Shutterstock

Feedback Hans de Jong

Today 09:00 o’clock – Han de Jong

The European Commission is more gloomy about Dutch inflation. Economists are more gloomy about the German economy. The likelihood of recession in the United States is rising sharply, while China is shrinking and the Russian trade surplus is rising sharply. I really try to discover as many positive aspects as possible in all kinds of developments. I do that because my experience shows that the economy is resilient and most things will somehow end up on their feet. But now I’m having trouble finding a positive angle.

The erosion of purchasing power continues. The European Commission has revised the estimate for average inflation in our country for the current year from 7.4% in April to 9.4% now. That’s quite an adjustment over such a short period of time. This adjustment also says something about the expectations for the second half of the year. We now have the inflation figures up to and including June. The average is 9.6%. So if we have to get to 9.4% for the year, the average in the second half of the year is going to be 9.2%.

The Commission therefore does not foresee much fall in inflation in the near future. That will change next year, because at the end of 2023, according to the Commission, inflation will only be 2.3%. This is possible if energy prices fall. Oil has become cheaper lately. Having become wise through trial and error, I still say: ‘We know that from the Commission, in a year and a half it will all be better. The problem is that those good times are being pushed further and further into the future’.

Period of contraction is coming

Although consumers are still drawing on reserves built up during the pandemic, a blow to consumer spending is inevitable. Add to this the fact that interest rates have risen sharply and that the government budget should not be expected to stimulate the economy. It is very likely that the Dutch economy, together with the other European economies, will face a period of contraction. This week the German ZEW published the results of their monthly survey of economists and analysts on the economic situation and prospects for Germany. The expectation component had fallen sharply after the outbreak of the war, but improved again in May and June. Another drop followed in July. This sub-index reached a lower level than in March 2020. The assessment of the current situation also deteriorated.

Chance of recession in the United States sharply increased

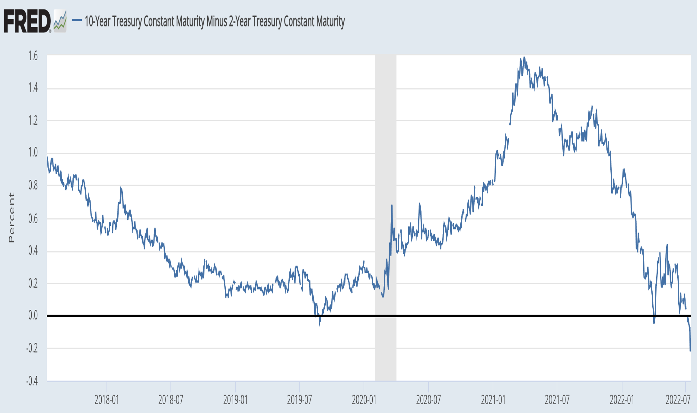

For the United States (US), I was more optimistic for a long time. That economy is of course less affected by the war in Ukraine and is self-sufficient in energy. As a result, the rise in energy prices does not lead to national impoverishment, with households having built up significant savings that can now be leaned on to support consumer spending. Unfortunately, the latest US figures are not very optimistic. Firstly, the yield curve is now really inverse. This means that the effective yield on two-year government bonds is now about 20 basis points higher than on ten-year government bonds. We’ll see if that continues or not. But in the past, that interest rate differential has proven to be a good predictor of recessions.

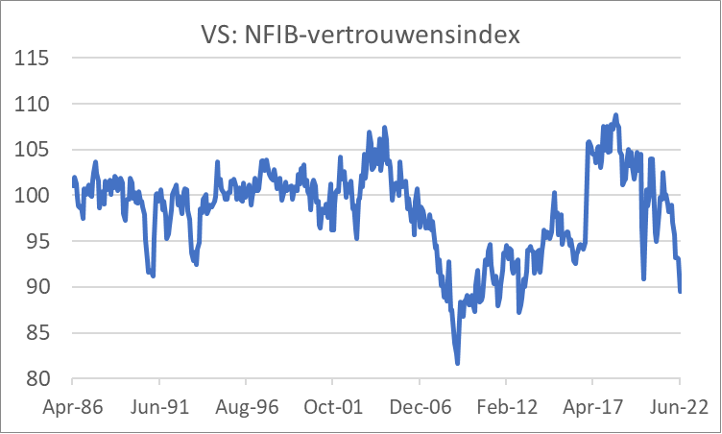

Consumer confidence had already fallen sharply. Now the confidence of entrepreneurs in SMEs has also fallen sharply. The National Federation of Independent Business (NFIB) confidence index fell from 93.1 in May to 89.5 in June.

