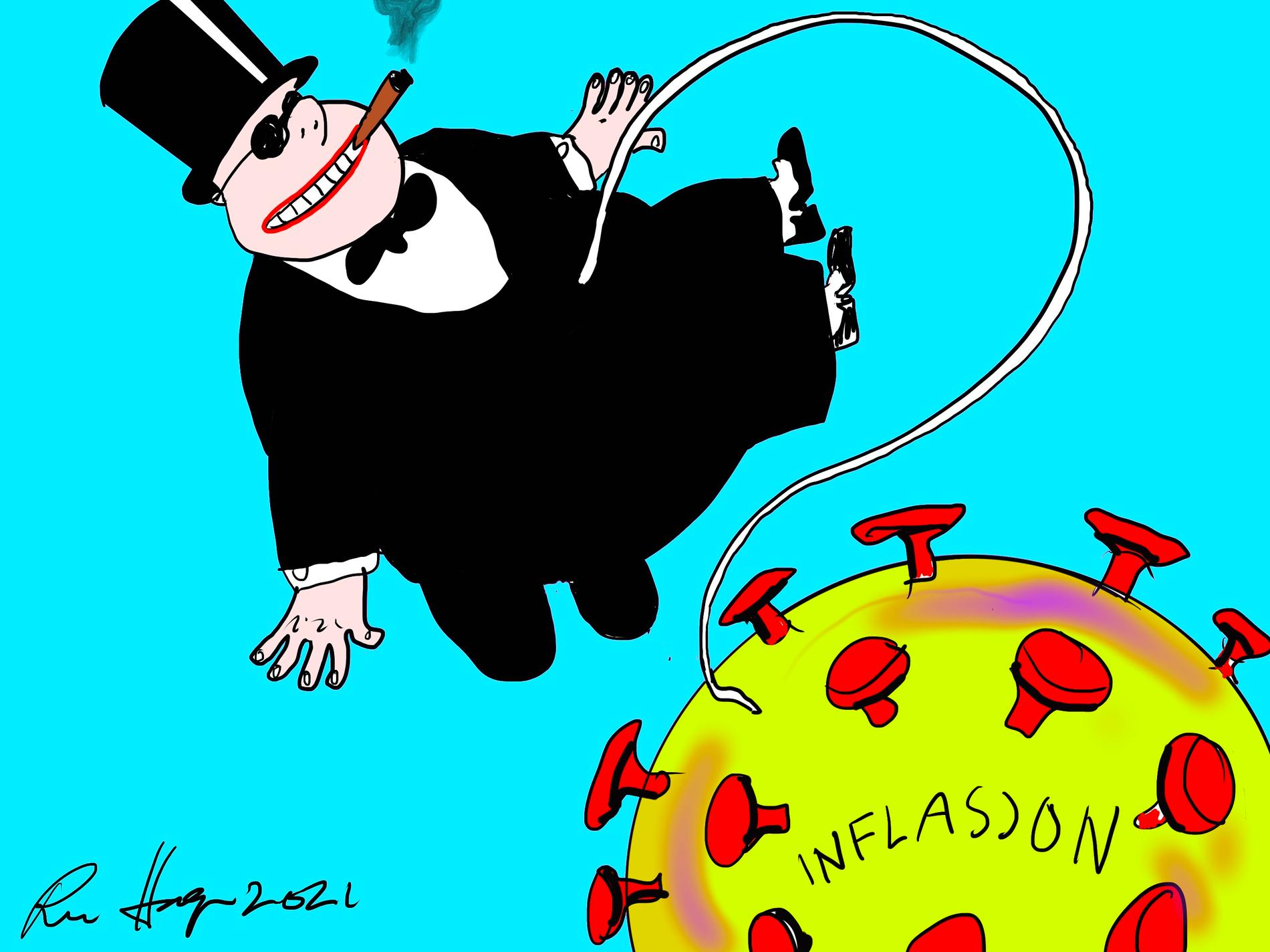

PRICE GALLOP: The prices of basic goods such as food, fuel and electricity have risen sharply in Norway. The situation is worse in the US, which is now in a technical recession. The US economy is in recession. Europe is struggling, as is China. Norway may follow suit in the coming months.

This is a comment. The comment expresses the writer’s position–

This is a comment. The comment expresses the writer’s position–

On Thursday this week it was announced that The US economy is in recession. At least according to the simple definition of the term.

Which says that a country’s economy is in recession, when the gross domestic product (GDP) goes down for two quarters in a row. It has now done so in the United States.

Recession means economic downturns. This means that a country’s economy is shrinking, rather than growing. Not only is the store doing worse, it is going into the red.

At the same time that the figures show a recession, the US central bank has raised the key interest rate as well a whopping 0.75 percentage points. Now the interest rate is at a “neutral” level, according to experts. This means that it no longer stimulates the economy, i.e. lubricates the wheels to go faster.

