It happens that the Tax Authority collects when it comes to taxes, but there are situations in which the Revenue Agency pays. Let’s go into detail.

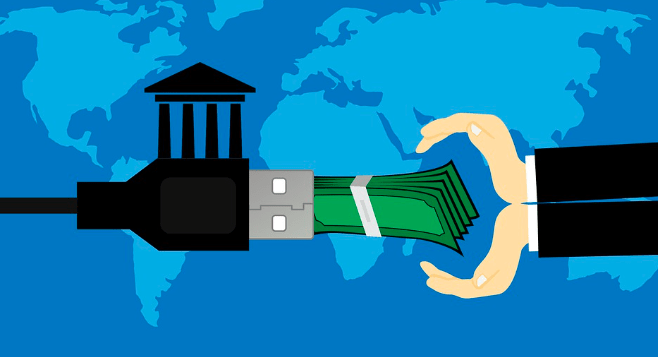

In the situation in which the taxpayer is not in debt but in credit with the tax authorities, the tax refund is triggered with credit to a bank or postal current account. These are those cases in which the taxpayer must receive sums from the tax authorities and must not give them, for once and therefore the tax authorities must take care of crediting these sums due to the taxpayer

(agenziaentrate.gov.it)

Often there are reimbursements that the Revenue Agency owes the taxpayer. When it comes to reimbursement this also happens without providing the IBAN code as a means of reimbursement to the taxpayer. Often the sums that the taxpayer must receive are late in arriving, for various reasons, in terms of timing and organization of reimbursements, as often happens with the Public Administration. Let’s analyze when to avoid that an expected tax refund never arrives.

The Revenue Agency and tax refunds

The Revenue Agency always recommends provide the IBAN to credit the sums due to the taxpayer, as this reimbursement method is faster and safer. Only when the IBAN is not provided, the tax authorities also process the tax refund with a check, another way of crediting the sums to the taxpayer.

When there is no IBAN provided by the taxpayer, the refund is made by check issued by Poste Italiane. There is a time frame within which this refund must take place. The days of time are 60. The check can be collected in two ways: in cash or by crediting an account.

(pixabay.com)

In cases where reimbursement is made by check In this case, the Revenue Agency is the person who provides for the tax refund. As far as the drawee is concerned, it is the entity Italian post.

In this case, the drawer makes sure to make it available to the drawee to pay the bearer, to whom the payment is due by legitimacy, of pay a sum of money which is indicated on the credit note. At this point it is a cover sum that is guaranteed, as an acquisition of the funds has already been proven.

–