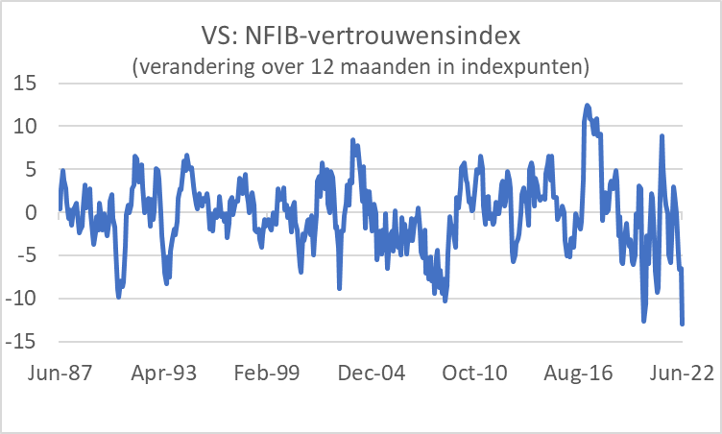

I find that NFIB index interesting and in the next picture I show how much the index has changed compared to a year earlier. The decline in the last twelve months is the largest in the past 35 years. This survey is 48 years old. Never before has the percentage of respondents expecting a better economy in the next twelve months been as low as it is now.

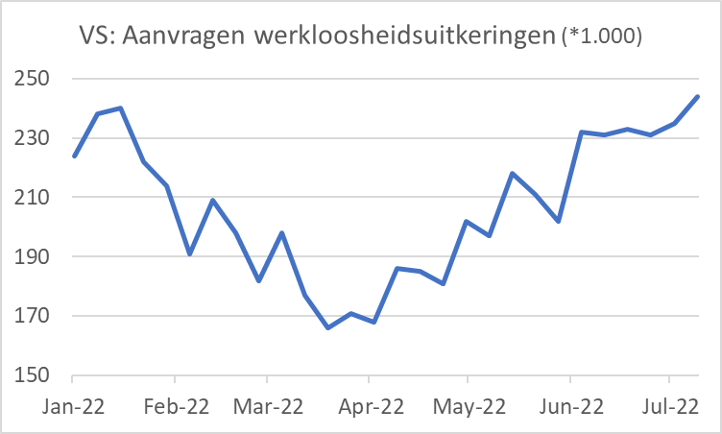

The US labor market is very tight, but it is currently deteriorating. Although there are almost two vacancies per unemployed person, according to the so-called JOLTS report, the number of applications for unemployment benefits is currently increasing at a rapid pace. In the week of July 9, 244,000 new applications were registered, the highest number since November last year.

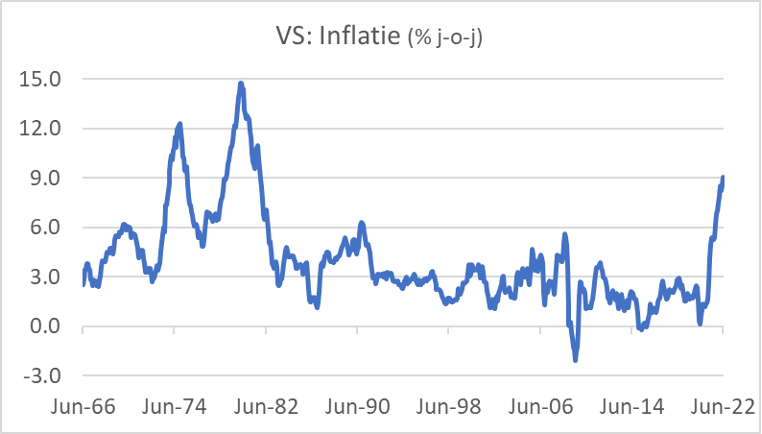

US inflation continues to rise

US inflation also continues to rise: 9.1% in June against 8.6% in May. Core inflation declined slightly, but at 5.9% (from 6.0% in May) it remained well above the Fed’s target of 2%.