–

PRICE GALLOP: The prices of basic goods such as food, fuel and electricity have risen sharply in Norway. The situation is worse in the US, which is now in a technical recession. Illustration image. The price race

But those who have to pay significantly more in interest costs are unlikely to perceive the sharp rise in interest rates as “neutral”. They are already struggling with pig feed and fuel.

This price gallop – inflation – in the US is at a staggering 9.1 per cent. It has not been higher for 40 years. This means that more and more Americans are unable to live on their wages.

There is still not full panic over the pond. And that is due to continued low unemployment. When people start losing their jobs, then there is a crisis. Now the warning lights light up yellow, instead of red.

However, if the energy crisis, the food crisis and the war in Ukraine cannot be resolved in the near future – a serious economic downturn is difficult to avoid.

What happens in the US doesn’t stay in the US. It has global impacts. Norway is directly affected by the many global crises raging at the same time.

Here at home, we see the same as in the USA – soaring prices, rapid and significant interest rate increases – and an electricity crisis. When things are not as bad here at home as in the USA, or Europe where inflation is 8.9 per cent, it is largely due to the oil billions.

Oil-oiled economy

It is in Norway that the authorities can afford to pay large parts of the electricity bill for private households, at a price tag of approximately NOK 22 billion. This is where companies get valuable corona support 14 billion kroner.

When the state takes some of the brunt of the financial consequences of natural disasters such as the corona pandemic and man-made crises such as the Ukraine war – ordinary people get more money in their hands. Compared to citizens of most other countries. This is money that keeps consumption up – and the famous wheels in motion.

A possible recession in the Norwegian economy is therefore shifted in time. Unemployment has not been lower since 2008, shows completely fresh figures.

And if a decline were to come, it will by all accounts be milder than in other comparable countries. We saw that with the financial crisis in 2008 and 2009. Where it was an earthquake elsewhere, it was a dump in Norway’s way.

Brutal vending

There is therefore hardly any reason for panic here at home – but there is just as much reason for concern. Especially for those who are already struggling financially. For Norway, this amounts to hundreds of thousands of people.

Not everyone can make the transition.

What we are now seeing is possibly one of the biggest economic u-turns we have seen in recent times. The graphs are turned abruptly and brutally.

Because it has not been many months since the policy rate was zero. And people who had been stuck in their homes with corona for months were asked to celebrate that the pandemic was over. By going out and spending money.

Now it was time to drink that beer, go to the theatre, eat the steak in a restaurant, simply increase consumption and start traveling again.

Many did as they were told. All arrows pointed upwards – red numbers turned green. Unemployment fell to record low levels. The order books were filled to the brim and the machinery steamed away.

Hardly anyone remembered the abyss we peered into in 2020, when Norge AS was more or less closed for the day. And Norway, like most other countries, went into recession. In fact, we experienced biggest fall in history in the mainland economy.

But it was short lived. As early as 2021, we were back where we were supposed to be.

Serving the crises

But it went way too fast. The demand was greater than the supply. Then the prices will likely go up. Then we get inflation. And then the vicious circle begins.

One of the consequences of the pandemic was a shortage of raw materials, a shortage of labor and skyrocketing transport costs. From getting a record number of unemployed during the pandemic, we had reached a situation where employers in some industries were crying out for labour.

On top of this comes the war in Ukraine and the extreme weather which, among other things, has affected production and access to food.

It is this “perfect storm” of global crises that has led the world into the predicament we are in today.

But then Norway is in the absurd situation that we are raking in unimaginable sums for these crises.

This week, Equinor delivered a record result of NOK 174 billion for the second quarter. They pay out nearly NOK 20 billion in dividends to their owners – by far the largest of them is us. The State of Norway.

It is estimated that the treasury is going to bring in a staggering amount 700 billion kroner in oil tax. So much money has never come in in one year.

We are spared

Norway is awash in oil money. Therefore, it is difficult to understand that the interest rate must rise and the people must be asked to tighten consumption in order to bring down prices.

It is hard to understand that there is anything to worry about at all.

But the more money the government injects into the economy, the higher the prices. If inflation remains high, wages must be increased. If wages increase, earnings for companies decrease. Which also has to deal with sky-high electricity costs and sky-high transport costs.

If the companies fail, people lose their jobs and we end up in recession.

Right now it is therefore important to keep your tongue straight in your mouth. The US, Europe and China are balancing on a knife’s edge. While poor countries stand on the brink.

Norway is luckier. The oil money gives us more tools in the coffers. It will not spare us anything that may come our way. But it will spare us the worst.

–

Related posts:

Do you like the clubhouse? Twitter aims to make its alternative available worldwide by AprilAccessories for iPad Pro 2021 (3. Gen)Elegant and Technologically Advanced Watches for Modern Women: Garmin Lily, Huawei Watch GT 3 Pro El...Honor Magic V price revealed! The returning brand does not intend to save customers