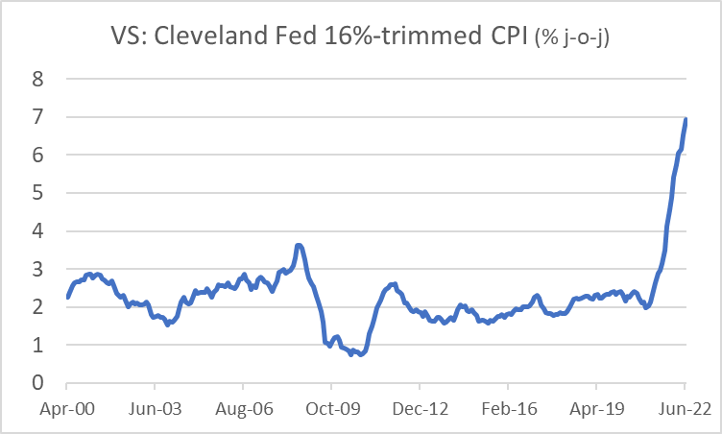

US inflation also continues to widen. Because outliers can strongly influence an average, the Cleveland Fed calculates the so-called ‘16% trimmed CPI’. That series does not take into account the 8% strongest price increases and the 8% least strong. Inflation calculated in this way is now 7%.

Due to the labor shortage, wage growth also continues to accelerate, as can be seen in the following picture. The wage increase also feeds the inflation process.

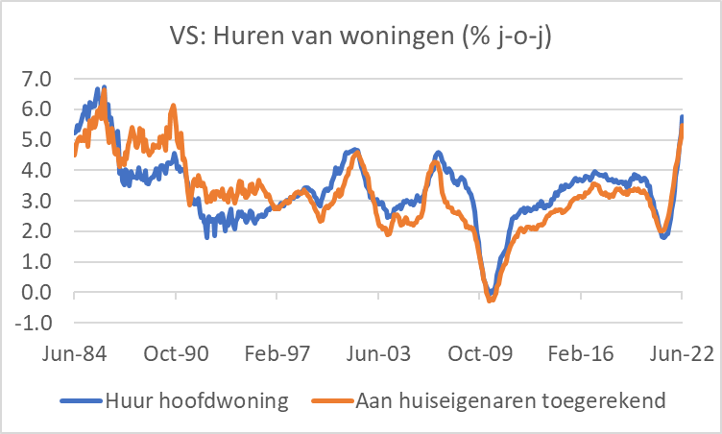

The Fed will certainly (have to) raise interest rates a little more. And yet, inflation in the US is not likely to fall sharply any time soon. I have regularly pointed out the importance of rents in the inflation picture. Together, the actual rents and the rents imputed to homeowners make up about 33% of the inflation basket. In the US, rents follow house price developments with a lag. Although the higher interest rates lead to some cooling of the housing market, the rent rise will accelerate rather than fall back in the coming months. The rent increase is now approaching 6%. If the total inflation rate has to go to 2% and rents rise by 6%, then all other prices together should not rise at all. Well, it really doesn’t look like that for now.

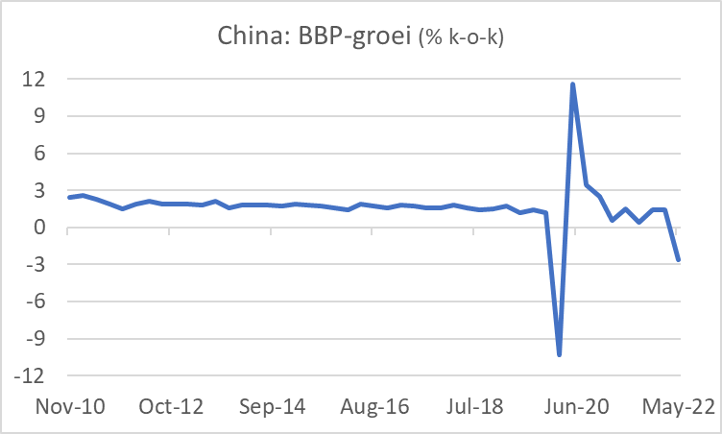

China crimp

The Chinese economy shrank by 2.6% in the second quarter compared to the first quarter. That was the worst figure since Q1 2020. Year-on-year, China’s GDP was just 0.4% above Q2 last year, after 4.6% in Q1.

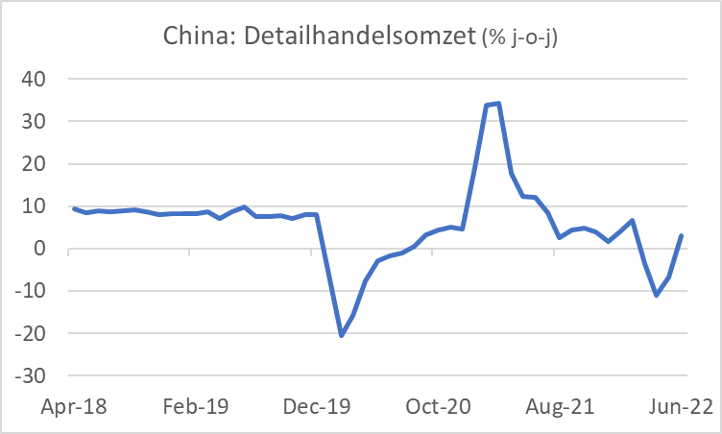

Of course, this disappointing development was mainly caused by lockdown measures. Other figures show that the March-May period was particularly weak. Some of the lockdowns were lifted in June. Industrial production growth, for example, picked up somewhat in June: 3.9% year-on-year against 0.7% in May. Retail sales exceeded expectations for June. Sales increased by 3.1% year-on-year, after having recorded -11.1% and -6.7% in April and May.

Due to the poorly effective Chinese vaccine against Covid-19 and the zero-tolerance policy of the Chinese government in the event of an outbreak of infections, China threatens to become a ‘stop-go’ economy. Very annoying for the rest of the world. Chinese exports picked up again in June, +17.9% year-on-year, but the import value was only 1.0% higher. In view of the development of prices, this implies a substantial ‘minus’ in volume.

Let’s talk about Russia

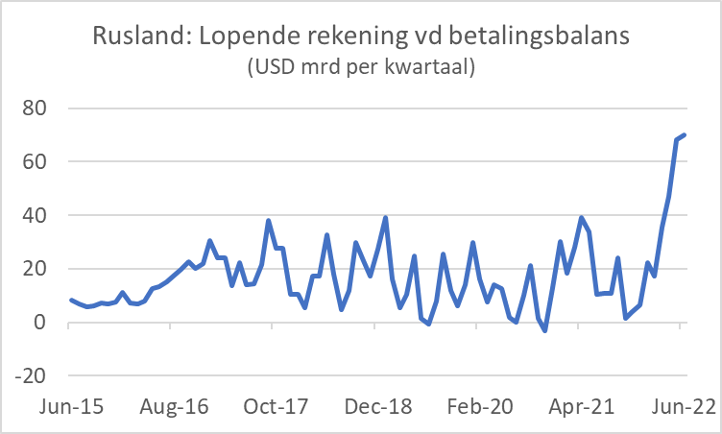

The sanctions against Russia have not yet brought an end to the war. They do have measurable economic consequences. In time, the cessation of exports to Russia will become a problem for that country because it remains deprived of essential parts for machines, vehicles and installations. Paradoxically, that export ban, along with increased energy prices, is positively impacting Russia’s current account balance of payments, as the following picture shows.

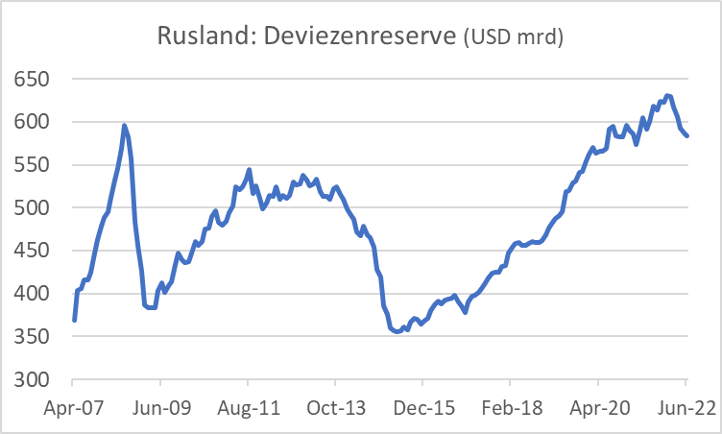

We have also tried to make Russia’s foreign exchange reserve useless. That could never quite succeed. The figures show that Russia has been draining its own foreign exchange reserve lately. But that is still nothing compared to previous periods.

Closing

This week’s macro data can be summarized briefly. The global economy is not doing very well. In our country, inflation remains higher than expected and a period of economic contraction seems inevitable to me. The risk of a recession in the US is also increasing. Unfortunately, China is in danger of becoming a ‘stop-go economy’ due to the likely, regular return of lockdowns. This is also not conducive to favorable economic development for us. Finally, the sanctions we have imposed on Russia have in any case no negative impact on Russia’s external position.

Han de Jong

Han de Jong is a former chief economist at ABN Amro and now a resident economist at BNR Nieuwsradio, among others. His comments can also be found on Crystalcleareconomics.nl

—

© DCA MultiMedia. This market information is copyrighted. It is not permitted to reproduce, distribute, distribute or make the content available to third parties for a fee, in any form whatsoever, without the express written permission of DCA MultiMedia.

–